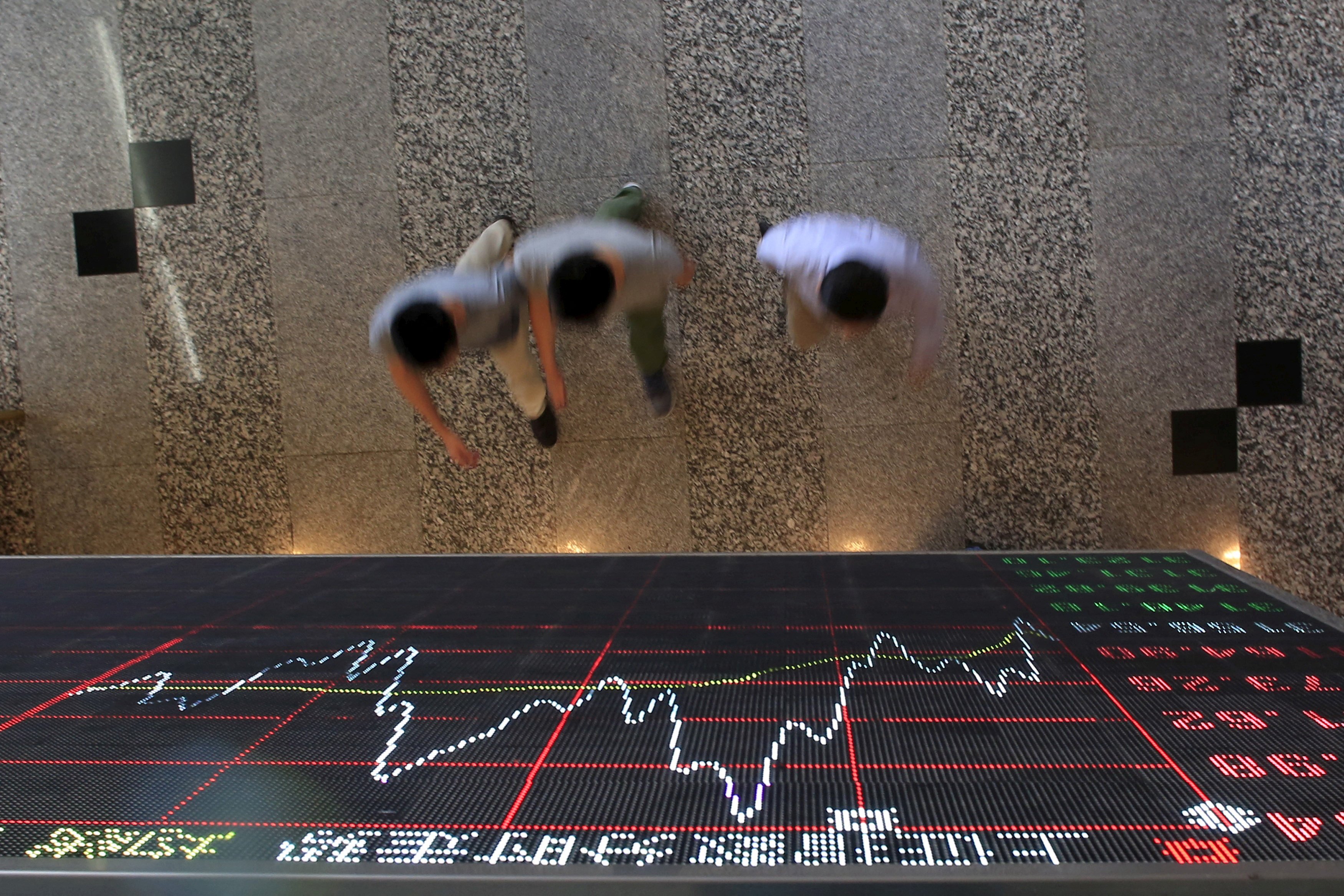

Foreign investors loaded up on Chinese stocks for a third straight month in April, adding to evidence that global fund managers have become more positive about the world’s second-largest market.

Hong Kong stocks emerged as the best-performing key market globally in April, after funds sought bargains by shifting out of expensive US and Japanese equities and as China’s growth shows more signs of stabilising.

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

The Mandatory Provident Fund, Hong Kong’s pension-fund operator, will launch its electronic platform in June, in the biggest overhaul of the city’s compulsory pension programme since it started in 2000.

The measures effective from Monday range from the removal of restrictions on homebuyers to support for the funding needs of developers.

Guolian Securities plans to buy a 95.48 per cent stake in unlisted Minsheng Securities, in an acquisition that is expected to make it a top-20 brokerage.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

Hong Kong stocks rose for a third day after earnings optimism drove the benchmark Hang Seng Index to a five-month high.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Chabaidao’s stock ended the day 27 per cent lower after slumping as much as 38 per cent. It raised about HK$2.6 billion (US$331.7 million) from the sale of 147.8 million shares at HK$17.50 each.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

CSRC’s new chief Wu Qing has sought to improve corporate governance and close deep valuation discounts in a bid to revive investors’ faith in China’s US$9 trillion stock market and these bold moves have met with some early success.

A document published by the nation’s cabinet on Friday promises to promote the ‘high-quality’ development of China’s capital market by strengthening supervision and guarding against risks.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

China’s stockbrokers took another pay cut in 2023 as the double whammy of a slumping equities market and a government crackdown on corporate extravagance eroded the incomes of financial workers. Things don’t look much better this year, one fund manager says.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

Hong Kong stocks ended steady but the mood was cautious as ahead of economic data releases that will drive sentiment later in the week.

China’s state-directed buying binge has swollen the size of exchange-traded funds (ETFs) tracking the underlying benchmark CSI 300 Index, helping them outperform the market while boosting their asset-size ranking.

Global fund managers have become more positive about Chinese stocks after the securities regulator took a flurry of forceful measures to halt a three-year decline, according to a joint-venture brokerage of HSBC Holdings.

Bond funds, driven by rate cut hopes, outperformed their stock market peers, which helped them gain a dominant share of issuance in the first quarter

Investors should exercise more caution when it comes to the valuations of Chinese stocks, as corporate earnings growth is set to slow because of Beijing’s pursuit of high-quality economic growth, according to China’s biggest money manager.

Chinese state intervention has tentatively put a floor under stocks, but corporate earnings show little sign of providing upwards momentum as pressure is building for investors to pocket profits from the decent gains the market has made.

Global fund managers have increased their exposure to Chinese yuan-traded stocks for a second month in March, indicating that foreign appetite for these shares is recovering.

‘The slowdown in IPOs will carry on, and the listing process for mega IPOs is expected to be lengthened,’ an analyst says, as the market watchdog has pledged to improve listing quality.

Hong Kong outperforms the region as President Xi Jinping assures US business leaders about China’s commitment to a market-oriented business environment.