Topic

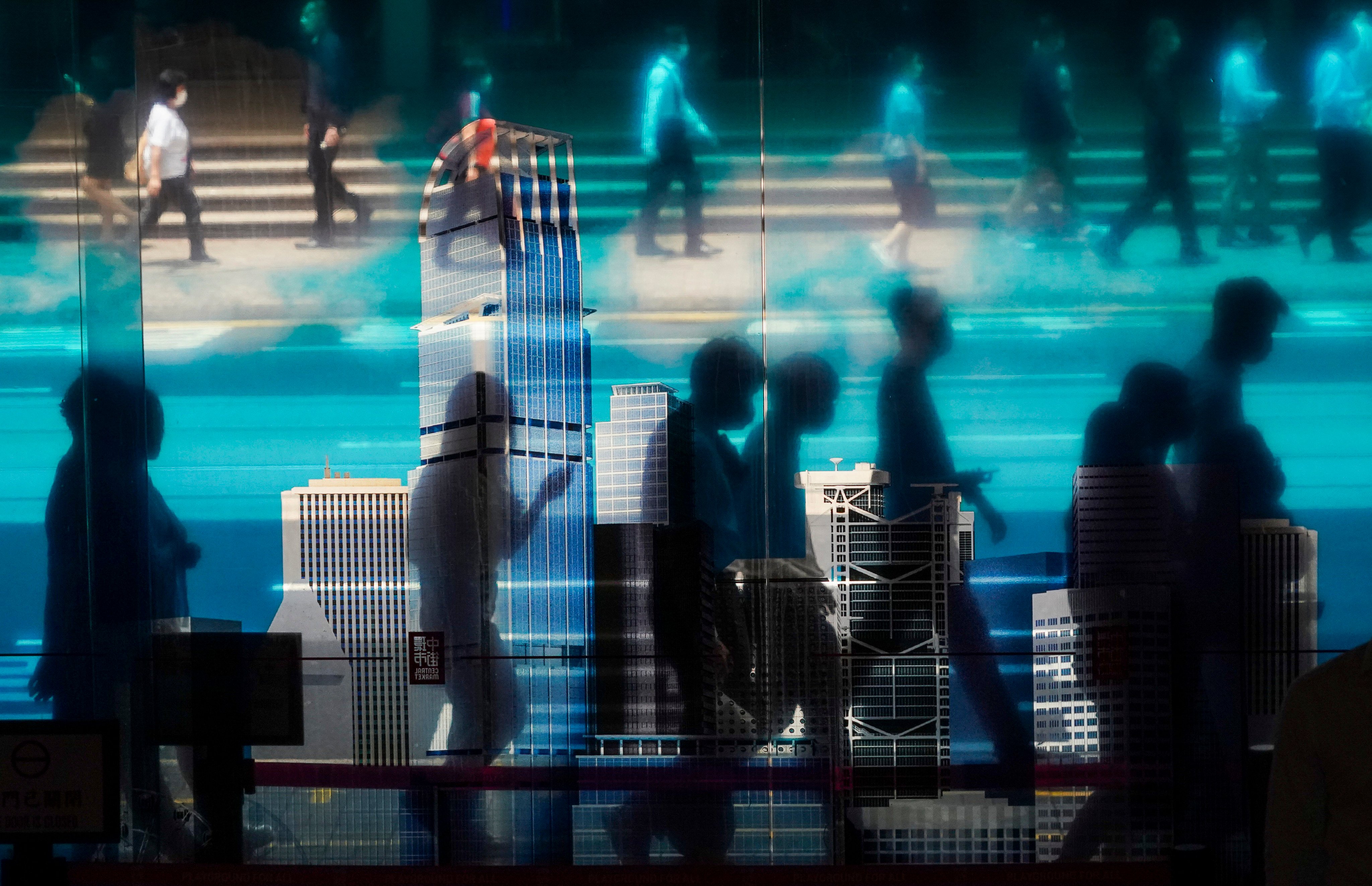

News about the global financial industry with a focus on developments in Hong Kong and China.

Attracting listings to the bourse from Southeast Asia, the Middle East and other regions, and introducing trading when typhoon signal No 8 is in force are at the top of his list.

As Beijing restructures the economy, the importance of having accurate and precise information from across the country is critical.

- Less than 30 per cent of Hong Kong businesses use senior job titles to attract talent, though 60 per cent of young workers expect rapid promotions: Robert Walters poll

- Experts say the trend is mostly limited to digital businesses and client-facing roles

Readers discuss the government’s efforts to attract family offices, and a new service for passengers transferring between commercial flights and private jets.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

In an official communique, China’s Politburo said ‘patient capital’ is expected to pitch in as the country moves towards a tech-driven growth model, showing a much-needed focus on the long term, analysts say.

Analysts say China’s central bank, with an eye on the yuan’s stability, could let it weaken gradually, but such a move ‘could backfire to some degree’.

Mayer Brown’s Hong Kong partners plan to reestablish their firm as Johnson Stokes & Master, which was the name of the Hong Kong-based entity that merged with Mayer Brown in 2008.

The outages came two days after Singapore’s financial regulator announced an end to the six-month ban on non-essential activities it had imposed on the country’s biggest bank.

Hong Kong will implement sound cybersecurity measures reinforced by strong backup systems to ensure a smooth launch of the MPF electronic platform next month, according to the MPFA’s Ayesha Lau.

‘Business performance was strong and broad-based across our segments, products and markets,’ CEO Bill Winters said.

Hong Kong’s biggest lenders including HSBC, Standard Chartered and BOCHK will keep their key lending and deposit rates unchanged, meaning local businesses and mortgage borrowers will have a longer wait for the cost of borrowing to decline.

Banking and insurance stocks boosted the Hang Seng Index close to bull market territory with the overall sentiment remaining upbeat following Beijing’s recent efforts to prop up stocks.

HKMA reiterated its warning for Hong Kong’s borrowers to “carefully assess” their financial power in considering buying property or taking on mortgages, as high interest rates “may last some time.”

Hong Kong’s largest virtual bank is preparing to introduce virtual asset trading services for retail investors, CEO Ronald Iu says. Plans are afoot as a new regulatory regime is rolled out in June.

Hong Kong kept its key interest rate unchanged for a sixth consecutive time in lockstep with the Federal Reserve’s overnight decision, with sticky US inflation forcing investors to delay rate cut bets.

Scammers have published a fictitious article with the appearance of a South China Morning Post story and a reporter’s byline to promote two online financial trading apps.

Mainland China visitors to Hong Kong during the golden week holiday period will be offered a host of freebies by banks vying for their business amid growing interest in the city’s cash-for-residency scheme.

Swiss bank UBS Group will host an investment conference in Hong Kong at the end of May, continuing a 27-year tradition begun by Credit Suisse Group, which it acquired last year.

The world’s largest cryptocurrency exchange allowed numerous trades that violated US sanctions, including ones involving Hamas, al-Qaeda and Iran.

The number of Hongkongers with negative-equity loans stood at 32,073 in the first quarter of the year, tripling from the previous quarter and the most since some 40,000 cases were recorded in the first quarter of 2004.

Total venture-capital investment in China in the first quarter fell 30 per cent quarter on quarter to US$11.5 billion amid economic uncertainty, geopolitical tensions, though China still accounted for eight of the top 10 deals.

Company leaders pledge to marshal resources carefully in 2024 as they strike a cautious tone about any potential recovery.

Six bitcoin and ether ETFs saw US$12 million in trading on Tuesday, compared with US$4.6 billion for US bitcoin ETFs on their first day.

Quinn said it was the ‘right time’ to look for a better work-life balance as the lender’s net profit slipped 1 per cent from a year ago to US$10.2 billion, surpassing the US$9.24 billion profit expected by analysts polled by Bloomberg.

After a stretch of trials in select Chinese cities, there is rising urgency to rapidly expand use of the underperforming retirement accounts as demographic challenges mount.

The government may press state banks to continue cutting lending rates, further eroding their margins, analyst says.

High inflation and elevated borrowing costs are dampening the attractiveness of leveraged private-market investments, but institutional investors across Asia-Pacific are still determined to increase their allocations in private assets, State Street says.

Reinhold Geiger is considering making an offer for the L’Occitane shares he does not already own at HK$33 to HK$34 apiece as early as Monday.

Stripping out the effect of exchange-rate fluctuations, new business value surged 31 per cent while annualised new premiums rose 26 per cent.