Topic

AIA is a multinational insurance company, offering a range of products including life insurance, accident and health insurance as well as savings plans. It also provides employee benefits, credit life and pension services to corporate clients. The company is active in markets across Asia and is headquartered in Hong Kong.

Trades in local dollar or yuan in city stock market will offer greater choice to those investors seeking to diversify not only in shares but also currencies.

- Stripping out the effect of exchange-rate fluctuations, new business value surged 31 per cent while annualised new premiums rose 26 per cent

- AIA’s Hong Kong-listed shares have lost 38 per cent since 2022, even with new business value growth of 30 per cent last year

Hong Kong’s revamped investment-migration scheme is paying off for insurers such as Prudential Hong Kong, which is planning to expand its product line to appeal to wealthy would-be Hongkongers.

UK insurer Prudential reported a strong set of results for 2023 driven by higher sales to mainland Chinese visitors as they returned to Hong Kong for better life policies and investment returns.

Hong Kong will play a key role in Janus Henderson’s Asia expansion plan because the city is a portal to China, while the new investment-migration scheme will create demand for investment products, CEO Ali Dibadj says.

AIA Group’s new sales in Hong Kong and mainland China continued to grow in the first two months of the year, indicating strong momentum from last year is carrying over in its two major markets, according to its top boss.

The repurchasing spree has come as the Hang Seng Index heads for an unprecedented fourth straight year of decline, as China’s slowdown and aggressive interest-rate hikes in the US trigger foreign outflows.

AIA Group’s new sales value grew 37 per cent in the first half, helped by new policy sales in Hong Kong to mainland Chinese customers seeking better investment returns and a hedge against currency weakness.

Hong Kong and foreign investors on Monday started to use offshore yuan funds to buy and sell shares of Alibaba, Tencent and 22 other companies, marking another milestone in the internationalisation of the Chinese currency.

Life insurance sales to mainland Chinese visitors rose by 28 times in the first quarter, as the reopening of the border unleashed a wave of pent-up demand, data from the Insurance Authority showed.

At least 26 companies disclosed buy-backs totalling HK$667 million (US$85.2 million) on Tuesday, according to data compiled by Securities Times. AIA has been the most active this year, acquiring shares worth HK$12.5 billion.

Lawmakers showed their support for the Hong Kong government’s proposed compensation scheme aimed at protecting policyholders who would get up to HK$4 million (US$636,942) per policy in case an insurer collapses.

UK-based Prudential reports 15 per cent growth in new sales across Asia in the first two months of this year, while Ping An Insurance tallies 5 per cent sales growth in the same period.

The value of life insurance policies sold to mainland customers tripled last year from 2021, according to figures released on Friday, as the easing of travel restrictions late in the year allowed cross-border traffic to resume.

The full reopening of China’s southern border with Hong Kong on January 8 was a relief for AIA, which counted on the two markets for 50 per cent of new sales in 2022.

Many of the 120,000 insurance agents who suffered during the pandemic are gearing up to serve returning mainland visitors – big spenders on local insurance products. And to tap this business, AIA, Manulife and Prudential plan to hire a total of 10,000 new agents this year.

Hong Kong Olympian says ankle injury that forced her to miss World Championships left her ‘a little down’.

Life insurance sales in Hong Kong jumped 25 per cent last year, the highest since 2016, after insurers bolstered staff numbers by recruiting flight attendants laid off amid the Covid-19 pandemic.

The Hong Kong-listed insurer conducted a number of deals last year, which helped boost net profit by 28 per cent to US$7.48 billion, beating analysts’ estimates of US$6.47 billion in a Bloomberg poll.

AIA joins a growing number of firms and institutions in curtailing holdings. According to the Insure Our Future campaign, 65 insurers with combined assets of US$12 trillion have so far divested from coal.

The plan underscores the realignment in China’s labour force amid the slowest economic growth pace in decades, after the government unexpectedly unleashed a wide-ranging slew of reforms last month that turned edtech, online education platforms and tuition centres into non-profit organisations.

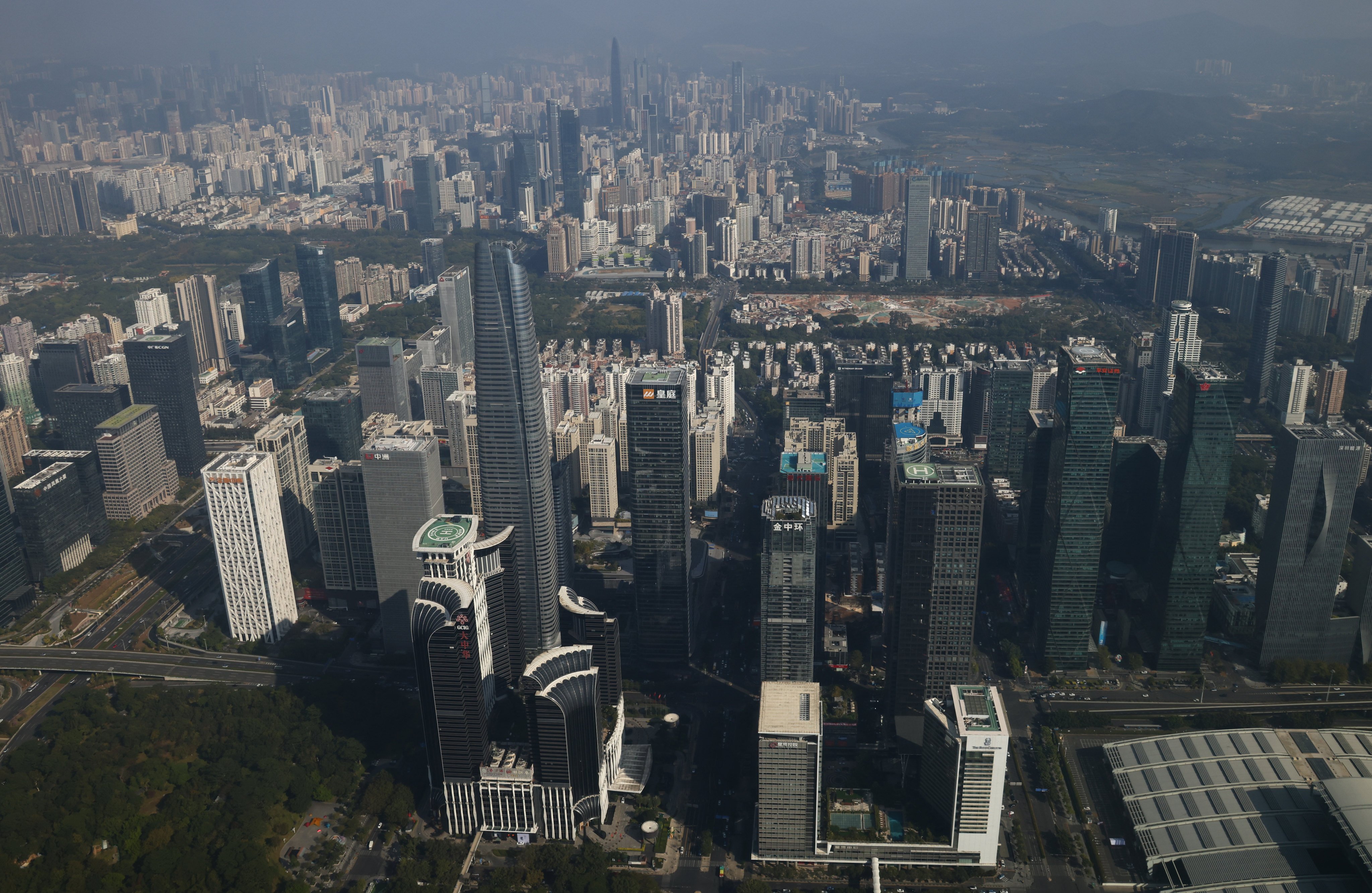

AIA seeks further expansion in China as it looks to build network big enough to serve 300 million potential “middle class” customers.

Hong Kong stocks tumbled as China looks to tighten its stranglehold on tech companies with anti-competition rules. The US securities watchdog cautioned investors about buying Chinese companies traded in the US.

Hong Kong’s biggest publicly traded life insurer will buy a 24.99 per cent stake in China Post Life Insurance as it expands its presence in the mainland.

Higher propensity to save for rainy days is bad omen for businesses in the region amid uncertainty about border reopening and relatively slow progress in vaccination efforts.

Insurance companies are hiring record numbers of agents in a bid to expand domestic sales after the pandemic cut off their lifeblood – mainland Chinese clients crossing the border to buy policies.

Exempted executives are still required to observe self-isolation rules if they arrive from ‘high-risk’ areas. They must be fully vaccinated and also produce negative Covid-19 test results before arriving in Hong Kong.

Match jerseys from 4-0 English Premier League win over Sheffield United led by Gareth Bale and Son Heung-min will be auctioned for charity.

The Bank of East Asia is looking to extract commission income from cross-selling AIA life policies to its banking clients after divesting its insurance assets. Cross-border wealth management and insurance schemes could be the next big thing, co-CEO Adrian Li says.

AIA and Bank of East Asia struck a 15-year partnership to distribute life, savings products to lender’s retail customers in the Greater Bay Area as part of agreement to sell BEA Life.