Hong Kong lawmakers, brokers support bill paving the way for mainland Chinese investors to trade yuan-denominated stocks in city

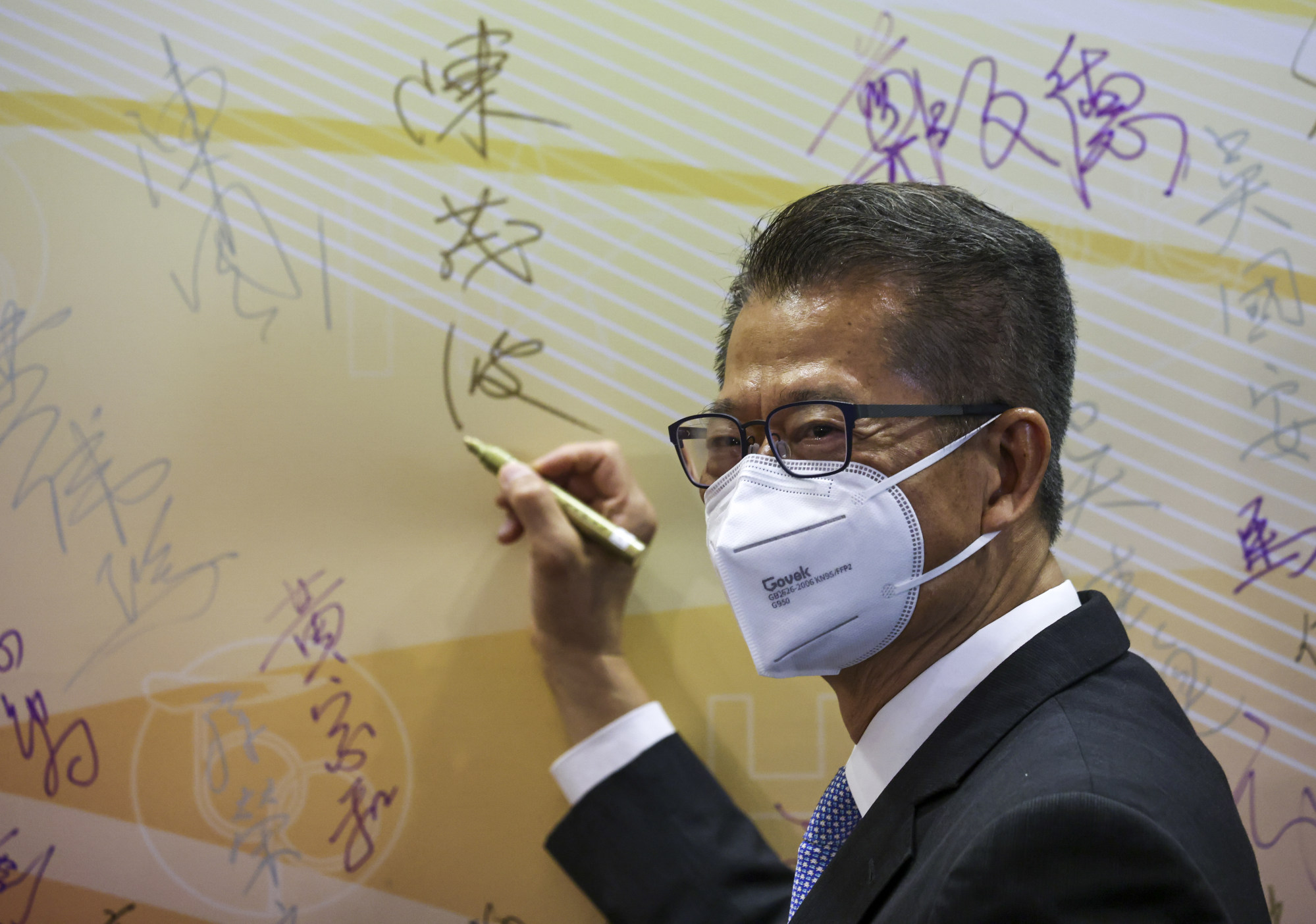

- Financial Secretary Paul Chan disclosed the plan to introduce a ‘one stock, two currencies’ option in his blog last weekend

- The daily turnover on the southbound link of the Stock Connect averaged US$5.3 billion last year

Hong Kong lawmakers and stockbrokers are firmly behind a proposed government legislation that will allow the city to introduce yuan-denominated stock trading.

“By adding a yuan trading desk option for the Stock Connect, such arrangement has [the benefit] of killing two birds with one stone,” Chan said in his blog. “We have completed preparations for the potential technical challenges that could arise from [from this new arrangement].”

A bill will be submitted to the Legislative Council this year to allow Hong Kong stocks under the Stock Connect scheme to be quoted in both Hong Kong dollars and the yuan for mainland investors to trade, he said. A market maker system which will quote Hong Kong stocks in both currencies will also be established.

Several lawmakers voiced support for the bill.

“The suggestion is in line with the central government’s 14th five-year plan to strengthen Hong Kong as a global offshore yuan business hub,” said Robert Lee Wai-wang, the lawmaker for the financial services sector and CEO of Grand Capital Holdings.

“The bill should be able to get support of the lawmakers, as the introduction of yuan shares can reduce the currency risks faced by mainland investors. It will help encourage more investors to trade in Hong Kong,” said lawmaker Edmund Wong Chun-sek, who represents the accountancy constituency.

Trading of ETFs in Hong Kong-China Stock Connect to start on July 4

Peter Shiu Ka-fai, lawmaker for the wholesale and retail sector, said “allowing yuan shares trading in Hong Kong will add to the attractiveness of the city’s capital market. It will also enhance Hong Kong’s role as an offshore yuan trading centre.”

Currently, mainland investors trading more than 500 Hong Kong stocks through the southbound channel of the Stock Connect know the exact yuan amount they have to pay or receive two days after a trade is executed. The settlement amount is calculated by China’s central securities depository based on the foreign exchange rates provided by banks at the close of market two days after the trade.

By giving investors the option to directly trade Hong Kong stocks quoted in yuan, they will no longer have to bear the risk of the offshore yuan’s spot exchange rate in Hong Kong eating into their returns.

This will also consolidate Hong Kong’s role as an offshore yuan centre, as it would gain another popular asset class that could be traded in the yuan. The average daily trading volume on the southbound link of the Stock Connect was HK$41.7 billion (US$5.3 billion) last year, data from the Hong Kong stock exchange shows.

Yuan-denominated stocks will catalyse the market for the city’s offshore yuan bonds, also called dim sum bonds, which is expected to grow to 70.6 billion yuan by the end of 2022, according to Standard Chartered.

A working group on the new initiative formed by bourse operator Hong Kong Exchanges and Clearing, the Securities and Futures Commission and the HKMA has completed a feasibility study, Chan said in his budget speech in February.

Hong Kong’s de facto central bank is obliged to keep the local currency within the HK$7.75 to HK$7.85 band per US dollar under its linked exchange rate system.

“Having a yuan-denominated stock trading option would certainly expand onshore investors’ access to Hong Kong assets, as their view on the value of the yuan versus the US dollar would adjust as the economic cycle shifts,” Wang said.

The move could lift trading volume on the Hong Kong stock exchange, which has reported a 30 per cent decline in average daily turnover this year to HK$128.15 billion.

“The introduction of yuan shares would help boost market turnover as it would add another choice of currency for mainland investors,” said Tom Chan Pak-lam, chairman of the Hong Kong Institute of Securities Dealers, an industry body.

“Hong Kong needs to continue to diversify its products to attract investors as the turnover has declined this year.”

The introduction of yuan shares trading in Hong Kong will be an important step for the internationalisation of the yuan, according to Louis Tse Ming-kwong, managing director at Wealthy Securities.

“This would also help to strengthen Hong Kong’s role as an international financial centre,” Tse said.

.jpg?itok=zSWXqQCw)