If successful, the No. 3 battery maker in China could become the second-largest IPO in Hong Kong this year.

Hong Kong lawmakers and stockbrokers said the proposed legislation will strengthen the city’s status as an international financial centre and reduce the yuan exchange rate risks affecting mainland Chinese traders.

China’s Ministry of Finance (MOF) sold two tranches of offshore yuan bonds in Macau on Wednesday, marking a step forward in its effort to develop an offshore yuan market.

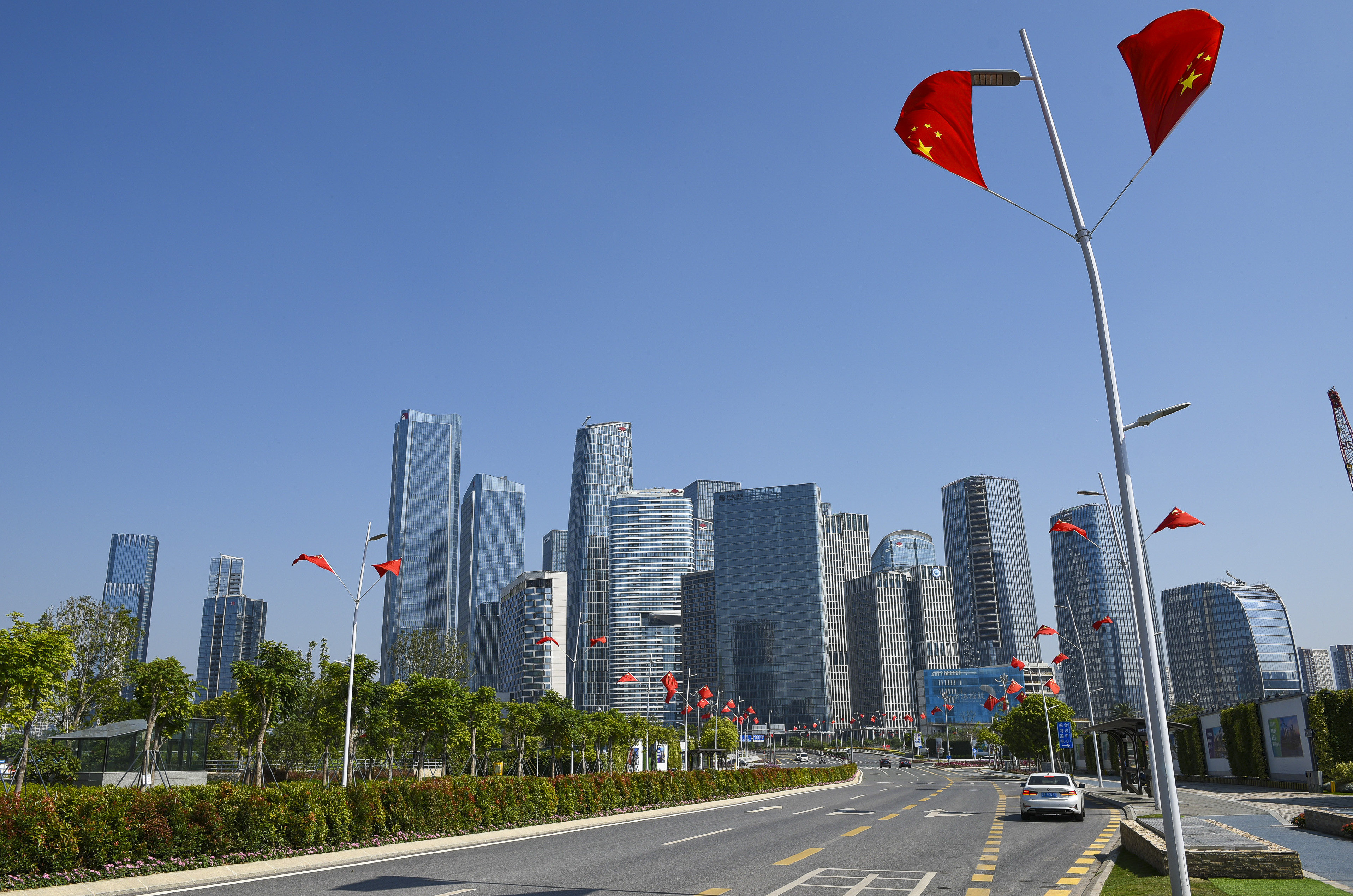

Hong Kong and Shenzhen have announced 18 measures for financial firms to set up in Qianhai, as the two cities seek closer collaboration in drawing venture capital to the special economic zone.

Onewo, the property services unit of property developer China Vanke, has received the go-ahead from the Hong Kong stock exchange’s listing committee for an IPO, and will start the investor education process this week, according to a source.

ICBC, the world’s largest bank by assets, sees more challenges ahead in staving off the impact of China’s strict zero-Covid measures on its loan quality.

Two Chinese state-owned banks said this week that their first-half earnings were largely unhurt by the country’s Covid-19 lockdown measures, but more challenges are in store.

Zhejiang Leapmotor Tech has won approval from the Hong Kong stock exchange’s listing committee, says a source, with the deal launch slated for September.

China Tourism Group Duty Free got off to a lacklustre start on its closely-watched debut on the Hong Kong stock exchange on Thursday, its shares barely moving from their IPO price.

Crypto exchanges such as Gemini and Bitstamp are offering returns of 3 to 5 per cent on staked cryptocurrency, as the anticipated Ethereum upgrade brings more attention to faster, greener blockchains.

Chinese banks are set to report 5 per cent year-on-year profit growth for the first half of 2022, as sustained loan growth to support infrastructure and companies is expected to offset weaker retail loan demand caused by Covid-19 lockdowns in the second quarter, analysts said.

The Hang Seng Index compiler will add four stocks to the benchmark gauge from September 5, boosting its capitalisation by US$88.7 billion.

The world’s largest travel retailer by sales prices its Hong Kong IPO at HK$158 per share or total proceeds of US$2.1 billion in the city’s biggest deal this year.

Hong Kong’s audit watchdog extends probe into China Evergrande’s property services unit as questions loom over its 13.4 billion yuan deposit guarantee, first disclosed in July.

Expectations of a pullback in US interest rate increases and lower currency market volatility are likely to pose challenges for Standard Chartered’s capital markets and trading business in the second half of 2022.

China Tourism Group Duty Free has received approval from the Hong Kong stock exchange for its IPO and aims to raise around US$2.7 billion.

The Hong Kong government has increased the size and guaranteed returns for its latest batch of Silver Bonds, offering some 2 million senior citizens an investment that could help hedge against inflation.

HK Acquisition Corp’s IPO as the city’s third special purpose acquisition company is fully subscribed and slated for listing in mid August, sources say.

More Hong Kong business owners, including actor Louis Koo, are minting NFTs to bring exclusive services and experiences to their customers.

AI Speech has entered into the Q&A portion of its listing application submitted to the Shanghai bourse in July. The company hopes to raise US$1.5 billion but is still in the early stages of a long vetting process.

Hong Kong’s commercial banks will increase the prime interest rate by 12.5 to 25 basis points in September, say analysts surveyed by the Post, although some expect a bigger increase sooner.

Four Chinese firms debuted on the SIX Swiss Exchange in the first test of Chinese global depositary receipt in Zurich.

Interest rate increases in the US and other major markets globally will have an impact on Hong Kong’s economy and exports, Financial Secretary Paul Chan Mo-po said on Thursday. But the second phase of the city’s Consumption Voucher Scheme will help offset this impact.

Modern Media is the publisher of the Chinese edition of Bloomberg BusinessWeek in Hong Kong under a licensing agreement.

Controlled by gold mining magnate Kanat Assaubayev, MM Petroleum and Kazakh Steel have applied for Hong Kong IPOs as the bourse desperately seeks non-Chinese listings.

Chinese A share companies line up share sales of global depositary receipts on SIX Swiss Exchange as Beijing pushes for further opening of its capital markets.

Barclays has received regulatory approval to set up a wholly owned unit in Taiwan, which will focus on underwriting and green financing solutions.

Despite the recent implosion of several crypto firms, some start-ups in NFTs and blockchain-based decentralised finance have the potential to become dominant players, according to KPMG and HSBC.

At least a fifth of rated Chinese property developers will end up becoming insolvent, putting as much as US$88 billion of their distressed bonds at risk, according to S&P Global Ratings.

An absence of offerings from Chinese developers and rising US interest rates sank bond issuances in the first half of the year to the lowest level since 2018, with little to no recovery in sight.