Asian foreign-currency bond issuance falls to four-year low amid Chinese developers’ woes, US rate rises

- Bonds issued in US dollars, yen and euros by Asia ex-Japan borrowers fell to lowest level since 2018

- Analysts see little hope of a recovery in the second half, with troubled Chinese developers shut out of market

An absence of offerings from Chinese developers and rising US interest rates sank bond issuances in the first half of the year to the lowest level since 2018.

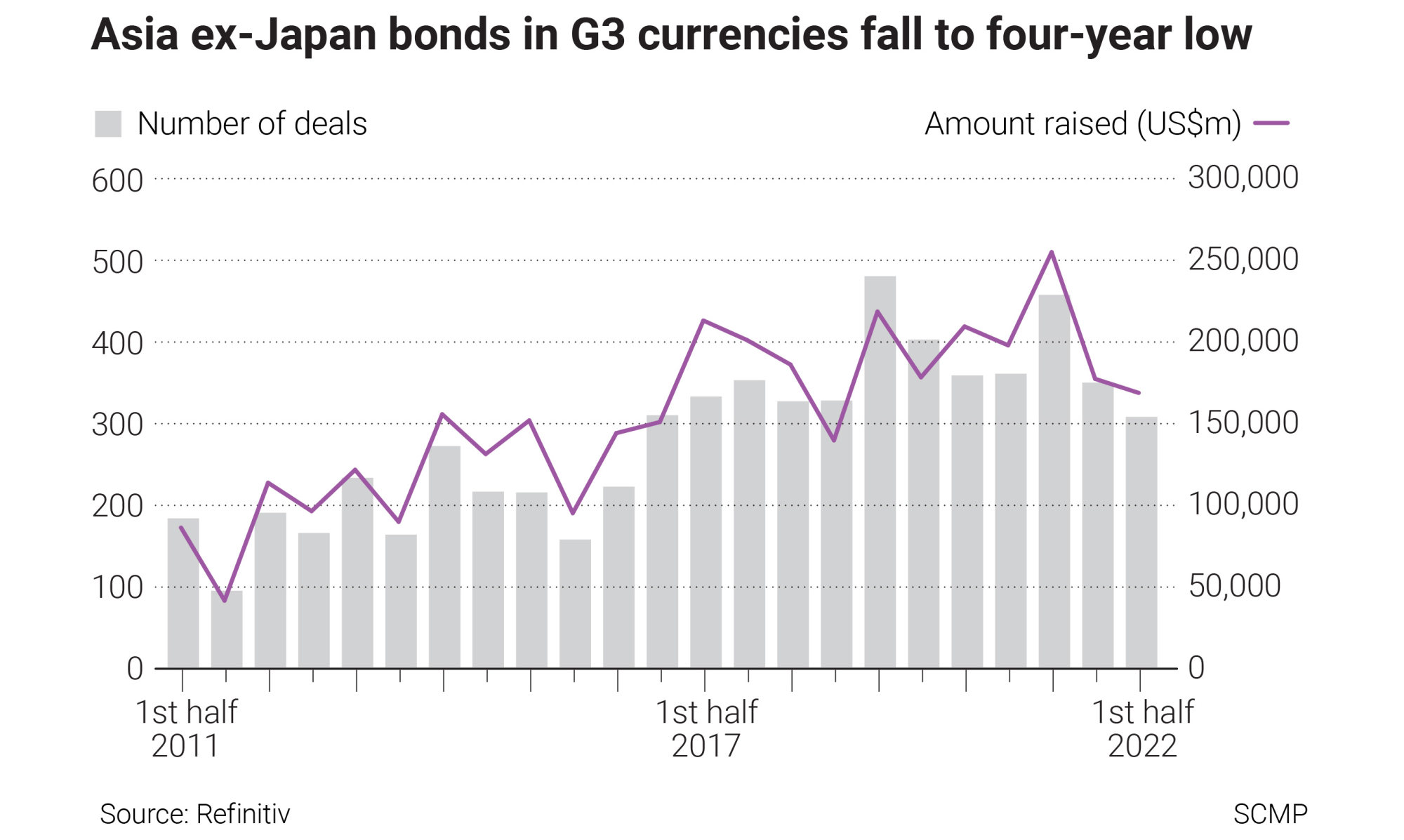

Issuance of bonds in the so-called G3 currencies, comprising the US dollar, the yen and the euro, declined 34 per cent year-on-year in the first six months of 2022 to US$169 billion, data from Refinitiv shows.

“I can’t see how issuance can rebound in the second half, when many Chinese issuers cannot refinance through raising bond funding, and investors’ demand for longer term papers beyond 10 years has nearly disappeared,” said David Yim, regional head of debt capital markets for Greater China and North Asia at Standard Chartered.

Investment-grade issuers, meanwhile, have been put off by the rising costs of dollar funding and have held back from tapping the market, Yim said.

Ten-year US treasuries rose to above 3 per cent in June from 1.6 per cent in January – before being dwarfed by the higher yields paid by the two-year note last week, resulting in an inversion of the yield curve. Such a phenomenon has sunk demand for longer-dated papers, as placing money in shorter term treasuries is returning more than money locked up for 10 years.

“It has been a very challenging six months for the Asian US dollar credit market,” said UBS CIO, the research unit of the Swiss bank’s global wealth management division, in a report published in June. The return on Asia investment-grade debt is down 9.8 per cent this year because of the change in US interest rates.

Combined with Russia’s invasion of Ukraine and growth concerns stemming from fears of more Covid-related lockdowns in China, issuance for 2022 is likely to fall well below the US$344 billion total Asia-Pacific ex-Japan issuance achieved last year, Yim said.

Property sales in China will need to recover for the Asian high-yield market to turn around, according to UBS CIO, which expects sales to bottom out towards the fourth quarter thanks to continuing policy support.

“We believe macro uncertainties stemming from persistently high inflation globally and China’s growth recovery will weigh further on the market in the near term,” said UBS report authors Timothy Tay and Devinda Paranathanthri.