Is capital evil? China’s widening crackdown has the ring of a bygone era defined by Mao and Marx

- Beijing’s warning against ‘colluding with capital’ sounds vague but is likely significant – and a sign its campaign targeting the private sector is about to widen

- China has good reasons to scale back excesses but its methods have fuelled leftist hype, prompting concerns it is abandoning the principles behind its economic success

Is capital evil?

Now the debate is set to ratchet up a notch. On Wednesday, the Chinese government introduced even more ominous lingo into the public discourse by accusing a former high-ranking official of “colluding with capital and backing disorderly expansion of capital”.

That is the most eye-catching of a slew of corruption allegations China’s top anti-graft agency, the Central Commission for Discipline Inspection (CCDI), has made against Zhou Jiangyong, once a political rising star and former party secretary of Hangzhou, capital city of Zhejiang province. Other charges include the more standard fare of trading power for a large amount of money and gifts, benefiting not only him but his relatives.

The announcement has immediately set tongues wagging about what the vague but potentially significant phrase of “colluding with capital” really means, who or what the word “capital” refers to, and its ramifications.

It came on the heels of CCDI’s annual national meeting which ended this month. Among other things, the agency vowed it would step up efforts to investigate and punish any corruption behind “the disorderly expansion of capital and (online) platform enterprises in order to sever the connections between power and capital”.

It probably means that the year-long campaign that originally targeted China’s big tech firms but later spread to other private sectors will deepen and more senior officials and businessmen will be implicated this year.

TV parades of China’s corrupt officials raise more questions than answers

Since then, regulatory crackdowns have extended to more sectors including gaming, private education, food delivery, property, and the entertainment industry. The intense moves have spooked investors and triggered a brutal sell-off in Chinese company stocks listed on overseas bourses from New York to Hong Kong over the past year, wiping off at least several trillions of US dollars in market value.

The latest sector to be hit appears to be the biomedical industry with the index tracking shares of companies in the sector falling nearly 50 per cent in the past few months.

Historically, the word “capital” has a special meaning in the public discourse. Back in the ideologically driven era of Mao Zedong, capital was denounced as wicked and intense struggles against “capitalist roaders” were a permanent feature of life, exemplified by the Karl Marx quote that “capital comes dripping from head to foot, from every pore, with blood and dirt”.

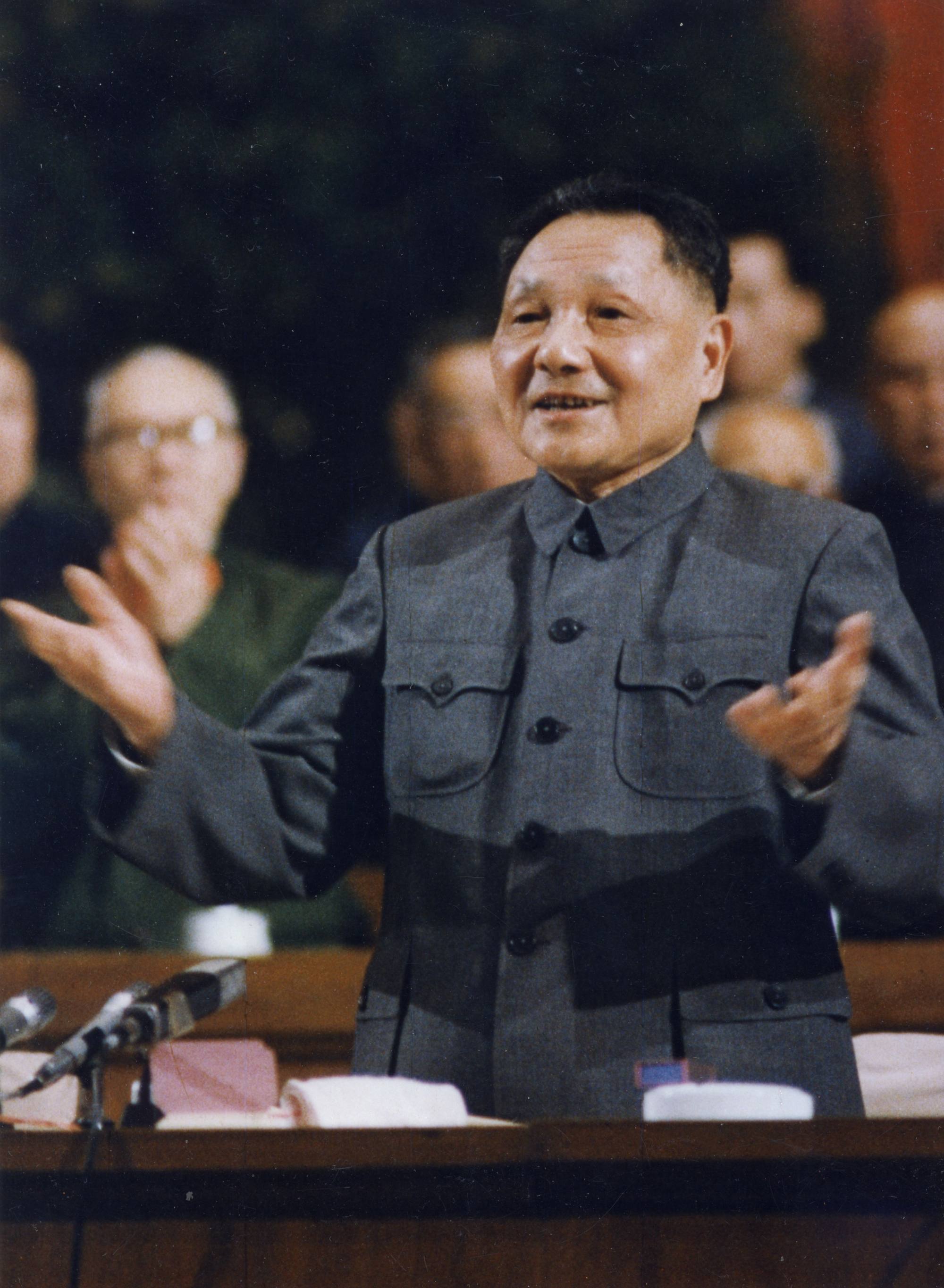

After Deng Xiaoping came to power in the late 1970s, he ditched Mao’s class struggle policy in favour of reform and opening up. Since then, while the party may still see realisation of communism as its highest ideal, it has effectively embraced capitalist methods and encouraged entrepreneurship. This has fuelled China’s economic growth and elevated its economy to be the second largest in the world.

Xian’s Covid-19 chaos exposes dark side of China’s top-down governance

The worries have risen further as the continuing regulatory crackdowns focus on those sectors dominated by the country’s most dynamic private enterprises. On top of the crackdowns, the leadership’s call for “common prosperity”, first uttered in August last year, has added to the jitters as it is widely interpreted as targeting the country’s nouveau riche.

In fact, as many analysts have pointed out, China has good reasons to scale back capitalist excesses including monopolies and unfair competition and rein in the freewheeling tech companies after their “barbarous” growth in the past decade.

But the political climate and the way those crackdowns are initiated have encouraged the country’s leftist elements to hype the crackdowns as “a profound revolution” and blame private entrepreneurs as a new breed of capitalists for social injustices and wealth inequality. This brings back memories of the bygone era when capital was bad.

In fact, the Chinese government should take the lion’s share of the blame for those excesses because of its lack of transparency or well-defined regulations and oversight in the past decade.

While it is high time for the government to enhance regulation using the metaphor of installing traffic lights to signal the go and no-go areas, its intention to label capital as a threat and go after the so-called nexus between capital and power is ill-considered and counterproductive.

The inherent nature of capital is to pursue profits. It is true for capitalism and socialism as well as state capital and private capital. That is what has driven entrepreneurship and innovation.

Of course, the authorities have every reason to tackle any corruption emerging from any sector.

But hyping the threat of capital serves no purpose other than fuelling more concerns that the country is moving further away from the entrepreneurship and other free-market principles that underpinned its dynamic economic growth of the past four decades.

Wang Xiangwei is a former editor-in-chief of the South China Morning Post. He is now based in Beijing as editorial adviser to the paper