Topic

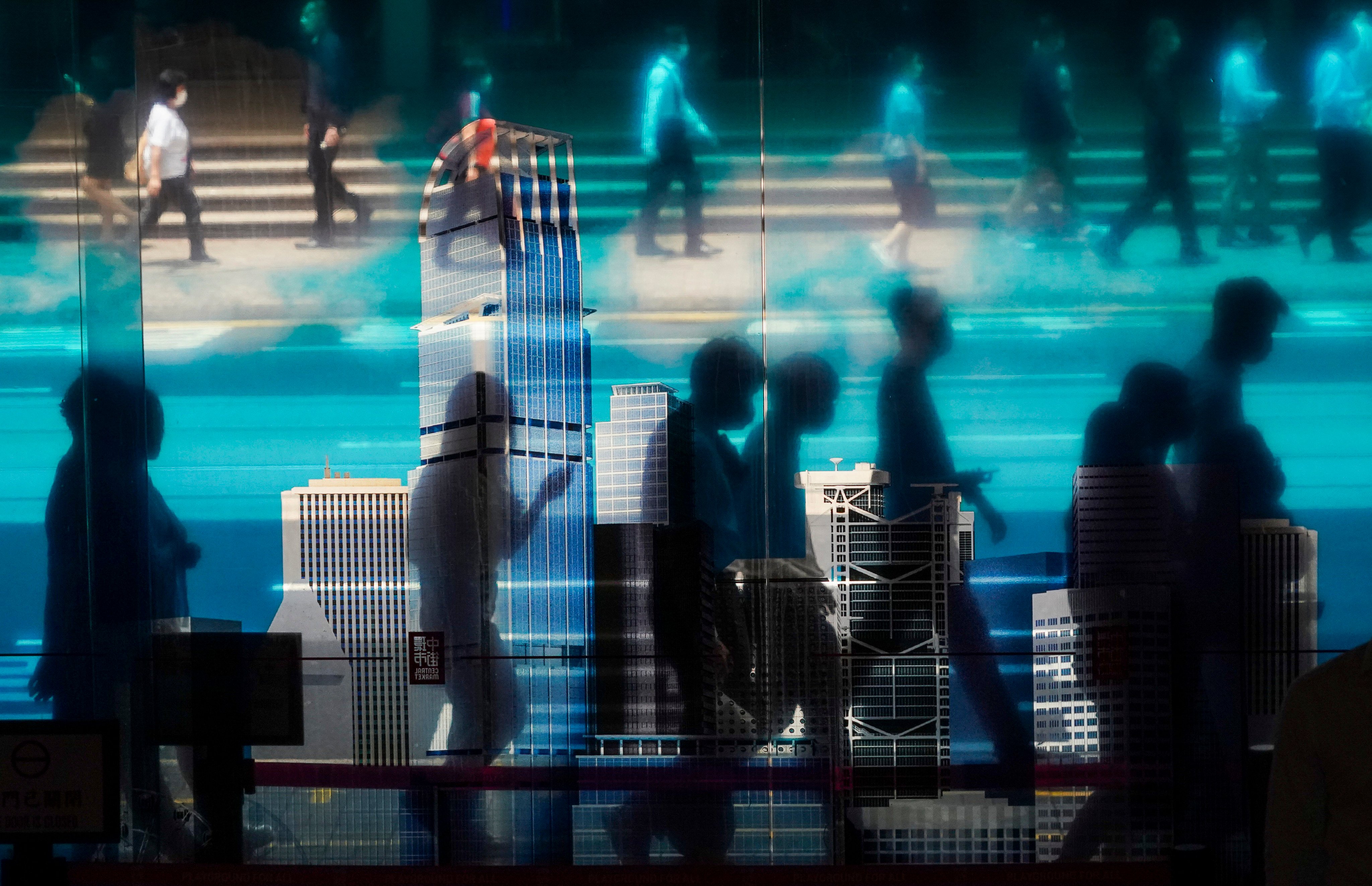

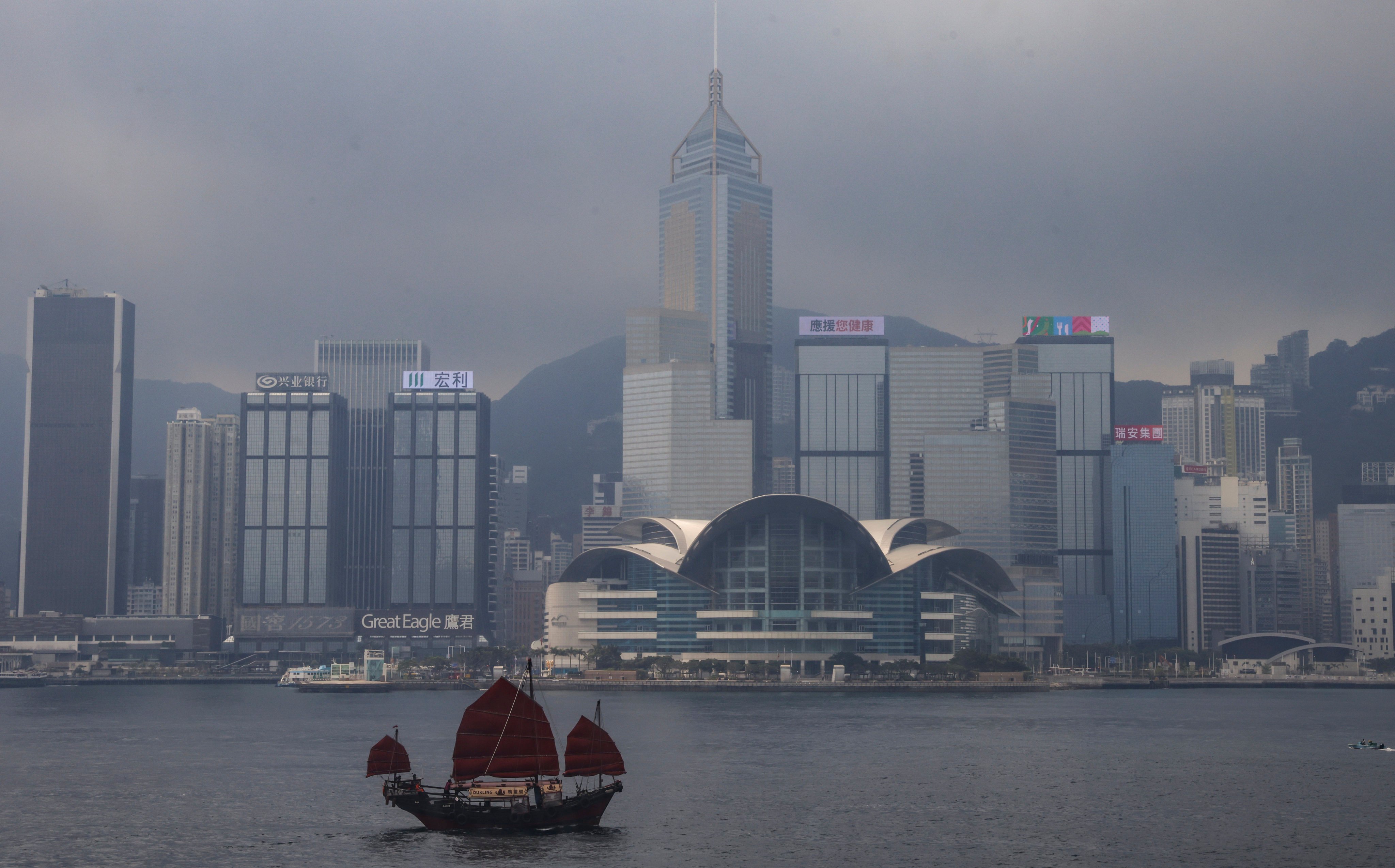

Latest news and features on investing, with a particular focus on the economies in Hong Kong, mainland China and Asia.

Large supply of homes due to come online soon in Hong Kong will, hopefully, help thwart the rise of a new generation of speculators.

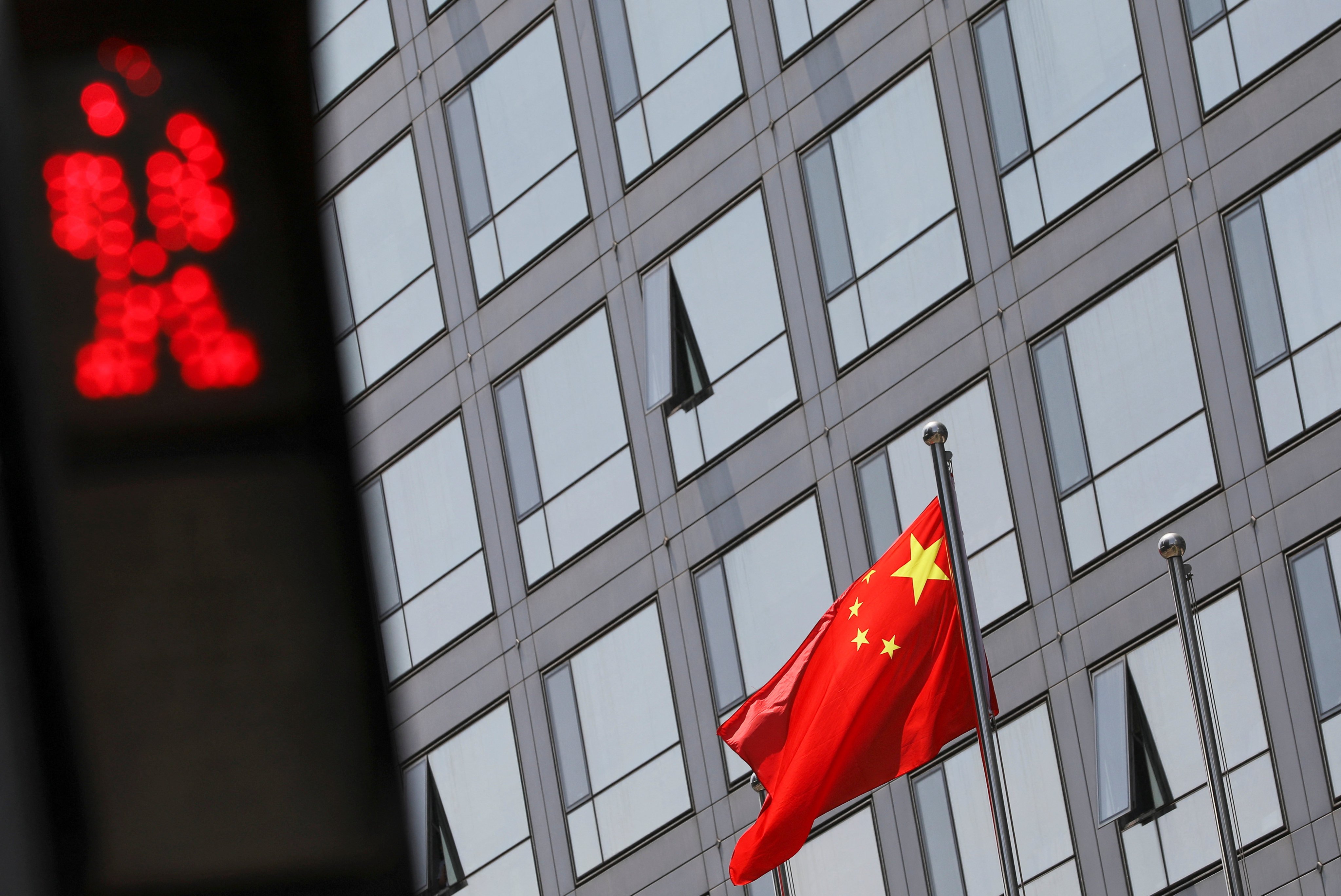

Beijing has been slow to address the visa and e-payment woes of foreign travellers, and some officials remain complacent about the exodus of foreign investment. Amid Article 23 jitters in Hong Kong, Beijing must address the multitude of concerns.

- The number of private debt funds in the Asia-Pacific region grew by 22 per cent to 94 at the end of 2023 compared with a year before

- ‘We are just scratching the surface of the opportunity’ in Asia’s private credit market, says Soo Cheon Lee, co-founder of Hong Kong-based SC Lowy

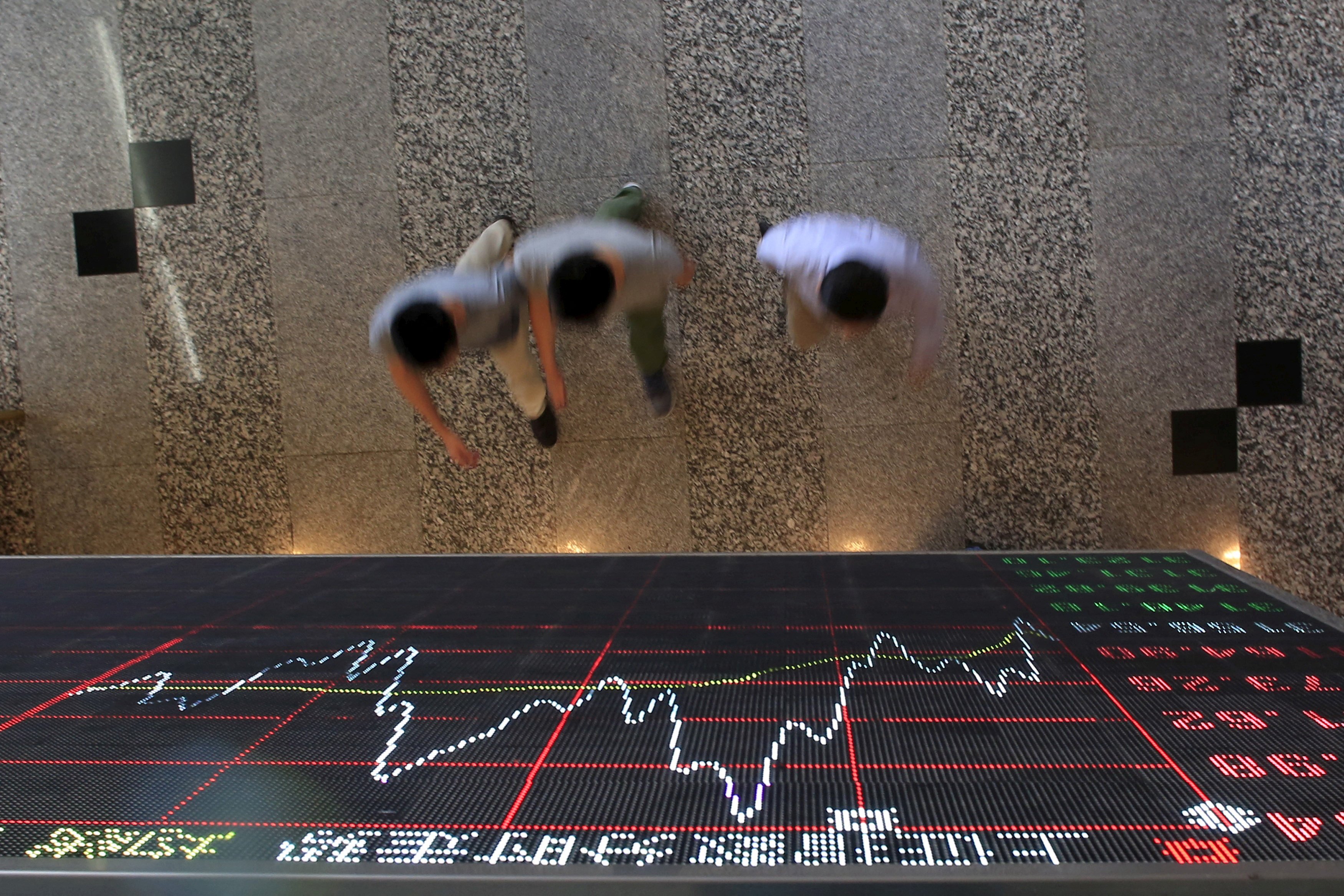

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, continued its comeback in the first quarter, posting a return of HK$54.3 billion (US$7 billion) as rising overseas stock markets offset losses in domestic equities.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

Ever wondered how the Big Apple’s billionaires made their money? Here’s exactly how they did it – and what some have planned for it once they’re gone

Hong Kong will implement sound cybersecurity measures reinforced by strong backup systems to ensure a smooth launch of the MPF electronic platform next month, according to the MPFA’s Ayesha Lau.

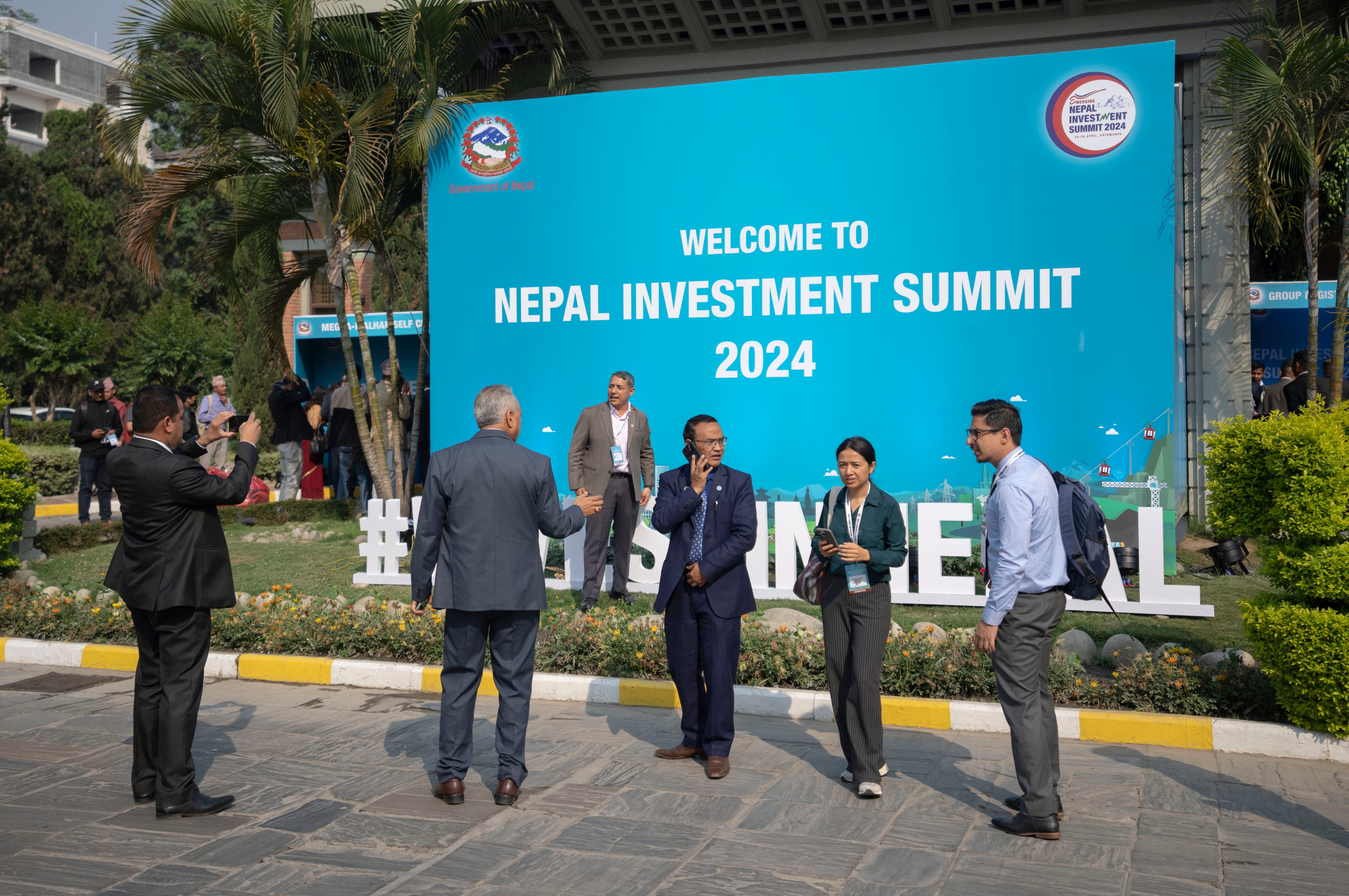

Nepal’s “dysfunctional” politics may curb its economic ambition amid jostling between India and China to step up their investments in the country.

Scammers have published a fictitious article with the appearance of a South China Morning Post story and a reporter’s byline to promote two online financial trading apps.

Total venture-capital investment in China in the first quarter fell 30 per cent quarter on quarter to US$11.5 billion amid economic uncertainty, geopolitical tensions, though China still accounted for eight of the top 10 deals.

Gold purchases in China rose by 5.9 per cent in the first quarter compared with the same period in 2023, as consumers seek security in ‘the only safe asset’, analysts said.

High inflation and elevated borrowing costs are dampening the attractiveness of leveraged private-market investments, but institutional investors across Asia-Pacific are still determined to increase their allocations in private assets, State Street says.

Disgraced property mogul Truong My Lan may have been the richest person in Vietnam at one point – before she was caught taking out billions in fraudulent bank loans

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

The Golden Horizon Fund, which will target companies across the Gulf Cooperation Council countries and China, marks the first time that CIC has invested in the Middle East.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Role of fund managers will be strengthened as cost of rule violations increases ‘substantially’, a lawyer says, while Goldman Sachs predicts higher ‘quality premium for large-cap stable growers’.

Despite its attempts to woo back foreign investment, China has yet to see a hoped-for return of overseas capital as enterprises express hesitation to jump back into the fray.

Wars in the Middle East and Ukraine, and continuing lower US interest rates have burnished gold’s billing as an investment, but it is the unrelenting Chinese demand that is juicing the rally.

Germany’s Allianz Global Investors looks forward to tapping mainland China’s ‘vast potential and steady growth’ after getting the green light to operate an onshore fund management company there, says regional head.

Gold markets in China have been inundated with a throng of new buyers, looking to put their money into a commodity which has skyrocketed in value as other investments have lost their lustre.

All financial institutions licensed by the SFC should be required to submit ESG reports for the development of a comprehensive ecosystem of sustainability disclosures, City University of Hong Kong says.

China has unveiled new foreign ownership rules for certain telecommunications services, a move to generate investment and confidence as it strives to meet broad economic goals.

HSBC plans to host another global investment summit in the city early next year after this year’s sell-out inaugural conference drew 3,500 attendees, an overwhelming success in proof that ‘Hong Kong is back’.

InvestHK says it has had 1,600 inquiries since March 1 launch, with 70 per cent of interest from professional services providers.

The future of China’s economic growth depends on strong innovation in the technology sector and – despite the current headwinds – investors would be wrong to sleep on the country’s potential, industry leaders says.