Topic

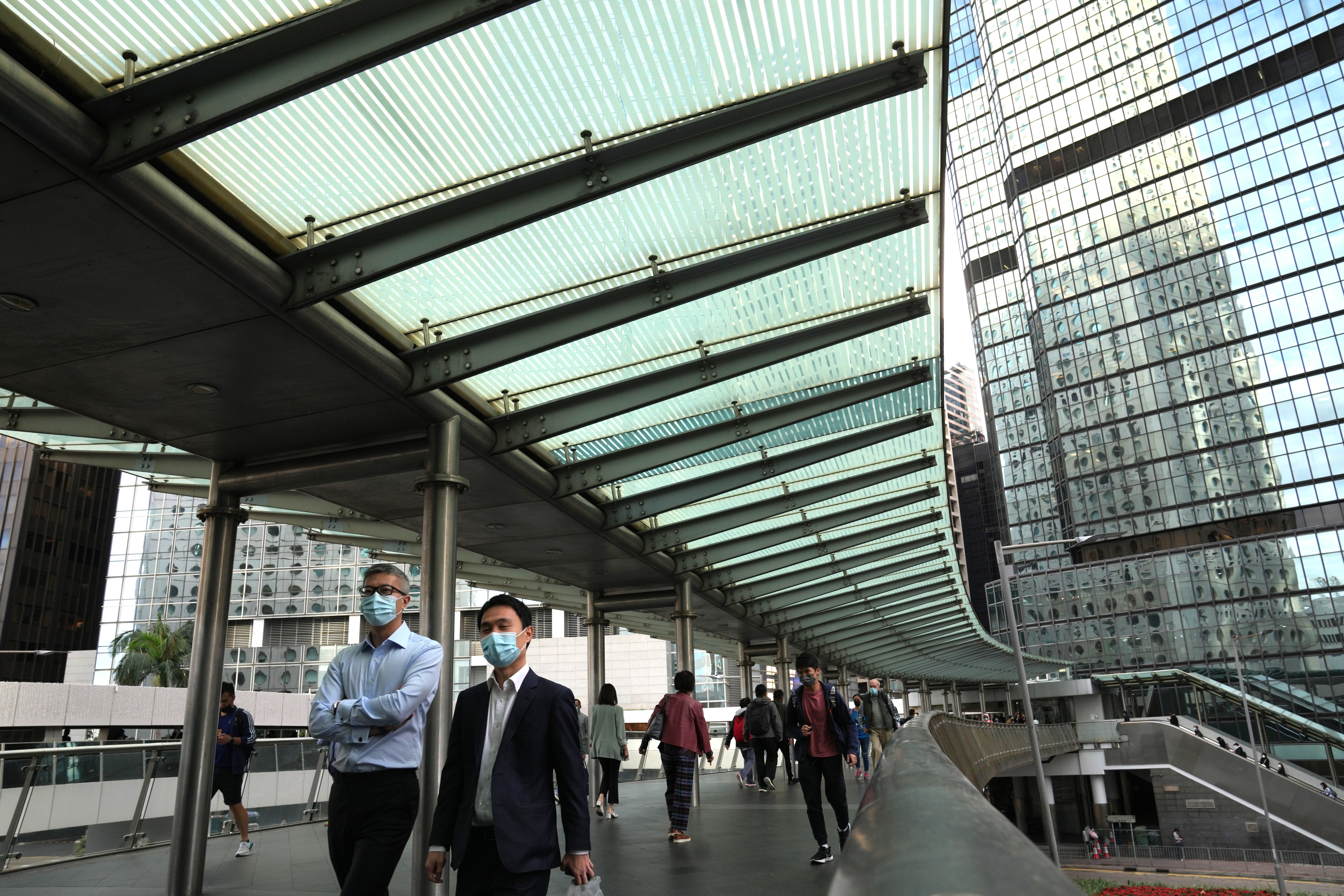

The Hong Kong Monetary Authority (HKMA) was established in April 1993 by merging the Office of the Exchange Fund with the Office of the Commissioner of Banking. The HKMA is responsible for maintaining monetary and banking stability, including maintaining currency stability within the framework of the Linked Exchange Rate system under which the Hong Kong dollar is pegged to the US dollar.

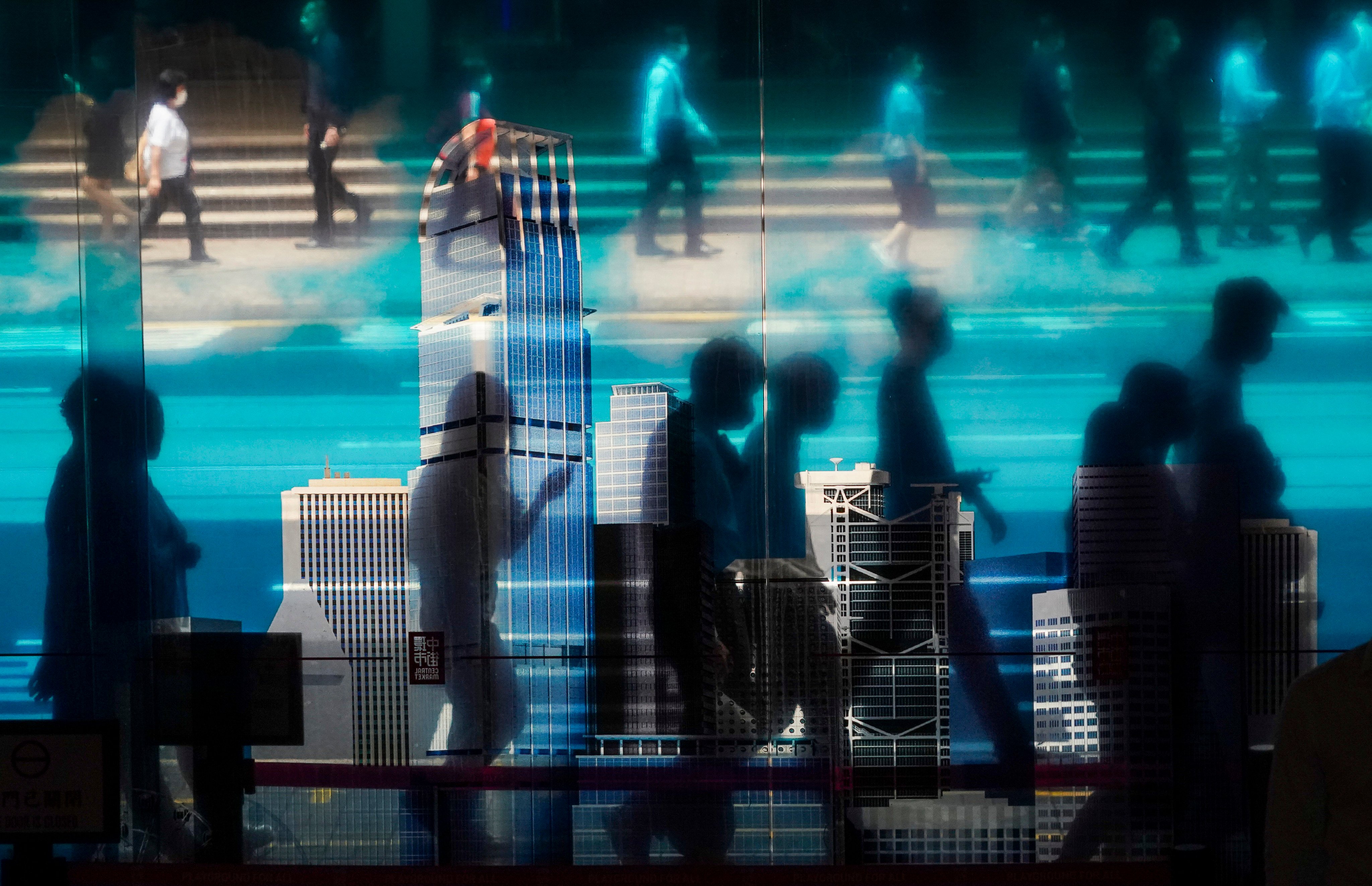

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

Large supply of homes due to come online soon in Hong Kong will, hopefully, help thwart the rise of a new generation of speculators.

With the Fed expected to start cutting rates before the end of the year, margins for lenders will narrow, potentially exposing threats in other areas. Hong Kong’s banks have made provisions and shored up balance sheets to ward off China property risk

From wealth management to bonds and banking services, mainland China has shown further support for city as a financial hub

Meeting of leading central bankers an answer to those who doubt city’s reputation as global financial centre.

Strong bond market drives rebound by war chest that helps defend Hong Kong dollar and hopes are high it will continue.

Hong Kong’s financial system is robust, but prudence is called for as even steady interest rates are likely to remain high for a while next year.

- A unified eMPF Platform will replace separate systems currently in use by different providers from June 26

- MPFA chairwoman urges the public to beware of potential fraud and stresses the authority has tough cyberattack safeguards in place

Hong Kong’s biggest lenders including HSBC, Standard Chartered and BOCHK will keep their key lending and deposit rates unchanged, meaning local businesses and mortgage borrowers will have a longer wait for the cost of borrowing to decline.

HKMA reiterated its warning for Hong Kong’s borrowers to “carefully assess” their financial power in considering buying property or taking on mortgages, as high interest rates “may last some time.”

Hong Kong’s largest virtual bank is preparing to introduce virtual asset trading services for retail investors, CEO Ronald Iu says. Plans are afoot as a new regulatory regime is rolled out in June.

Hong Kong kept its key interest rate unchanged for a sixth consecutive time in lockstep with the Federal Reserve’s overnight decision, with sticky US inflation forcing investors to delay rate cut bets.

Scammers have published a fictitious article with the appearance of a South China Morning Post story and a reporter’s byline to promote two online financial trading apps.

The number of Hongkongers with negative-equity loans stood at 32,073 in the first quarter of the year, tripling from the previous quarter and the most since some 40,000 cases were recorded in the first quarter of 2004.

Buoyed by the brisk sales of flats following the removal of Hong Kong’s property cooling measures, the city’s developers have this year launched 4,800 new units as of last week, a seven-year high.

Commissioner of Police Raymond Siu says deception cases in city grew 0.9 per cent, with all but investment scams declining between January to March.

Hong Kong offers plenty of wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, according to speakers at the Apec Business Advisory Council summit.

Hong Kong’s SMEs are more optimistic than their peers in mainland China, Singapore and Australia when it comes to growing their businesses this year, thanks to government support and an increase in online sales, a survey shows.

The Hong Kong Monetary Authority’s SME information platform is part of its ongoing efforts to help SMEs affected by the shift in consumer and tourist spending patterns.

A new operating model enabling Hongkongers to use the services of multiple credit reference agencies for the first time will start on April 26, the Hong Kong Association of Banks and two other industry groups announced.

Property agents have raised sales forecasts for the year amid project launches at discounted prices, but say a lack of a rate cut could pare those estimates.

Scam operators seemingly thumb their noses at the regulator, which recently launched a campaign warning the public about financial frauds.

Tokenisation has proved to be cheaper, more efficient and better than ‘the old-fashioned way of trading’, Noel Quinn says, but HSBC will stay ‘away from crypto’.

Police say 505,000 scam alerts sent to users of Faster Payment System (FPS) between launch of warning system in November and March.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

Hong Kong property sales rose to a 10-month high in March, surpassing 5,000 deals a month after the government lifted all property cooling measures, data from the government shows.

Monetary authority announces a nine-point plan that offers reassurance about access to credit relief amid market rumours of loans being called early.

HSBC Gold Token, which will be available on the lender’s online banking and mobile app, is the first such retail product to be issued by a bank, according to HSBC, as the government pushes for more digital assets to be rolled out for public use.

New home sales in Hong Kong stuttered slightly on Friday, with buyers giving a lukewarm response to Henderson Land Development’s latest project in Tai Kok Tsui.

‘There are only a few [international financial centres], and Hong Kong is one of them. It is hard-won. We must not lose this place,’ CK Hutchison and CK Asset chairman says.

Hong Kong’s monetary authority cautioned borrowers to carefully assess interest-rate risks before buying property as it remains uncertain when the Fed will cut interest rates.

The HKMA has held its base rate at current level after raising it 11 times from March 2022 to July 2023 to the highest level since December 2007.

Hong Kong’s Global Shipping Business Network has finished a prototype of its first electronic bill of lading in collaboration with Ant Group’s ZAN blockchain unit.

City’s biggest bank and start-up hub aim to build ‘international fintech corridor’ to further Hong Kong’s goal of being an international hub for such technology.

Chan says new or expanded firms, together with 30 companies that made similar moves last year, will invest more than HK$40 billion in the city and create 13,000 jobs.

The HKMA’s new wholesale central bank digital currency project aims to enhance interbank settlements for tokenised money. A planned sandbox will test settlement of tokenised real-world assets.

The Hong Kong Monetary Authority has launched the second phase of a pilot programme to explore ‘innovative’ uses for a central bank digital currency (CBDC) for public use, five months after it unveiled the results of the first trial run.