Topic

Latest news and analysis about investments that align with the principles of environment, social and corporate governance (ESG) investing.

- Code will be ‘vital in fostering greater transparency, quality and reliability of ESG information, as well as comparability of products’, SFC head says

- Code, drafted in line with global practices, will allow SFC-licensed intermediaries and other end users to compare the conduct of ESG providers

Hong Kong should learn from China’s experience and adopt Europe’s stringent definition of green hydrogen while formulating a strategy on the clean-burning fuel, according to Civic Exchange.

Environmental sustainability is a leading concern for the younger generation, and they have been pushing businesses to take more action on climate change, according to a Deloitte survey.

A carbon trading system that promotes tighter supply and higher prices can induce China’s cement makers to undertake costly investment, Ian Riley of World Cement Association says.

The International Chamber of Sustainable Development will also expand the accredited planner course, which more than 3,000 people have completed in Hong Kong, to Southeast Asia and the Middle East.

Hong Kong-based private equity firm and BP Ventures to invest US$10 million each in the latest funding round, helping Hysata to scale up its green hydrogen facilities in New South Wales.

CK Infrastructure’s US$113.5 million purchase of UU Solar, its second acquisition of UK renewable-power assets in two weeks, includes 70 solar, wind and hydropower projects.

Fintech company Stacs and ESG consulting firm Downundered are among those offering tools for SMEs to measure emissions.

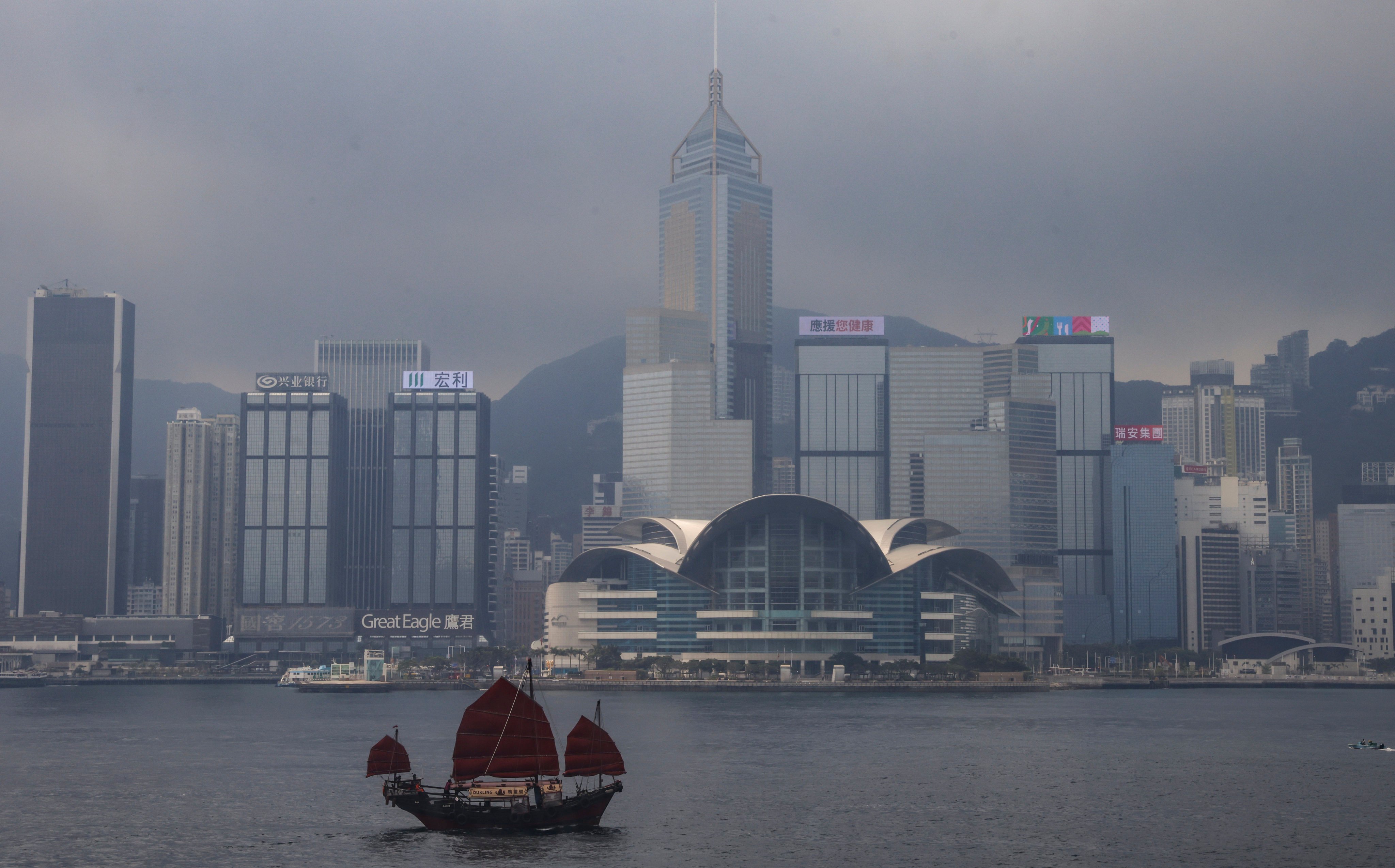

The HKMA has issued a ‘green taxonomy’ framework to help banks and investors determine the sustainability of economic activities, the latest effort to boost the city’s standing as a green finance centre.

‘Private firms are obviously looking at the torch that is potentially coming for themselves,’ when it comes to declaring emissions goals, says Net Zero Tracker project leader

All financial institutions licensed by the SFC should be required to submit ESG reports for the development of a comprehensive ecosystem of sustainability disclosures, City University of Hong Kong says.

The Chinese stock market is poised to see the emergence of shareholder resolutions on ESG issues next year, as incoming corporate governance reforms start allowing many more minority owners to present proposals for voting, a stewardship expert says.

Climate mitigation and adaptation projects that ‘stand on their own’ appeal to more mainstream investors, one financier says, especially after controversies that dented confidence in voluntary carbon credits.

The chairman of the conglomerate IMC Pan Asia Alliance Group has called for family businesses to promote sustainability, which he believes will benefit their succession planning and business values.

The meeting underscores Huawei’s long-standing ties with PetroChina in projects that have helped modernise its operations in the energy industry.

Avant Meats is expanding its lab-grown seafood production capacity amid growing popularity of sustainable seafood.

The nation’s largest oil and gas producer says it is on track to peak carbon emissions next year and double the contribution of low-carbon energy to its output capacity over two years, top leaders say.

The Women Workplace Index, which was launched on Tuesday, will collect data from firms on policies and practices such as those against sexual harassment, as well as maternity leave and equal pay.

Government plans to establish a clear pathway on sustainability reporting for businesses in Hong Kong this year, a move that is ‘essential’ to ‘reinforcing Hong Kong’s leading position on the international sustainable-finance map’, says financial services secretary.

With the world facing a US$4 trillion green investment gap a year, transition finance will grow in importance because of regulatory support in Asia, experts say.

Towngas, which last raised its basic tariff by 4.4 per cent in August 2022, is under pressure to lift gas tariffs this year ‘as we need to invest further in our network infrastructure’, managing director Peter Wong says.

Companies in Asia-Pacific will need education, cooperation with suppliers and exchanges of best practices to meet tightening climate-disclosure requirements, says Alexander Bassen of the Greenhouse Gas Protocol’s Independent Standards Board.

The government should further open the local environment-protection market to attract investment from Greater Bay Area companies, says a vice-president at the Hong Kong-listed company.

The number of sustainability funds has tripled since the world’s largest emitter of greenhouse gases pledged to peak emissions by 2030 and reach carbon neutrality by 2060, with local asset managers seizing opportunities arising from the green transition, Morningstar says.

CLP will source more nuclear energy from China’s Guangdong province to feed its power grid and sees business opportunities in decarbonisation as it phases out coal-based assets.