China’s largest bitcoin miner ramps up VC funding by investing in Hong Kong blockchain start-up

The deal marks the latest investment made by Bitmain, which is also the world’s biggest supplier of cryptocurrency mining equipment, in the red-hot blockchain sector

Bitmain Technologies, China’s largest bitcoin miner, has ratcheted up its venture capital activity by investing in the Hong Kong-based software company behind the EOSIO open-source blockchain protocol.

The investment made by Bitmain, which is also the world’s biggest supplier of cryptocurrency mining equipment, was part of the latest funding round completed by Block.one, according to a statement released by the blockchain start-up on Tuesday.

The amount of financing raised by Block.one from its new investors, which included PayPal co-founder Peter Thiel, was not disclosed. The fundraising was first reported by Bloomberg.

The start-up’s EOSIO blockchain protocol, which was introduced in May last year, was designed to enable secure data transfer and support high-performance decentralised applications, including cloud storage and authentication. This platform also supports Block.one’s own cryptocurrency, EOS, that has been widely speculated as a challenger to ethereum.

“The EOSIO protocol is a great example of blockchain innovation,” said Bitmain co-founder and co-chief executive Wu Jihan, aged 32, in the statement from Block.one. “Its performance and scalability can meet the needs of demanding consumer applications and will pave the way for mainstream blockchain adoption.”

In May this year, Block.one raised a record US$4 billion through the sale of EOS tokens, surpassing the initial public offerings (IPOs) so far this year. Its EOS token is currently the fifth most valuable cryptocurrency behind bitcoin, ethereum, XRP and bitcoin cash, according to data from CoinMarketCap, which ranks digital currencies by market capitalisation.

A spokesman for Bitmain declined further comment on the company’s Block.one investment.

That deal marked the latest foray into venture capital investments for Bitmain, which led a US$110 million funding round in US cryptocurrency start-up Circle Internet Financial in May this year.

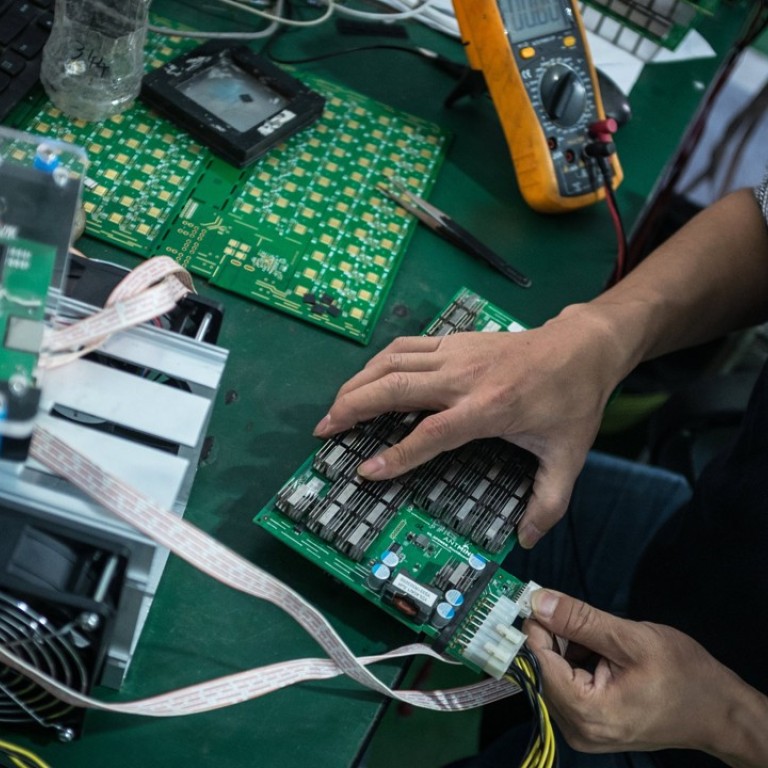

Bitmain’s push into venture capital funding shows how flush in cash the Beijing-based company has become since it started operations in 2013. The firm controls as much as 80 per cent of the global market for cryptocurrency mining gear, according to a report from Bernstein Research in February.

It was also the most funded blockchain start-up in China, raising a total of US$450 million from investors that include Sequoia Capital and IDG Capital Partners, according to the China Internet Report co-authored by the South China Morning Post, its tech news site Abacus and San Francisco-based venture capital firm 500 Startups.

Wu, who studied economics and psychology at Peking University, rose to fame on Twitter, where he has 106,000 followers, after lashing out at trolls, according to his interview with Bloomberg in May. Wu has an estimated net worth of US$2.1 billion, according to the Bloomberg Billionaires Index.

He and co-founder Micree Zhan together own about 60 per cent of the business, he said.

There may be more funding projects in store for Bitmain as its financial war chest expands. Wu, who estimated that Bitmain had a US$12 billion valuation and booked US$2.5 billion in revenue last year, said the company was open to an IPO in Hong Kong, according to a Bloomberg report last month. Canaan Creative, China’s second-largest bitcoin mining hardware maker after Bitmain, also aimed to have a public listing in the city.

Interest in China remains high for blockchain technology, the distributed ledger technology behind cryptocurrencies like bitcoin and ethereum, amid mixed feelings by the central government over cryptocurrency exchanges, initial coin offerings and cryptocurrency mining, which is the process of creating new digital currencies.

China helped raise the profile of blockchain when it became one of the first countries in the world to include the technology as part of a state-level policy. In 2016, Premier Li Keqiang announced that blockchain was written into the 13th Five-Year Plan, a road map for the country’s development in the five years to 2020.

Fan Wenzhong, head of the international department of the China Banking and Insurance Regulatory Commission, warned against illegal fundraising under the cover of blockchain projects during a fintech summit in Shanghai over the weekend.