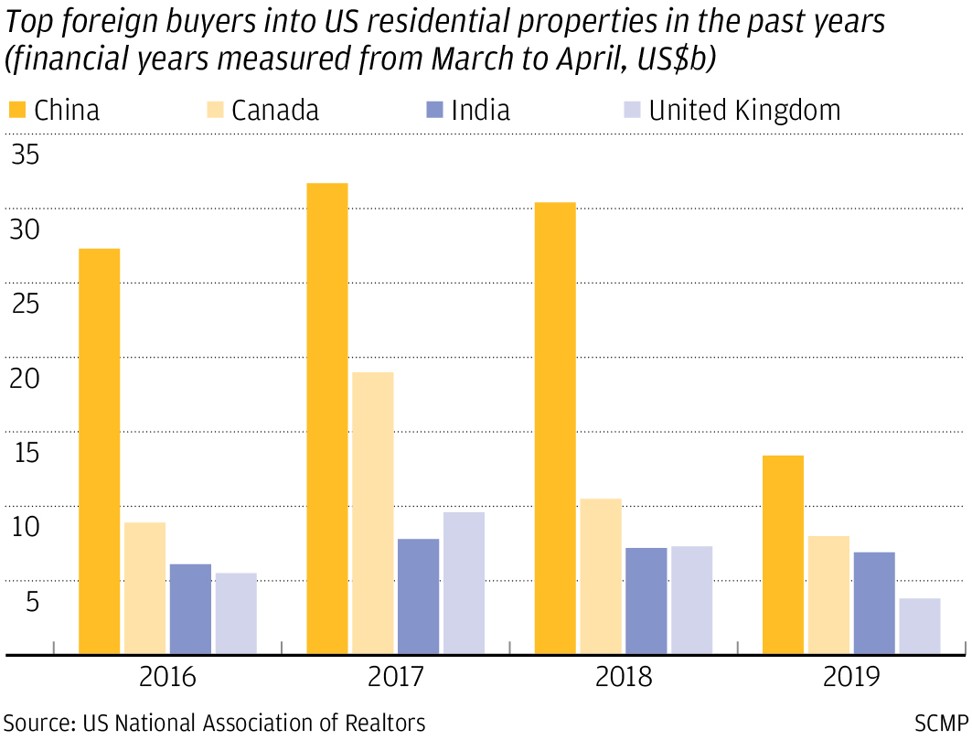

Chinese investment in US homes contracts by the most in nearly 10 years as trade war, capital controls bite

- Chinese investment fell 56 per cent against a 36 per cent drop in overall foreign purchases

- Chinese purchases of US$13.4 billion made them the top buyers of US homes

Chinese buyers pulled away from the US residential market in the past year, as the trade war and tighter capital controls led to a 56 per cent decline in investment – the biggest contraction since at least 2010, according to the US National Association of Realtors.

Still, their investment of US$13.4 billion in the 12 months to March 2019 was the largest – 11 per cent – among all foreign buyers for the seventh straight year. But China’s 56 per cent retreat was much sharper than the 36 per cent decline in overall foreign purchases. Chinese investment in absolute terms fell to its lowest level since 2014.

“A confluence of factors – slower economic growth abroad, tighter capital controls in China, a stronger US dollar and a low inventory of homes for sale – contributed to the pullback of foreign buyers,” said Lawrence Yun, chief economist of the association.

Other observers said that a near 6 per cent appreciation in the US dollar and a backlog of applicants for a key investment visa programme also affected sentiment.

“The data from our platform showed that in the first quarter Chinese buyers’ enquiries for US property was down 27.5 per cent from a year earlier, the fourth time it had fallen in the last five quarters,” said Carrie Law, CEO and director of Juwai.com, a website connecting Chinese buyers to overseas properties. “Trump is responsible for a big part of the drop in Chinese interest. His aggressive rhetoric and his visa restrictions and trade war has scared some potential buyers, and not just from China.”

Becco Zou, a property agent with Caliber Real Estate in Bellevue, near Seattle, said she felt demand from mainland buyers had significantly weakened since late last year, and these buyers reported substantially more difficulties in transferring money out of China.

“I have many domestic clients so I didn’t feel the impact much. But those realtors who mainly rely on Chinese customers suffered a drop in business,” Zou said, adding Seattle’s property market remains robust because of strong local demand from tech talent arriving in the city.

She said that some wealthy Chinese were even divesting their US properties as they were losing hope in attaining green cards through the EB-5 investment visa programme, noting that sales of luxury houses, town houses and condominiums, favoured by foreign buyers, were taking longer.

Juwai’s Law said that without Chinese capital controls and the Trump effect, there would be an avalanche of Chinese investment in US real estate, similar to 2015-16.

According to the survey, foreign buyers tended to buy more expensive homes, with a median purchase price of US$280,600 compared to US$259,600 for local buyers. The median price of the Chinese purchases was still higher at US$549,000.

Property services firm Uoolu said that the UK, Australia, Japan and Southeast Asian nations of Vietnam and Philippines were the main beneficiaries of Chinese buyers’ shift away from the US.

Japan led the surge with a 160.5 per cent jump in inquiries in the first half, followed by 64.8 per cent for Vietnam.

Chinese investment in US property cools amid US-China trade war