125 years: how Hong Kong and Manulife, the city’s longest-continuous insurer, are entwined

- Company stays with the city through many ups and downs, including wartime invasion, stock market crashes and epidemics

- Agents’ dedication to serving their customers recognised by awards and highlighted by record-breaking business performance

[Sponsored article]

The story of Hong Kong’s rise from its humble origins as a quiet port inhabited by fishing and farming communities into a thriving metropolis and global economic powerhouse is well known. But a lesser-known story is how that transformation gave rise to a new industry that, in return, helped the city blossom.

From covering the risks for traders – such as piracy and fire, to offering a safety net for various stages of life and businesses, the insurance industry has evolved in tandem the vibrant and resilient city through many defining moments.

In 1887, The Manufacturers Life Insurance Company is incorporated in the Canadian city of Toronto, with the country’s first prime minister, Sir John A. MacDonald serving as its president. Ten years later, it sets up operations in Hong Kong alongside offices in South China and Shanghai. Now, 125 years later, the company, which has been renamed Manulife, is the city’s longest continuously operating life insurer.

Here we look at how Hong Kong and Manulife have developed in tandem over the decades through a series of highs and lows and witnessed many historic moments.

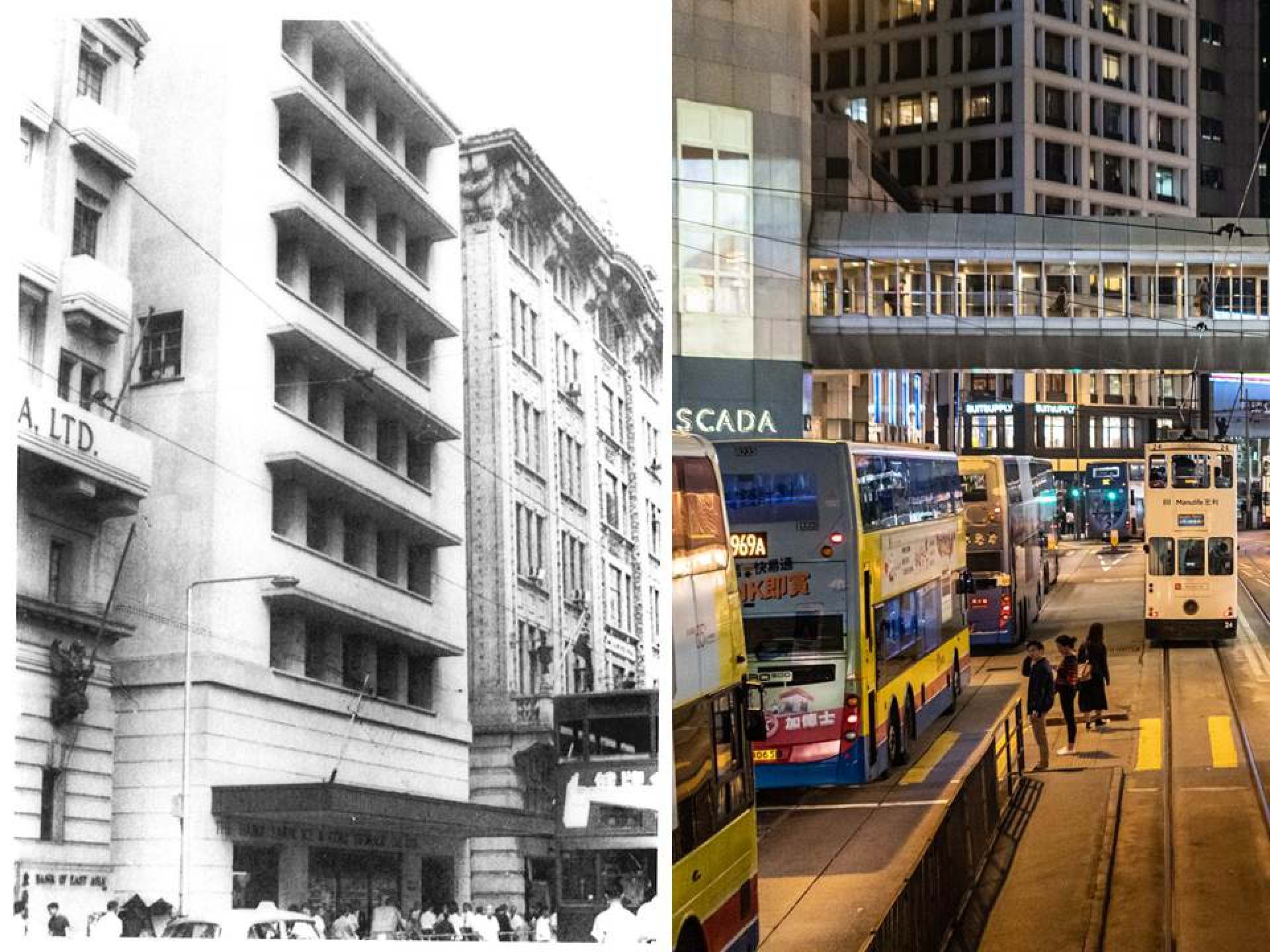

The rise of Hong Kong

1897: Manulife sets up home in Asia

In the late 19th century, the demand in Hong Kong for insurance grows beyond simply serving the bustling seaport businesses, and must also meet the needs of its sprawling population of over 200,000. It’s when Manulife seizes the opportunity to venture into Southern China and makes Hong Kong its first home in the region. Its insurance products cater not only to businesses, but also individuals, including women and children, with product brochures published in Chinese as early as the 1910s.

1920s-1940s: city ‘takes off’ as businesses thrive

The city’s development takes off in the 1920s, signified by the opening of Kai Tak Airport. Following the first recorded flight departure from grass-covered Kai Tak Airport on Lunar New Year’s Day in 1925, it continues to increase in importance over the years as Hong Kong becomes an influential international hub.

Hong Kong’s population more than triples from about 277,000 at the turn of the century to over 840,000 by 1930.

Manulife’s faith in the city’s potential pays off as the sales team of its South China Branch, based in Hong Kong, wins the Manulife President’s Trophy in 1932 – recognising the outstanding achievements of the top insurance sales team compared with the company’s other global branches. It is a huge accomplishment for a small overseas branch – the first of many such successes for the Hong Kong team in the ensuing decades – and a clear sign of the city’s thriving economy.

The company also predicts the need for retirement protection for the city’s workers, leading to it launching its pension management services in 1936.

The city is attacked in December 1941 during the second world war. One Manulife agent named Tang braves an air raid to return to its new office in Windsor House (now the Landmark) to submit a client’s application, symbolising the company’s commitment to its customers and Hong Kong.

Post-war Hong Kong

1946-1947: post-war recovery as industries flourish

Eric Mitchell, Manulife’s Hong Kong branch leader – who helped defend the city as commander of its Volunteer Defence Corps – reopens its office after the end of the war on August 15, 1945. Not every company can return to the city during the early days of its recovery. Manulife decides to help its fellow insurers who have not resumed operations to collect premiums.

Many civilians return home after fleeing the fighting and the city’s industries flourish, while Manulife expands its Hong Kong team, resulting in a new sales record soon after the war.

1950-1960s: strong economic growth despite challenges

The population surge causes housing shortages and poor living conditions for the disenfranchised, as highlighted by a devastating fire in Shek Kip Mei on Christmas Day 1953, which destroys the squatter homes of about 53,000 people. The incident leads the government to introduce emergency housing measures, which mark the start of the city’s public housing programme.

Sound and proactive policies help the city’s economy to rapidly expand. In the 1960s, Hong Kong – along with Singapore, South Korea and Taiwan – becomes known as one of the region’s four Asian Tigers. Manulife recognises the city’s potential and strengthens its commitment by renaming its South China Branch the Hong Kong Branch in 1959 and increasing its sales team to 30 full-time agents by 1962.

An Asian Tiger

1970s: educated ‘middle class’ workforce

Thanks to a series of new government policies and social welfare measures, the city enjoys strong economic growth and sees the birth of a skilled “middle class” workforce. The changes help it to transform from a manufacturing hub into a financial centre.

As the population becomes more affluent, people begin to look for security and recognise the importance of life insurance. As a leading insurer offering life products in Hong Kong, Manulife becomes an obvious insurance partner for many Hongkongers. Income generated from monthly premiums at the Hong Kong office hit HK$125 million in the early 1970s – the fourth highest total out of Manulife’s worldwide branches. In 1971, it climbs to No 2. Between 1974 and 1981, the company wins the President’s Trophy another six times, highlighting the growth in customer demand and sales.

Manulife moves into an office in the newly built, modernist 52-storey Connaught Centre (now Jardine House) known for its iconic round windows, which is Asia’s tallest building at the time.

1977: rebound after global economic crisis

The city recovers after the early 1970s’ global stock market crashes and oil crisis – recording impressive rises in gross domestic product of 27.4 per cent and 15.9 per cent in 1976 and 1977, respectively. Manulife’s Hong Kong office enjoys success, too, as the local sales team is ranked first globally in the company throughout the year.

1980s: eventful decade and expansion

Manulife maintains its confidence in Hong Kong throughout an eventful decade marked by challenges including natural disasters (the deadly Typhoon Ellen in September 1983) and an economic downturn known as Black Saturday, when the rate of the Hong Kong dollar against the United States dollar hits an all-time low of HK$9.6.

The decade’s pivotal moment, confirming Hong Kong’s future return to China in 1997, is the signing of the Sino-British Joint Declaration in Beijing on December 19, 1984.

The insurer continues to expand its product range in the city, including a two-in-one pension fund product that combines a fixed savings account and stock investments described by local newspapers as an “invaluable product at these difficult times”.

1990s: confidence returns as city experiences monumental decade

The decade is dominated by Hong Kong’s return to mainland Chinese sovereignty on July 1, 1997.

Other significant milestones include the opening on May 22, 1997 of the 2,160 metre-long Tsing Ma Bridge, the world’s second longest suspension bridge and – a year after the handover – the closure of Kai Tak Airport and opening of Hong Kong International Airport at Chek Lap Kok, in July 1998.

Cheung Chau windsurfer Lee Lai-shan hits the headlines around the world in July 1996 after winning the city’s first Olympic gold medal in the mistral class at the Atlanta Games.

Throughout the decade, Manulife remains steadfast in supporting the city. Its hard work is rewarded when the Hong Kong office receives Standard & Poor’s “AA+ rating” for its claims-paying ability – the city’s first insurer to be rated by independent international analysts at that time.

As the new Bauhinia flag is raised following the 1997 handover, the company celebrates its centenary in the city and becomes an anchor tenant of Manulife Plaza, the tallest building in Causeway Bay.

Manulife also recognises Hongkongers’ increasingly sophisticated need for wealth management with the launch of a mutual funds arm in 1997. In 1999, Manulife becomes the first international life insurance company to be listed on the Hong Kong stock exchange, under stock code 945.

Into the 21st century

2000: workers get structured savings scheme

The city’s population reaches 6.8 million at the end of 2002 as Manulife celebrates its one millionth customer in the city.

The government provides stronger retirement protection for its workforce with the launch of its structured savings scheme, the mandatory provident fund (MPF) system on December 1, 2000. Manulife – one of the major MPF providers at the start – has been the city’s largest MPF provider by assets under management since 2016.

2003: support for Sars-hit city

After Hong Kong starts to battle the deadly outbreak of severe acute respiratory syndrome (Sars), Manulife stands by the city. It launches the “We Care –We Share” campaign to offer compassionate life coverage of HK$50,000 to its clients, and it also doubles the coverage to HK$100,00 for medical professionals. Other initiatives include a Sars-related telephone counselling hotline for children with learning disabilities, and a HK$300,000 donation to support medical professionals and Sars-hit families residents as part of The Community Chest of Hong Kong “Operation Unite” Fund.

2004: focus of regional insurance in Asia

Hong Kong, which is home to Asia’s highest concentration of insurance companies and has high demand for health and savings products, recovers from the socio-economic impacts of Sars as the insurance industry records a 19.5 per cent growth in total gross premiums – or 9.6 per cent of Hong Kong’s gross domestic product.

A family of three who were Manulife Hong Kong customers are reported missing in Indonesia when the 2004 Indian Ocean earthquake triggers a tsunami that hits the archipelago. Their remains are later identified through DNA. As both the insured and beneficiary die in this tragedy, the insurer’s agent Estella Wong urgently follows up claim issues and compensation for the couple’s ageing parents, who are their inheritors.

2008: one of official partners of Beijing Olympics

Hong Kong’s economic growth is underlined by China’s rising status on the international stage. The Beijing Olympics and Paralympics begin with the city hosting the equestrian events, while Manulife serves as one of the Games’ official worldwide partners.

The world is hit by a global financial crisis caused by the bursting of the US housing bubble, leading to the failure of many financial institutions. As economies slow, lending tightens and global trade declines. To help boost confidence among Hongkongers, Manulife quickly launches a range of products, including the market’s first and only MPF fund focused on investing in the healthcare sector. This aims to provide long-term capital growth through a diversified portfolio of shares of companies in healthcare and related industries.

2010s: development energises Kowloon East

As the government encourages investment to energise development in the city’s Kowloon East district, Manulife responds with action. It becomes the first major financial institution to move there – relocating its main Hong Kong operations into Manulife Financial Centre in Kwun Tong in 2010.

Manulife also acquires a new building in the district, West Tower of One Bay East in Ngau Tau Kok for HK4.5 billion in 2013. It renames the 21-storey building Manulife Tower, which at the time is the largest single office tower bought in Kowloon. Manulife Tower opens in 2015, and in the same year, ManulifeMOVE is launched as an innovative insurance concept which rewards customers with discounted premiums for living more actively.

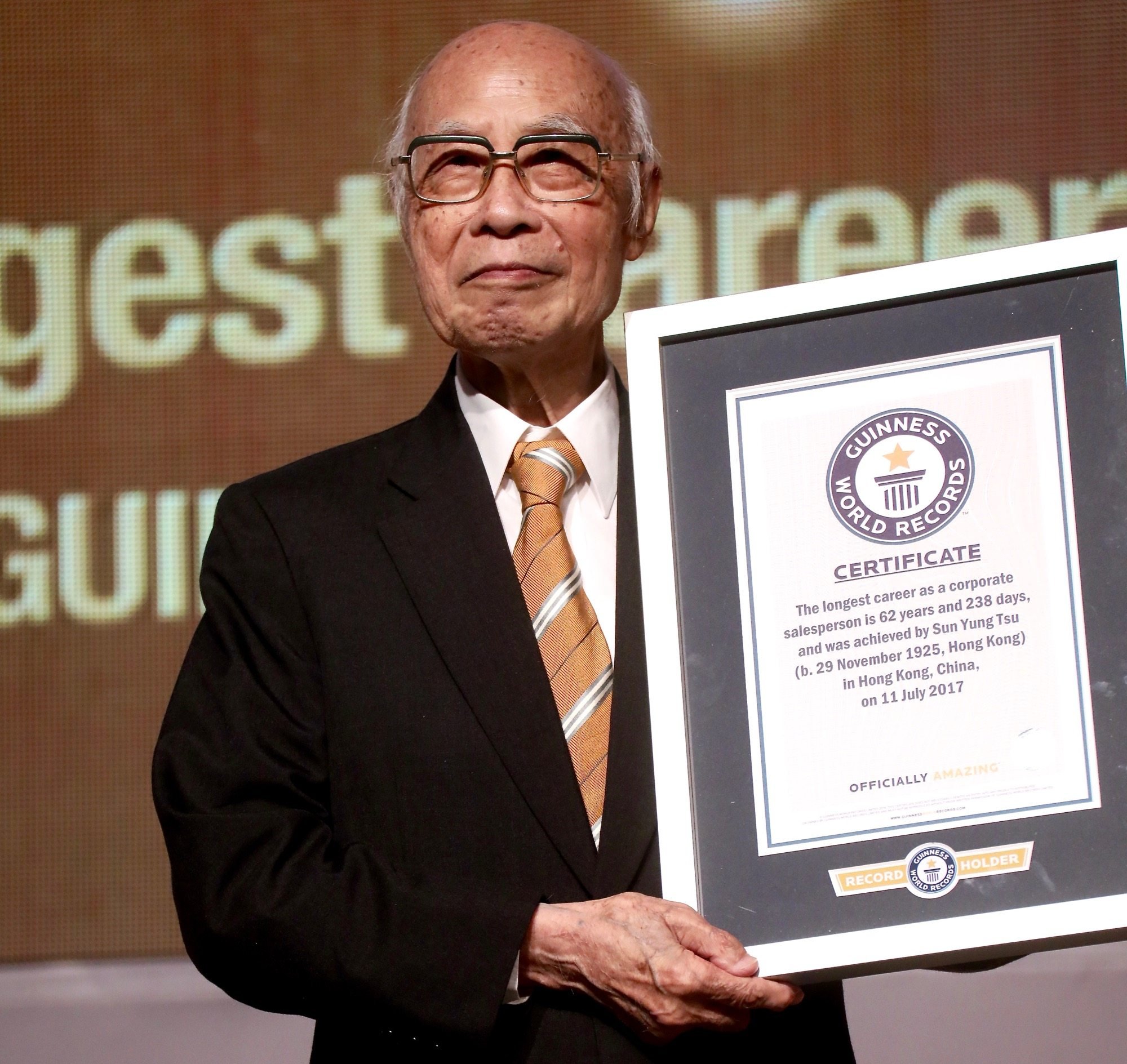

2017: veteran agent claims Guinness World Record

Manulife Hong Kong life insurance agent Joe Sun exemplifies the company’s commitment to the city as he claims the Guinness World Record at the age of 91 for the “longest career as a corporate salesperson” of 62 years and 238 days on July 11, 2017. Sun, who died in April this year, joined the company in 1954 and was among only seven candidates chosen from some 400 applicants at that time. His world record still stands.

2020-present: resilience during Covid-19 pandemic

Early 2020 sees the rapid spread of the Covid-19 pandemic. Within 24 hours of Hong Kong’s first case being confirmed on January 23, Manulife works around the clock to launch its first campaign to help the city fight the spread of the coronavirus disease. It provides special coverage benefits including hospital cash and family support benefits. Claim procedures are also simplified through the use of digital platforms, which the company has been ambitiously building over the past few years.

It is also the first insurer in Hong Kong to donate hygiene supplies to vulnerable groups in the city after a panic over the shortage of surgical masks at the start of the Covid-19 pandemic.

During the year, Manulife pays out about HK$3.3 billion under individual insurance claims, fulfilling its promise to protect the well-being of the city and its residents.

Uncertainty caused by the pandemic means the 2020 Tokyo Olympics is delayed until July 2021, when Hong Kong fencer Cheung Ka-long wins the city’s second ever Olympic gold medal with victory in the men’s foil event.

The city also celebrates five more Olympic medals in women’s events: two silvers delivered by swimmer Siobhan Haughey, and three bronzes won by cyclist Lee Wai-sze, karate exponent Grace Lau Mo-sheung and the table tennis trio of Doo Hoi-kem, Lee Ho-ching, and Minnie Soo Wai-yam.

Despite continued challenges in 2021, Manulife increases its presence in the city by opening its premium customer service Manulife Prestige Centre, while International Trade Tower in Kowloon East is renamed Manulife Place after the company signs the city’s largest office leasing deal, at about 145,000 sq feet, since 2019. These moves provide additional space for the company’s ever-growing agency force and also highlight its continuing confidence in Hong Kong, even at times of a pandemic.

The year 2021 also sees the company ranked as Hong Kong’s biggest life insurer in terms of total new premiums.

2022: celebration of 125 years of achievements and commitment

Manulife celebrates its 125th anniversary as the longest continuously operating life insurer in Hong Kong. Its team of about 11,500 agents – up from just a dozen in the early 1900s – serves about 2.4 million Hongkongers – nearly one third of the city’s population.

It is also named in a YouGov online survey as the No 1 “Customer Satisfaction Insurance Brand” in Hong Kong and No 1 “Brand Advocacy for Hong Kong Insurance Sector” for the fourth year in a row.

Just like the city it serves, Manulife has come a long way from its humble beginnings, embraced many challenges – and continues to thrive.