China and Gulf states changing face of development finance in Africa

- As major investors displacing the traditional Western powers, China and the GCC are precipitating a reconfiguration away from the North-South flow of development resources

The rapidly evolving engagements of China and the GCC across Africa may catalyse a paradigm shift in international development cooperation. As major investors displacing the traditional Western powers in Africa, China and the GCC are precipitating a reconfiguration away from the entrenched North-South flow of development resources.

This carries immense promise but also significant challenges. It could pioneer collaboration models more tailored to the needs of the developing world. But translating this into tangible benefits hinges on robust institutional frameworks and effective African representation.

While both the Gulf states and many African nations have substantial oil, gas or mineral reserves, their economic development starkly diverges. Why are Gulf nations so much richer than the African nations? Despite a population of under 60 million – less than 5 per cent of sub-Saharan Africa’s 1.2 billion people – the Gulf states boast a much larger collective gross domestic product than that of the entire African region. On a per capita basis, Gulf states also command more resources.

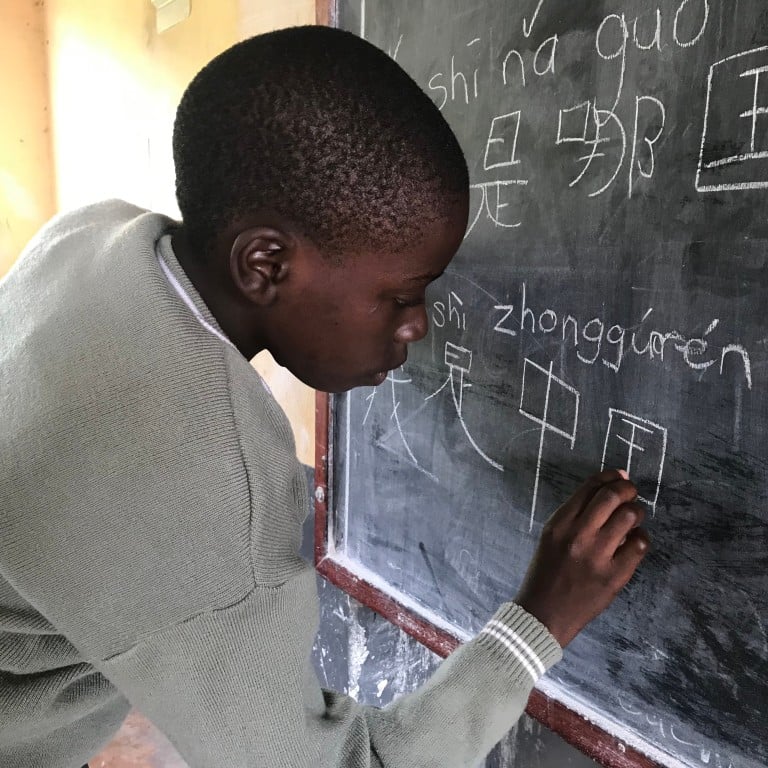

Africa attracts limited FDI because it lacks infrastructure and human capital. Unlike East Asia and akin to India, Africa has yet to translate its huge, growing population into human capital. China is uniquely qualified to help.

Both China and the GCC are vying for geopolitical influence in Africa. The GCC’s engagement in Africa is concentrated in the northeastern Islamic states, where it has religious and cultural ties. But this ideological outreach risks exacerbating social divisions, enabling extremist financing and emboldening repression. In contrast, China pursues a more even-handed approach across Africa, in its courting of supporting votes at UN and other multilateral forums.

With its colonial legacy, Europe is the leading cumulative investor in Africa. While China has surpassed the United States in FDI in Africa for most of the last decade, its share of FDI into Africa has fallen sharply since 2022. Emerging as a leading investor in recent years, the UAE brought the greatest investment dollars to Africa in 2022, more than from Britain and France combined, and dwarfing amounts from both the US and China.

The GCC, together with China (including Hong Kong) and Europe, constitute the triad of top investors in Africa. These actors have played critical roles in different stages of development in Africa and their important roles continue to evolve.

The GCC may be tempted to play China against the West in Africa. But given its state capitalism and geopolitical agendas, it may find a slightly greater alignment with China. China may exploit this by emphasising its complementary interests with the GCC while managing the economic and geopolitical competition.

For Africa, reaping the greatest development benefits from this four-way dance requires an orchestrated coordination among all the African nations. But forging such a unified continental stance also means facing the immense challenges stemming from the diversity of interests across 54 countries, historical regional rivalries and tensions, constraints in negotiating capacity, misaligned incentives of political elites and institutional barriers to effective integration.

Overcoming these obstacles through reforms could potentially transform Africa’s Balkanised nations into a more coherent bloc.

Rich world must follow China’s lead and support Africa’s green revolution

Whether Africa can forge a path towards a broad-based development hinges on its ability to build effective and accountable institutions.

Just as the UAE transformed itself through effective governance, and as Saudi Arabia pursues similar reforms, African nations must prioritise strengthening checks and balances, upholding the rule of law, harmonising business regulations, combating corruption and developing robust state capabilities.

Effectively emulating the institutional models that facilitated the rise of East Asia will shape Africa’s path in capitalising on its international partnerships to drive inclusive growth.

By pioneering context-appropriate models of plurilateral cooperation, grounded in the shared experiences of developing nations, a new paradigm of inter-South engagement could provide a counterweight to the traditional North-South architecture. But realising this transformative potential hinges on the participants’ willingness to transcend narrow self-interests for genuinely reciprocal partnerships – which promise better outcomes for all.

Winston Mok, a private investor, was previously a private equity investor