Is China an open economy? Beijing says it is but IMF differs

International Monetary Fund says further steps are needed to foster further openness

The International Monetary Fund (IMF) has urged China to adopt further steps to open its market, disagreeing with Beijing’s assessment of the country’s progress in reforming state-owned enterprises, reducing trade and investment restrictions and its efforts to reduce government debt.

“We are looking at China and comparing it with other G20 countries … in terms of service trade and investment, the Chinese economy is still very restrictive,” Alfred Schipke, IMF’s chief China representative, said at a symposium in Beijing.

Fostering further openness was one of the policy recommendations made by the Washington-based fund after its annual economic consultations with China in May.

In its report, the IMF urged China to de-emphasise its annual growth target, enhance its controls on credit growth and modernise its policy framework.

International calls for further reform have grown louder, with Beijing’s restrictions on market access raised at the World Trade Organisation and cited as the justification for the unprecedented trade war with the United States.

The IMF findings were based on available data from the Organisation for Economic Cooperation and Development (OECD), the World Bank and the International Finance Corporation.

Beijing, however, said the IMF should not have used OECD indicators to measure China’s openness because it is not a member of the Paris-based organisation.

Instead, it argued, the country’s trade and investment regime is “more open” than the IMF’s assessment and has already complied with all its World Trade Organisation commitments.

Chinese authorities have mounted a vigorous defence of their market openness as this year marks the 40th anniversary of the start of the country’s economic reforms.

The government announced earlier this year that it would allow foreign control of financial and auto joint ventures, increase access to its capital market and narrow the list of sectors in which foreign investment is restricted.

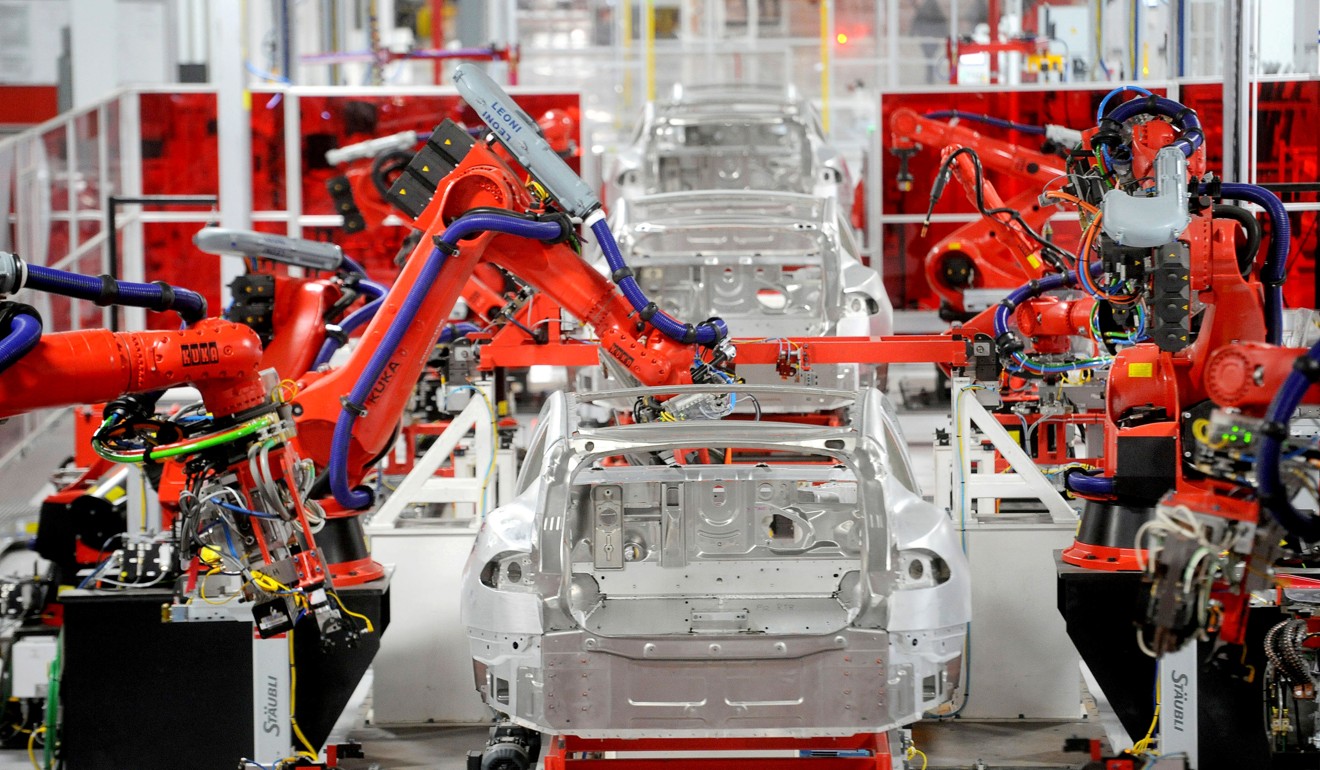

JP Morgan has expressed interest in starting a financial joint venture in China, while the government will allow Tesla to have full ownership of its planned auto factory in Shanghai.

Both the US and European Union have refused to recognise China as a market economy, a move that would limit their ability to use domestic laws to limit Chinese imports.

The US administration has also imposed tariffs on $50 billion of Chinese imports to pressure Beijing to increase market access, reduce subsidies for domestic industries and better protect intellectual property.

Beijing has stepped up it efforts to woo back foreign investors, trying to address their complaints over what they see as an uneven playing field.

Although foreign direct investment in China remains the world’s second largest after foreign investment in the US, totalling US$131 billion in 2017, the IMF said it has trended down over the past decade as a percentage of GDP. The ratio has already fallen below the average of emerging market economies.

“[FDI] has been a key driver of China’s growth in the past … that’s a little bit worrisome,” Schipke said of the downward trend.

Beijing also disagreed with the IMF’s practice of including debt held by local government financing vehicles in its measurement of the total debt at all levels of government, even though it recently started an investigation to determine the size of such implicit government liabilities.

Beijing sees a better outlook than the IMF on other reforms, including a reduction in industrial overcapacity and reduced leverage in the financial system. Great progress has also already been made on the reform of state-owned enterprises (SOE), Beijing believes.

However, in the eyes of the IMF, “SOE reform has been somewhat slower [than expected], and the economy is still leveraging up.”

The government’s policy priority has shifted toward economic stabilisation in the past month, given the effects of the trade war and the campaign to reduce debt, with signs of monetary and fiscal loosening becoming more obvious.

Even though China will need to be vigilant to prevent a rapid economic slowdown, the fund called for more use of on-budget spending to boost consumer spending, rather than return to the previous practise of relying heavily on additional infrastructure spending.

“It should not go back to the good old days of spending more on investment, but rather should lower social security taxes so that people can spend more to foster consumption,” Schipke added.

The National People’s Congress, China’s legislature, is due to debate a personal income tax cut bill next week.