Global Impact: what does a post-Apec US-China relationship, and their global competition, look like?

- Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world

- In this week’s issue, we look to the future of the US-China relationship following the meeting between presidents Xi Jinping and Joe Biden in November

Mixed signals have also come from reinvigorated bilateral negotiations on the economic front.

US lawmakers criticise lifting of sanctions to gain China’s help on fentanyl

However, analysts questioned how much progress could be made, with political frictions limiting the working group’s ability to resolve more fundamental issues.

US Congress mulls new methods to restrict investment in Chinese tech sectors

But engagement with China remains a Biden administration priority. More high-level US-China engagements are planned for the near term, with the most significant being an expected phone call between Xi and Biden “this spring … in the coming months”, a senior Biden administration official told reporters after the Wang-Sullivan meeting.

‘Chaotic for the whole world’: fears over Trump’s Taiwan agenda if he wins again

Speaking about Taiwan’s lock on manufacturing for the world’s most advanced semiconductor chips, he said “they took our business away” and that “we should have stopped them”.

“The US will always pursue ‘America first’, and Taiwan can change from a chess piece to a discarded chess piece at any time,” Chen Binhua, spokesman for Beijing’s Taiwan Affairs Office, said at a regular press briefing, in response to the wave of attention that those hardline comments about Taiwan produced.

But Chen spoke too soon.

60-Second Catch-up

Deep dives

‘Chaotic for the whole world’: fears over Trump’s Taiwan agenda if he wins again

-

Now headed for a rematch with US President Joe Biden, Donald Trump suggested during his first administration the self-governing island was not a priority, analysts say

-

If his indifference continues in a second term, one expert notes, it would be a ‘major geopolitical gift’ to Beijing

Donald Trump, the leading candidate to secure the Republican Party nomination for US president, has sparked a new debate, with months-old comments about Taiwan doing the rounds on social media.

In a clip recorded in July, the former president refuses to spell out whether the US would help to defend Taiwan during a possible second term, even if it meant going to war against Beijing.

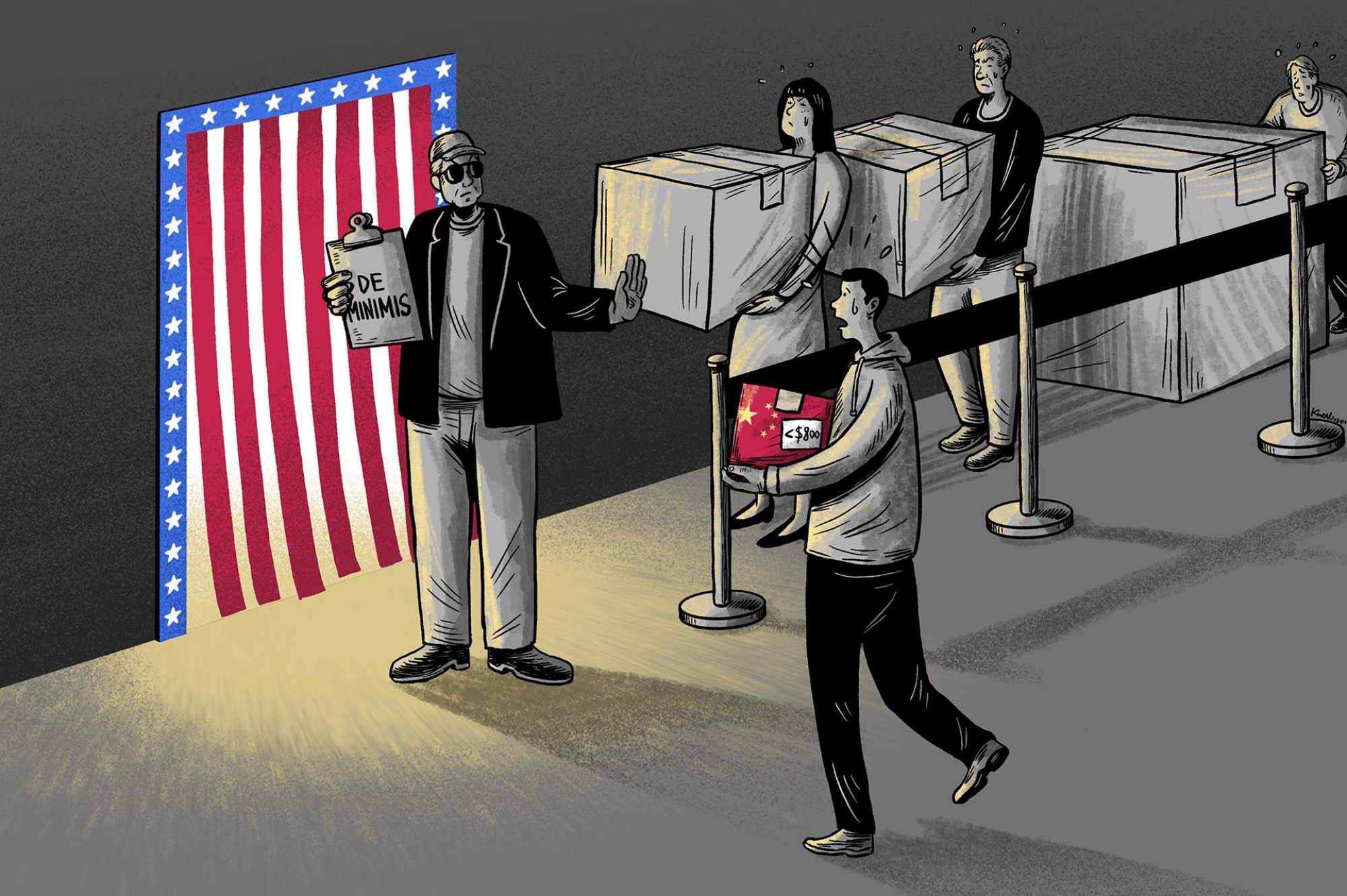

Why China hopes US won’t touch century-old trade rule for imports under US$800

-

E-commerce giants Shein and Temu flourish as parcels surpass quarter of a trillion dollars in value annually amid push to tighten de minimis provision

-

US lawmakers argue Chinese goods produced from forced labour are being allowed into the states, but election year factors cast doubt on reform

Transitioning away from placing large containers of bulk cargo on overseas-bound ships, Wang over the past year has embraced a sea change in volume and scale that has proved lucrative.

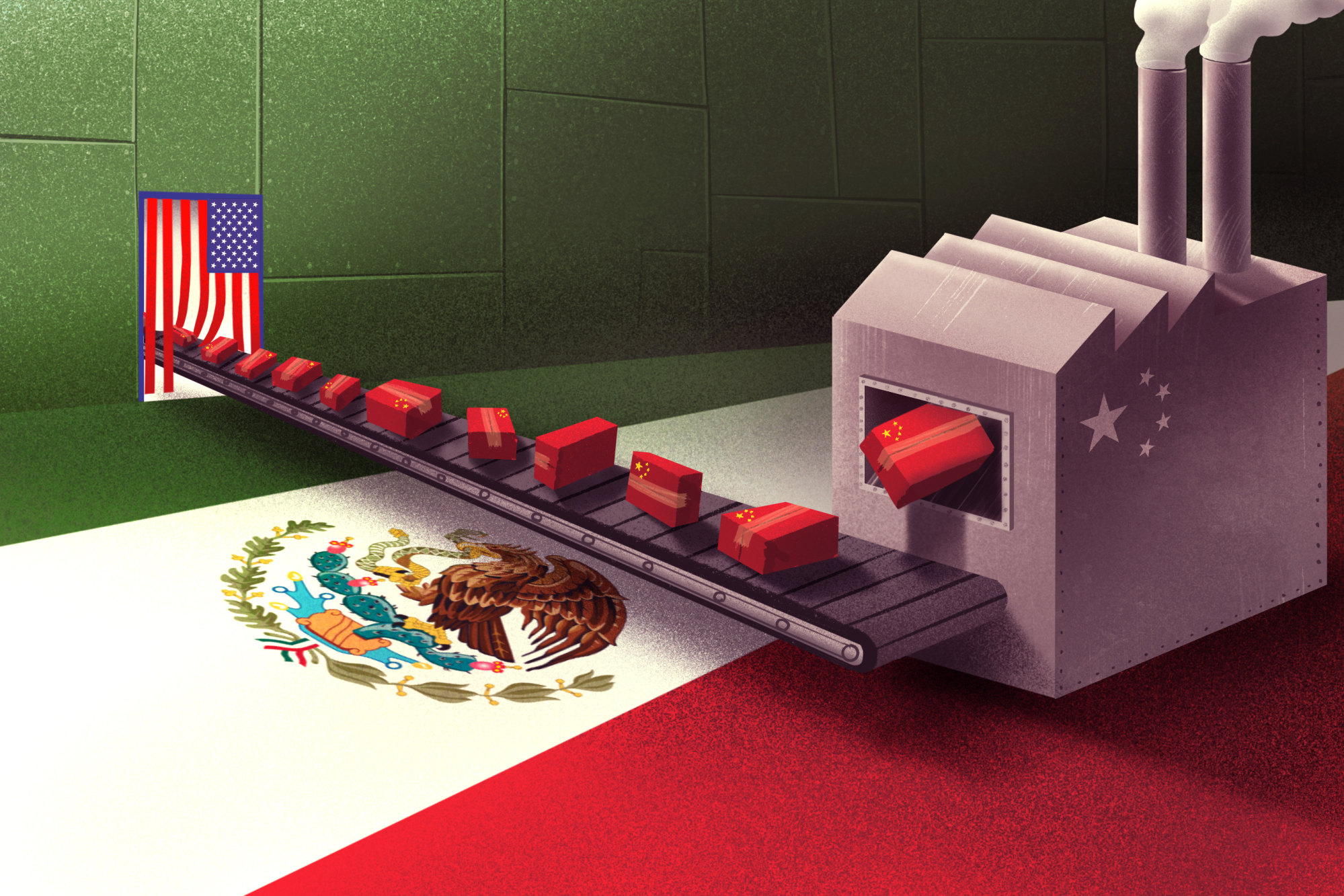

China’s investment in Mexico is up – but is dodging US tariffs the whole story?

-

Investment in Mexico by Chinese companies has increased in recent years, and the timing suggests heightened US trade restrictions are a factor

-

The country has appeal outside its role as a bypass, however, with a relatively inexpensive labour force, high urbanisation and growing middle class

Though sidestepping Washington’s tariffs has been a prime incentive for Chinese manufacturers to boost their investments in Mexico, the United States’ southern neighbour offers far more than an alternate route into the world’s richest country – as well as its fair share of risk, analysts warned.

Time to compromise? Has US economic growth strengthened its hand with China?

-

US economy expanded at annualised rate of 3.3 per cent in fourth quarter, while China is faced with challenges at home and abroad

-

Trade and economic talks have increased since Xi Jinping met Joe Biden, with US Secretary of the Treasury Janet Yellen set to return to China this year

Stronger-than-expected economic growth in the United States and China’s contrasting slow recovery could push Beijing to “be more willing to compromise” in its trade and economic negotiations with Washington, though talks are ultimately “driven by politics”, according to analysts.

US and China have ‘strong reasons to favour status quo’ in 2024 economic talks

-

President Joe Biden seen trying to avoid ‘undue escalation’ with China, while Donald Trump hails friendship with President Xi Jinping amid threats of higher tariffs on Chinese goods

-

US-China Economic Working Group’s latest meeting comes as both sides struggle to see eye to eye on economic affairs in their ‘strategic rivalry’

Washington and Beijing appear keen on staying the course in their interactions, with warm handshakes and sincerity in dialogues, but they lack the incentive to resolve deep-seated differences, according to analysts who point to a just-concluded meeting of the US-China Economic Working Group.

Employing such a tactic in a formal economic-dialogue structure, they say, serves the respective agendas in both countries and comes as the administration of US President Joe Biden is facing a resurgent challenge by predecessor Donald Trump in an election year, while President Xi Jinping has his hands full trying to revive China’s economy.

Great power lite? Why China is reluctant to wade into the Red Sea crisis

-

Beijing has called for an end to the attacks on the ships and expressed concern over the escalating situation

-

But it is unlikely to play a bigger role in resolving the conflict, affecting its global standing, analysts say

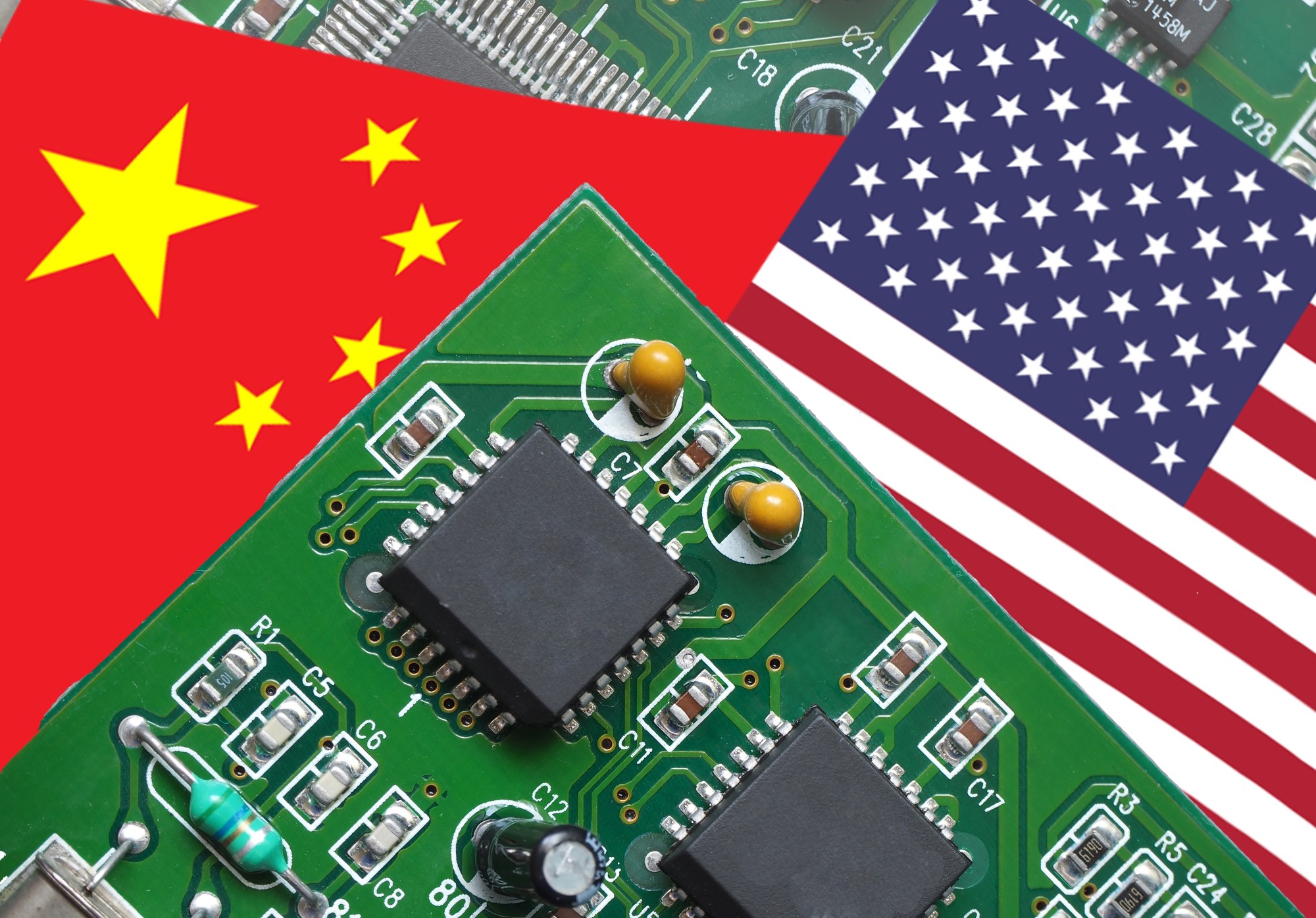

US Congress mulls new methods to restrict investment in Chinese tech sectors

-

Hearing is held to build on President Joe Biden’s executive order banning US investments in four Chinese tech sectors

-

Witnesses urge lawmakers to use existing authorities, including current export control lists, rather than create new mechanisms

Amid the growing tech war between the world’s two largest economies, the US Congress considered new ways on Tuesday to restrict US investment in China that involves sensitive technology.

The hearing by the House Financial Services subcommittee on national security, illicit finance and international financial institutions followed US President Joe Biden’s executive order in August prohibiting US private equity and venture capital investments from flowing into four Chinese tech sectors: artificial intelligence, quantum computing, semiconductors and microelectronics.

Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world.