Is China’s state-led industrial policy on a perilous path? Some Beijing advisers warn of ‘detrimental’ implications

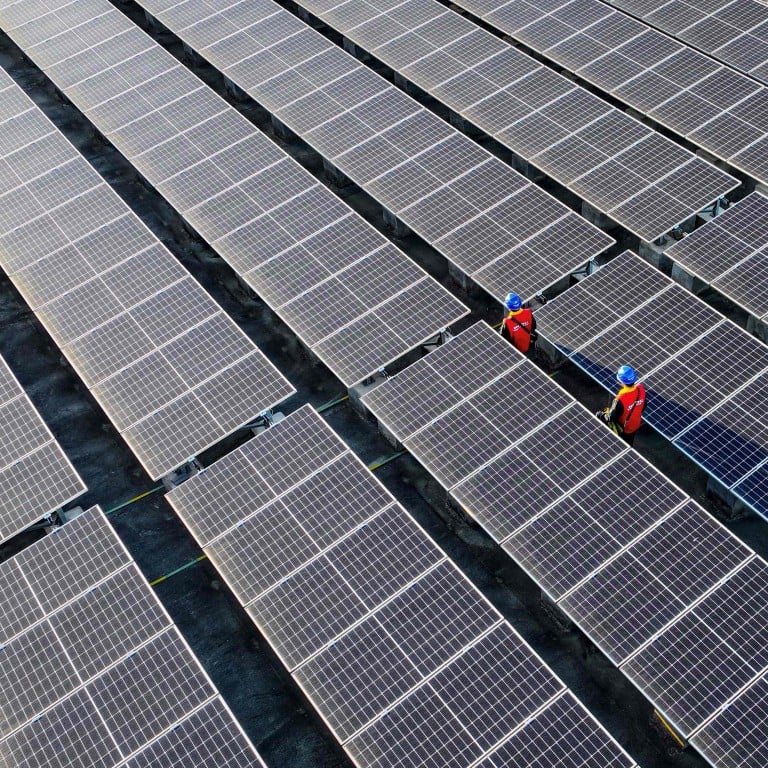

- Injecting funds into strategic industries such as alternative energy has given China a massive leg up on the international competition, but domestic experts say cracks may be showing

- The potential for a wave of trade protectionism against Chinese products is seen posing big risks to economic development and innovation

China’s surging exports in alternative energy and its widening trade surplus are fuelling debate not only overseas but also in its own backyard over whether Beijing should adjust its industrial policy that the US and Europe frequently criticise amid fraying ties.

The discussions of late reflect a deep division among Beijing’s policy advisers on the efficacy and consequences of the country’s economic growth model, which underpins much of its industrial policy.

Some of those advisers contend that China’s industrial policy works to its advantage amid intense competition with the US in advanced technologies. In the midst of weakened domestic demand post-pandemic, they see state-led investment as an effective path to steady growth.

However, others warn that Beijing’s broader trade relations with the West are at stake, and that the government needs to consider carefully the global impact of pumping massive funds into strategic sectors – some of which have already become awash with overcapacity.

We need to take situations like this seriously

Huang Yiping, a former adviser to China’s central bank and the dean of Peking University’s National School of Development, said a balance needs to be struck between expanding domestic consumption and increasing government investment.

“We have enough investment to create new production capacity, but it is also best to have corresponding demand to absorb such newly added production capacity. This kind of economic growth is sustainable,” Huang said on Wednesday during an online forum held by China Macroeconomy Forum, a think tank associated with Renmin University in Beijing.

Huang added that China shouldn’t underestimate the ramifications of its industrial policy and the corresponding response from the US and Europe, which have already stepped up their own investments to reduce reliance on China in the supply chain.

“We need to take situations like this seriously, because if it really turns into a relatively common wave of trade protectionism against Chinese products, it may actually be detrimental to our next stage of development, especially in innovation,” Huang said.

Xi demands ‘disruptive’ innovation to ‘fight battle in core technologies’

China’s industrial policy, often defined as any state intervention that reallocates resources to support firms or sectors to achieve national objectives in making the country’s manufacturing competitive, has always been a contentious issue.

Critics have long blamed that policy for job losses in other markets, citing China’s widening trade surpluses with the rest of the world as evidence of the country dumping cheap exports onto its trading partners, effectively pushing out competitors.

And China’s trade surplus with the rest of the world could widen even faster in renewables compared with lower-value exports of the past, according to Lu Feng, a professor at Peking University’s National School of Development.

Speaking during a forum arranged by the university on Wednesday, following Beijing’s annual parliamentary gatherings known as the “two sessions”, Lu estimated that China’s trade surplus in industrial products had reached an “unprecedented” scale of US$1.5 trillion to US$1.7 trillion in just the past few years, accounting for 30 per cent of the country’s entire industrial output value.

“A substantial increase in exports requires goodwill from foreign countries, which is not unconditional. And the same goes for China. When more foreign countries export to China, we will also be under pressure,” Lu said.

But there is also a considerable wealth of opinion among policy advisers and industry executives that China’s tried-and-tested industrial policy gives the country an edge, even if it comes at a hefty price.

Liu Hanyuan, the founder and chairman of Tongwei Group, the world’s largest producer of polysilicon solar cells, has shrugged off domestic overcapacity in the solar industry, which has led to price wars in recent years.

“If you look at it rationally, you will find that to achieve the energy transformation and carbon neutrality goals in about 30 years, the scale of the photovoltaic industry may be more than 10 times what it is today,” Liu said in an interview with the state-backed National Business Daily published on Sunday.

‘Smarter investment needed’: China must fix overcapacity as it eyes new growth

Liu Yuanchun, president of the Shanghai University of Finance and Economics, said that the model still has a certain “vitality” to it, and that there are ways to reduce inefficient spending. But overcapacity is not a reason for giving it up, he told the Shanghai-based Guancha news portal in an interview published on March 4.

A more pressing concern, some advisers contend, is the debate over where state investments should be prioritised. A property market crisis and debilitating levels of local-government debt have sparked credit curbs in construction over the past few years.

Xu Gao, chief economist at Bank of China International, said that channelling government funds into manufacturing will always lead to overcapacity.

Also speaking at Wednesday’s forum by Peking University, Xu said that investment in infrastructure and property is a necessary step to stabilise growth before the country can introduce reforms that aid in the distribution of wealth to the people.

“Such reforms obviously take time,” Xu said. “Before substantial progress has been made in the reform of income distribution, suppressing investment [in construction] is self-defeating and would shake our foundation in our great battle with the United States.”

Additional reporting by Luna Sun