‘All is not well’ in China’s economy, Rhodium Group report warns, slamming Beijing’s lack of structural reform

- After GDP growth surpassed expectations in 2023, US-based research firm says slower annual growth in range of 3-4 per cent ‘is here to stay’ for China

- Report says China made ‘meaningful’ progress in attracting foreign investment but failed to address structural problems that brought about mounting local-government debt

The annual growth of China’s economy could slow to just 3 to 4 per cent in the coming years unless the nation addresses structural problems, warns a fault-finding report by the US-based Rhodium Group that meanwhile viewed the beleaguered property sector in a more positive light, expecting it to be relatively stable this year.

China’s recovery from the coronavirus pandemic was largely uneven in 2023, and its economic performance was particularly weighed down by some underlying problems resulting from years of large-scale credit and investment expansions.

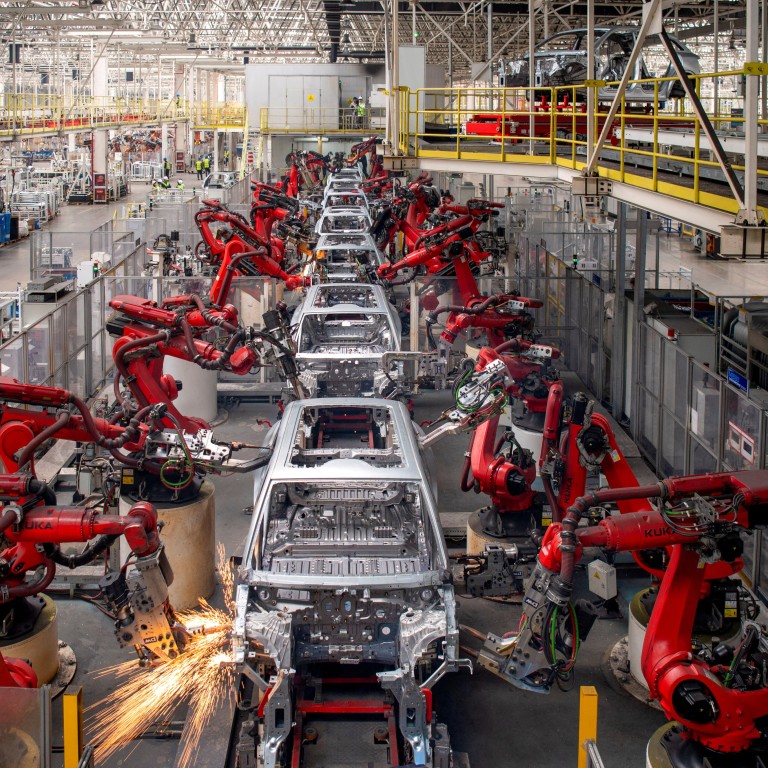

Moreover, China is facing growing export controls in some sectors and weak domestic demand that have raised questions over its position as the world’s leading manufacturing destination for foreign firms.

“Policymakers did next to nothing to tackle real structural problems,” the US-based research firm said in the report released on Monday, adding that “structural problems require structural reforms”.

China’s three-legged race to fend off the 4 D’s of an economic apocalypse

Last year, China’s economy grew by a higher-than-expected 5.2 per cent, and Beijing is again expected to set a gross domestic product (GDP) growth target of around 5 per cent for 2024.

“Though we expect the severity of 2022-23 declines to set China up for a modest cyclical rebound in 2024, long-term growth potential will disappoint until fundamentals are addressed,” the report said.

It also said that Beijing’s boasting of GDP growth above 5 per cent came “despite a running battle to roll out extraordinary support measures, including lifelines for property developers, midyear expansion of the fiscal deficit ceiling, monetary policy easing and other steps”.

“As 2024 gets under way, new emergency steps to prop up stock markets are being added to the mix – yet another sign that all is not well,” the authors wrote.

In the quarters to come, property will shift from a massive drag to a modest boost to [China’s] GDP growth

What’s more, the report said the results of China’s efforts to turn into a “market-based” economy were mixed in terms of building a modern innovation system; encouraging equal competition between state firms and private companies; and increasing its appeal for portfolio investment.

China made “meaningful” progress in attracting foreign investment, but it did not address structural problems that brought about mounting local-government debt, the report added.

And its openness to trade contracted in the second half of last year, marked by increased controls on raw materials amid trade tensions with the United States.

But the firm also pointed to a “reasonable” likelihood that China’s policymakers would try to get more reforms back on track, including in the real estate sector.

“In the quarters to come, property will shift from a massive drag to a modest boost to GDP growth, though from a much lower base,” it said. “We expect this stabilisation due to the three years of destocking that have already taken place, bringing the real estate industry near a long-term equilibrium level of activity.”

EV restrictions from US, EU could throw a wrench into China’s recovery plans

While Beijing has yet to announce a date for its third plenum – the traditional twice-a-decade gathering of the top leadership in Beijing, at which decisions on China’s economic and reform agenda are usually made – Rhodium said it’s “reasonable” to expect it will take place in the first half of 2024.

“While cyclical conditions will stabilise this year, Beijing must soon acknowledge that slower growth, in the 3 per cent or 4 per cent range, is here to stay,” the report said.

It also warned that a lower growth rate could affect foreign firms in industries that rely on China as an importer.

“Some foreign firms will be edged out by lower-priced Chinese competition as Beijing boosts domestic manufacturing, like in lithium-ion batteries and other renewable energy products,” the authors wrote.