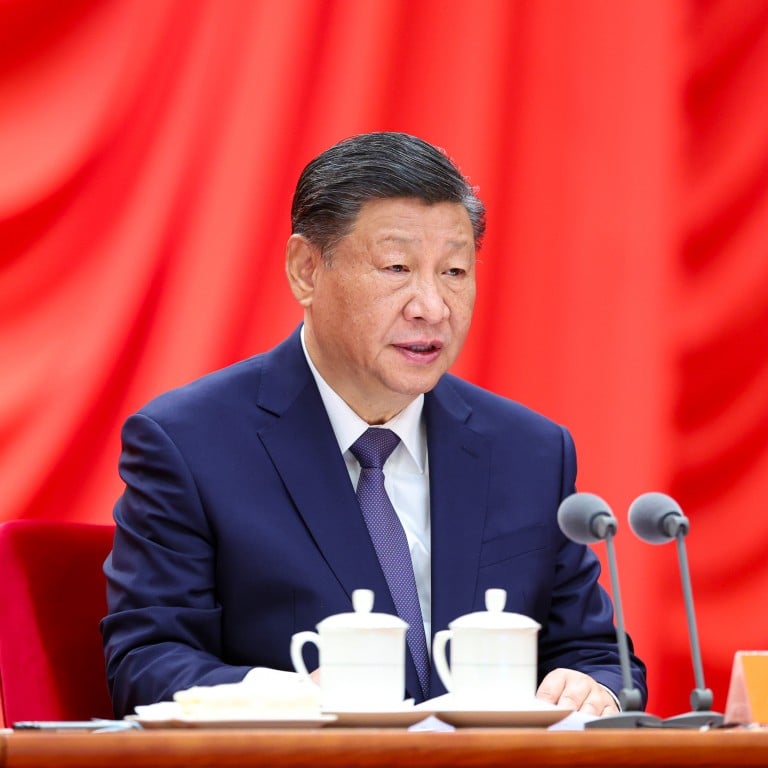

China’s Xi Jinping lays out road map for becoming ‘financial superpower’ – but warns risk can throw efforts off-track

- At a top-level meeting, President Xi Jinping put forward a definition of a ‘financial superpower’ and laid out how China can become one

- Plan elaborates on goals first set out at financial work conference last year, emphasises institutional strength, government coordination

However, the world’s second-largest economy faces more urgent tasks in its efforts to defuse rising financial risk, he said during a high-level meeting at the Central Party School in Beijing.

“A financial superpower should be based on a strong economic foundation,” Xi was quoted by state outlet Xinhua as saying. “It must have world-leading economic, technological and comprehensive national strength.”

Major differences from the Western models, Xi said, include the Communist Party’s leadership and the emphasis on financing support for the real economy.

He also stressed fundamentals, saying a strong currency, central bank, financial institutions both domestic and international are key to superpower status, as well as strong supervision and talent.

Financial regulation must have teeth … corruption must be resolutely punished and moral hazard must be strictly prevented

While long-term work is required to become a financial superpower, Xi said, he also emphasised the importance of preventing systemic financial risk, adding financial regulators and industry authorities must clarify their responsibilities and strengthen cooperation.

“Financial regulation must have teeth,” he said. “All localities must plan for the overall situation based on one region and practise risk management and stability maintenance.”

Amid property slowdown, China seeks to bolster rental housing market

China will focus, he said, on enhancing its competitiveness and influence on international rules, promoting “high level” financial opening-up.

“[We will] streamline restrictive measures, enhance the transparency, stability and predictability of our policy, and regulate overseas investment and financing activities, improving financial support for the Belt and Road Initiative,” he said.

The authorities have responded by reshuffling the regulatory regime, with a Central Financial Commission set up to oversee the multi-trillion dollar industry.

A vast majority of China’s banks, securities houses and insurers are controlled by governments at different levels.

Mounting local government debt has also triggered concerns over regional economic prospects and a potential spillover to the banking sector, which has significant exposure and can be sensitive to economic cycles.

Fitch Ratings said last week that many Chinese banks are seeing heightened capital pressures, including some systemically important banks.