Russia’s sanctioned VTB Bank wants to build ships with China, defiant CEO says on trip with Putin in Beijing

- Russian state lender, tasked with saving a struggling state shipbuilding firm, needs China’s help as bilateral ties continue to strengthen amid external pressure

- CEO Andrey Kostin hails broader use of the yuan and continues to decry the effects of Washington’s sanctions on the global financial system

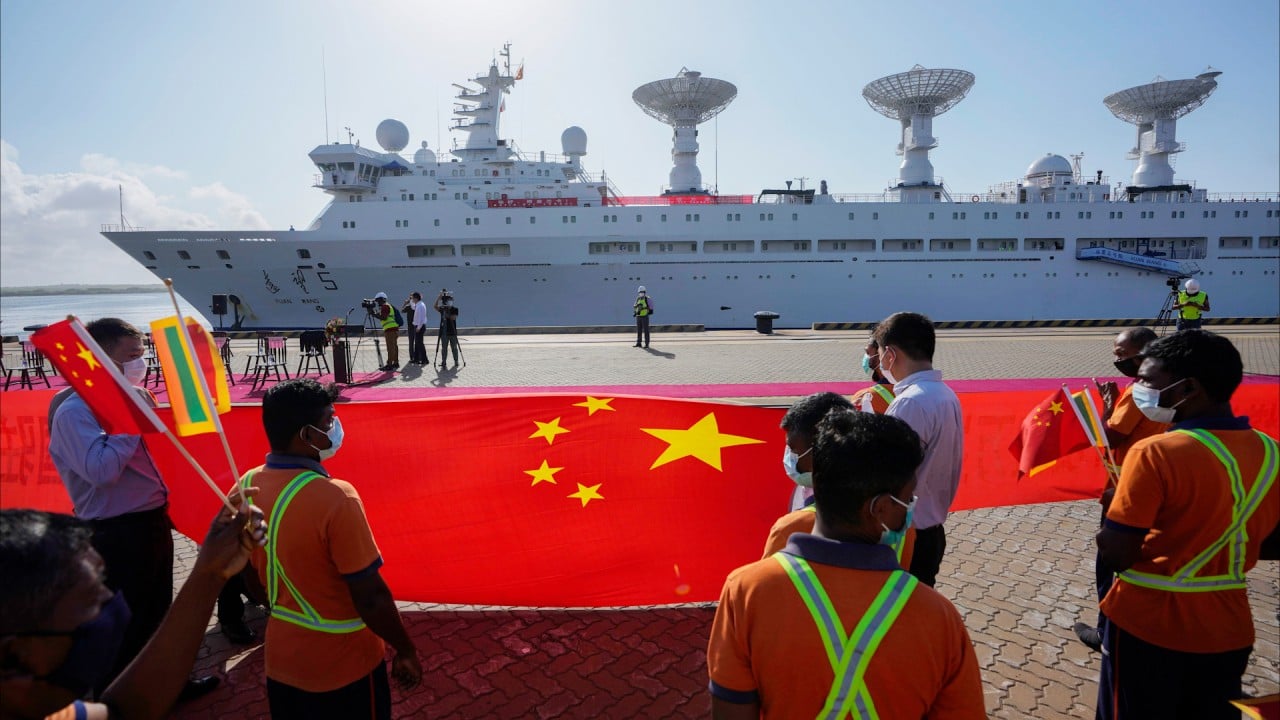

Grappling with the financial repercussions of the Ukraine war and Western sanctions, Russia’s second-largest lender is turning to China for lucrative opportunities to offset losses – and they have even floated the idea of building ships together.

With the conglomerate in financial straits, Moscow wants to see VTB “attract external funding” to salvage it.

Enter its CEO, Andrey Kostin, who accompanied Putin on a trip to the belt and road forum in Beijing last week. Speaking to the Post, he said he was looking to scout out Chinese partners in finance and shipbuilding.

Xi signals China will stay the course with belt and road pledges

In the face of sweeping US sanctions, Russia has turned increasingly reliant on China since invading Ukraine in February 2022.

“We are coming to China because it is No 1 shipbuilder globally. We need cooperation with China … I’ll probably return in November to meet with Chinese companies, we might even look to build a new shipyard with China,” said Kostin, seen as one of Russia’s most influential bankers, with close ties to Putin.

Kostin said that USC, with a legacy of building warships, is now aimed at switching lanes into commercial vessels. And China is a natural partner.

“Russia’s shipbuilding was focused on the military, but now [there is] a big demand for tankers, ships for transferring gas, for tourism, for fishing,” he said, adding that they decided to visit China after having spent the past few months getting a better idea of what has been plaguing USC.

[W]e don’t have specific plans for cooperation in warships construction

But jointly made destroyers and battleships appear to be off the table.

“We do have military, but at the moment we don’t have specific plans for cooperation in warships construction,” Kostin said.

When speaking at the belt and road forum on Wednesday, Putin mentioned a slew of bilateral projects, including the North-South corridor in European Russia, the north-south transport artery through Siberia, and railways from Siberia to China via Mongolia.

Kostin flouted the idea of pitching these transboundary projects to Chinese investors.

“A railway [being envisioned] might go from Russia through Azerbaijan to Iran and farther to Saudi Arabia,” he said. “It’s only a nice idea, but I think [Russia] will be very keen on inviting China to participate.”

The value of China-Russia trade increased by 30 per cent in 2022 to US$190 billion, and both sides are looking to reach US$200 billion this year.

Kostin said Russia’s infrastructure strategies were very much in line with the belt and road plan, Beijing’s decade-old initiative to link economies into a China-centred trading network.

“The positions of both sides are the same … What President Xi thinks is the same [as] what President Putin thinks,” Kostin said. “BRI is beneficial for anyone participating, and Mr Putin was very supportive – he said that more than once.”

Chinese companies with perceived Russian connections have been blacklisted by the US, and more than 50 Chinese entities have been sanctioned as of this month.

Ukraine war: US adds 42 Chinese firms to export blacklist for ‘support to Russia’

But Kostin said helping Russia was merely a “pretext” for Washington’s sanctions. His comments came as Beijing and Washington continue to square off in trade and technology, and with the latter warning that China could face consequences for aiding Moscow.

“Americans have a ‘double deterrence policy’ – against China and Russia. And probably the first target is China, as China competes with America in economy and finance. Recent restrictions are not related to Russia,” Kostin claimed. “The US may be a little bit afraid because they also depend on China in trade.

“They are definitely targeting China with a very hostile policy, saying it’s a deterrence. They don’t want you to become stronger, and that’s why they’re doing it.”

Washington has levelled similar allegations against Russia following its invasion of Ukraine.

Kostin remains defiant, saying threats of US sanctions will not deter Chinese entities from embracing Russian partners, including USC.

“[China’s] strength comes not from America, but from your people, from your leadership, which is conducting very, very wise policy.”

Kostin also discussed the rising use of China’s yuan in Russian deposits and trade.

“Yuan is easily traded in Russia, many clients keep deposits and investments in yuan and Russian companies are more interested in increasing yuan-denominated borrowings,” Kostin said.

Russia’s VTB offers high rates to hoard yuan, skirt dollar sanctions

“We should have more direct corresponding bank accounts to deal in roubles and yuan, and we should create a new international depository settlement hub. There’s so much money outside America and Europe. If Russian companies want to raise capital, they can go to China or the Gulf states.”

“There are a lot of opportunities for the yuan to become No 1. [China is] growing as an economic power; it should be followed by the yuan’s growth.”

And when it comes to China overtaking the US as the world’s largest economy, Kostin warned that “if your currency is not much used, that won’t be very logical”.