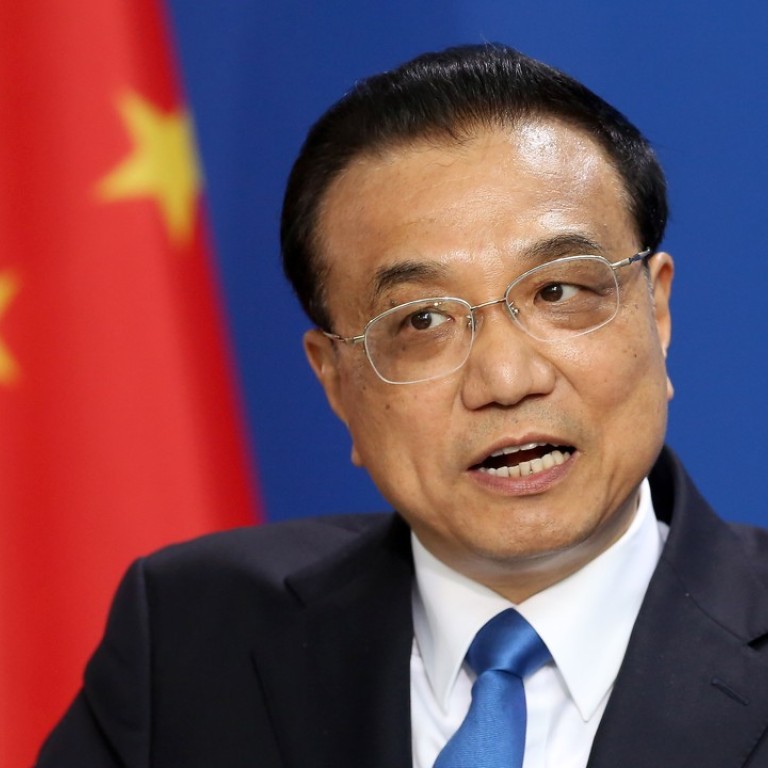

China premier says yuan not a weapon in trade row as economic ‘cold war’ looms

Comments to World Economic Forum in Tianjin are implicit rejection of Donald Trump’s claim that Beijing has been manipulating its currency

Li told the World Economic Forum in Tianjin that Beijing had not manipulated the exchange rate of the yuan to cope with trade tensions, rejecting speculation that the Chinese government deliberately engineered the 8 per cent depreciation of the yuan seen since March to offset the effects of US tariffs on Chinese imports.

“Some people think China deliberately [devalued the yuan]; this is groundless,” Li said, in an indirect response to US President Donald Trump’s allegations that Beijing is manipulating its currency.

Trump: ‘we probably have no choice’ but to put tariffs on all Chinese goods

Separately in Geneva, former Chinese central bank governor Zhou Xiaochuan said China must plug loopholes in the way it applies rules on subsidies and technology transfer to address complaints from Washington and Brussels.

“There could have been some inappropriate behaviour sometimes, but we are improving” in areas of government subsidies and forced technology transfers, Zhou said on Wednesday.

Zhou’s promise of further improvement in trade practices, and Li’s assurance that China won’t let an escalating trade dispute spread to the currency realm, along with his promises of fair treatment to foreign businesses in China and strong intellectual property rights protection, however, neither brightened the prospects of a looming economic war between the world’s two biggest economies, nor shored up confidence in the future value of the Chinese currency, also known as the renminbi.

The gaping differences between Beijing and Washington about China’s economic model were laid bare at the Tianjin event when two US Republican congressmen called out China’s commitments to free and fair trade just minutes after Li’s keynote speech.

Darrell Issa, from California, and Todd Rokita, of Indiana, called on China to stop “stealing and cheating” and urged the government to take timely actions that would allow a ceasefire in the trade war with the United States. The two congressmen voiced strong support for the Trump administration’s trade confrontation with China. “Every action the US has done is measured and reasonable” and was based on “sound evidence”, Rokita said.

The trade dispute between the world’s two largest economies has so far remained largely restricted to tariffs on goods and has not spread to other financial realms, despite repeated threats from Trump, dating back to the 2016 election campaign, that he would label China as a currency manipulator.

“A one-way depreciation will do more harm than good for China,” Li told hundreds of business and political leaders at the event, entitled the Annual Meeting of the New Champions.

“China will not choose the path of bolstering exports by devaluing the yuan … the yuan exchange rate will be kept basically stable.”

The yuan exchange rate barely moved both in the onshore market in Shanghai and the offshore market in Hong Kong after Li’s speech. The onshore exchange rate closed at 6.8548 per dollar on Wednesday.

Zhu Haibin, the chief China economist with JPMorgan, wrote in a note that yuan depreciation “is a more effective way to do damage control” in managing fallout from additional US tariffs than retaliatory tariffs.

“With a mild depreciation against the dollar, the tariff impact could be largely offset,” Zhu wrote.

Meanwhile, China is expected to refrain from a large devaluation as such a move could trigger capital outflows that would undermine China’s financial stability and even “competitive devaluation of other currencies”.

In addition, Trump again threatened to “pursue phase three” of tariffs on US$267 billion worth of Chinese goods, affecting almost all the remaining Chinese imports into the US.

Li, the number two official in the Chinese government, did not mention Trump or the US in his speech, although he did say that “unilateralist acts in any form won’t solve problems”.

He reiterated Beijing’s official line that China would accelerate its plan to open up to the outside world and uphold international free trade rules.

“I welcome you filing complaints to the Chinese government, including all levels of governments, if you have any problem in doing businesses in China,” Li said.

The US congressman in Tianjin, Issa, however, said he was sceptical.

“There are hundreds of [intellectual property] cases in China that are decades old, years and years old, [but they] simply never get a day for a trial because if they did, they would have to admit that China has done wrong,” Issa said.

US Senate wants to reinstate ZTE’s ban if it breaks Trump’s deal

Li also ruled out a massive stimulus programme to offset the economic impact of the trade war, saying the government would fine-tune its fiscal and monetary policies to cope with the economic challenge.

“We have many tools in reserve and so our macroeconomic policies are able to manage difficulties and challenges,” he said.

In July, the Politburo, the top decision-making body, ordered the government to implement policies to stabilise the economy, including investment, trade, finance and employment. The government responded by expanding fiscal spending and loosening monetary policies.

At a State Council meeting on Tuesday, Li urged local governments to cut fees and taxes for businesses and, in particular, not proceed with tighter social insurance tax collection policies without Beijing’s prior approval.

The meeting also agreed to cut customs administrative red tape to make it easier for Chinese exporters to sell products abroad.