Plant-based meat’s success in Asia boils down to cost and outreach

- Research suggests the plant-based meat industry should target consumers seeking protein diversity or nutritious supplements rather than a replacement

- Survey also indicates affordability would boost prospects for plant-based protein consumption in Southeast Asia

The problem? According to new research conducted by the Good Growth Company, consumers in Southeast Asia – one of the world’s fastest-growing economic regions – overwhelmingly say they intend to keep eating animal meat. Meanwhile, nearly a quarter want to increase their consumption over the coming year, not decrease it.

That’s bad news for the planet. But this top-line figure obscures more nuanced takeaways, which collectively reveal several “middle path” areas where an accelerated uptake of climate-friendly alternative proteins like plant-based meat is not only possible but could also strengthen the regional economy.

This same principle held true on the other end of the spectrum: people who currently consume animal meat infrequently were significantly more sceptical of consuming plant-based meat.

If that feels counterintuitive, it’s because plant-based meat marketing has traditionally focused heavily on the idea of substitution (‘Want a healthier alternative? Drop the meat and try veggie chicken instead!’).

But this data shows that framing plant-based meat only as a replacement product risks leaving out a lot of potential purchases. Consumers were unequivocal that what they are truly craving is protein diversity, not wholesale replacement. That’s an audience worth speaking more directly to.

The data also shows that Asian consumers broadly agree with alternative protein companies that their products come with a lot of potential benefits. When asked to describe their impressions of the plant-based meat category, the top survey answers were “healthy”, “easy to digest” and “tastes good.”

So what’s holding shoppers back from filling their baskets with plant-based pork? By far the most important factor is affordability. Almost half of the nearly 6,000 survey respondents in the study said that if plant-based meat was “more affordable”, they would eat more of it.

Just how affordable does it need to be to tip the scales? Among consumer segments that expressed high interest in eating plant-based meat, up to three-quarters said they would buy it at price parity with conventional meat. But if plant-based meat manages to achieve a price 20 per cent lower than conventional meat, more than 80 per cent of all consumers would buy it, including about half of those who would otherwise reject it.

Conversely, if plant-based meat is priced 20 per cent higher than conventional meat, there are huge drop-offs in interest among everyone except the most enthusiastic consumers.

Recent research by the Good Food Institute APAC has shown that the average plant-based meat product price is currently 35 per cent higher compared to its conventional counterpart, which begs the question: how many consumers are withholding their purchases until prices come down?

Moreover, since most Southeast Asian consumers view plant-based meat as a chance to diversify their protein consumption rather than a straight replacement for conventional meat, interest in what are known as “blended meat” products – which mix plant-based meat into conventional meat – was nearly unanimous. Ninety-three per cent of surveyed consumers expressed an interest in trying blended meat, including more than three-quarters of people sceptical of trying fully plant-based meat and 80 per cent of those who have eaten it but don’t intend to again.

They suggest that even though consumers are hesitant about fully transitioning from conventional animal meat, there are pathways to wider market adoption by framing plant-based meat as a healthy add-on to existing diets or a nutrient-dense ingredient to be blended into the conventional meat people already eat.

That could create a virtuous cycle in which plant-based meat producers can scale up their manufacturing capacity, better leverage economies of scale, and drive down plant-based food prices across the board – including for fully plant-based products.

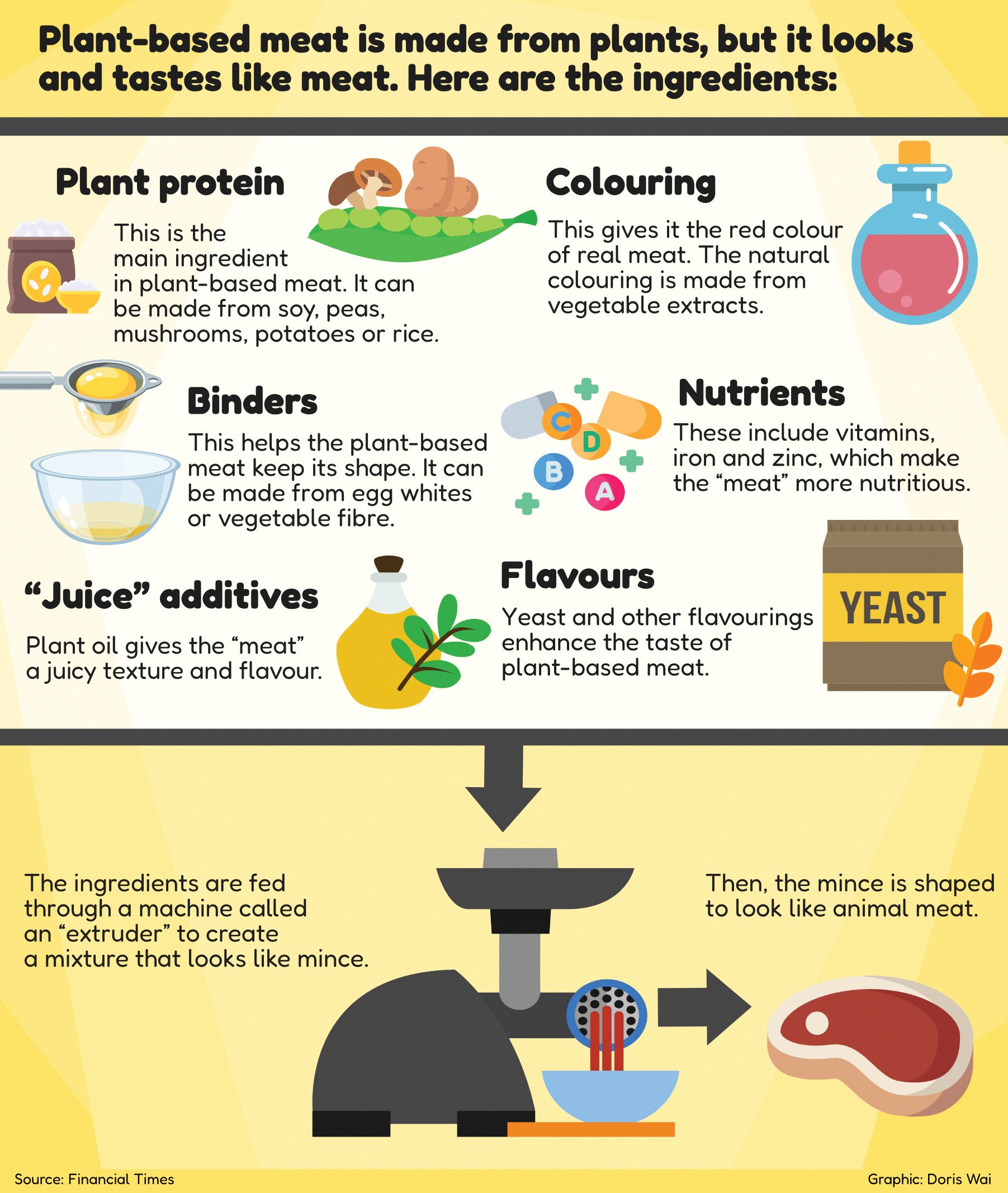

Plant-based meat is already doing so much right. It delivers many of the familiar, meaty flavours that consumers crave, with a tiny fraction of the climate footprint of its conventional counterpart.

But, at least for now, the data shows consumers don’t want to be asked to choose between plant-based products and the conventional meat they know and love.

As the expression goes, the customer is always right. By addressing the cost hurdles keeping many shoppers away, and repositioning plant-based protein as not only a substitute but also a high-value ingredient that can be blended into the conventional meat supply, the sector can meet consumers where they are and satisfy Asia’s surging protein demand without breaking the planet.

Ryan Huling is senior communications manager at the Good Food Institute Asia-Pacific. He previously served as an international expert on nutrition and sustainable food systems for the Food and Agriculture Organisation of the United Nations