5 reasons Hong Kong’s financial hub status is secure

- Hong Kong’s fundamentals actually put it in a position of unique strength

- It’s the gateway to mainland China and the top clearing centre for the renminbi, while the city’s cosmopolitan charm is appealing to talent

The often-misquoted line from Twain that appeared in the New York Journal in the spring of 1897 was his way of ridiculing what was obviously not true. According to the Journal, Twain was “undecided whether to be more amused or annoyed when a Journal representative informed him today of the report in New York that he was dying in poverty in London”.

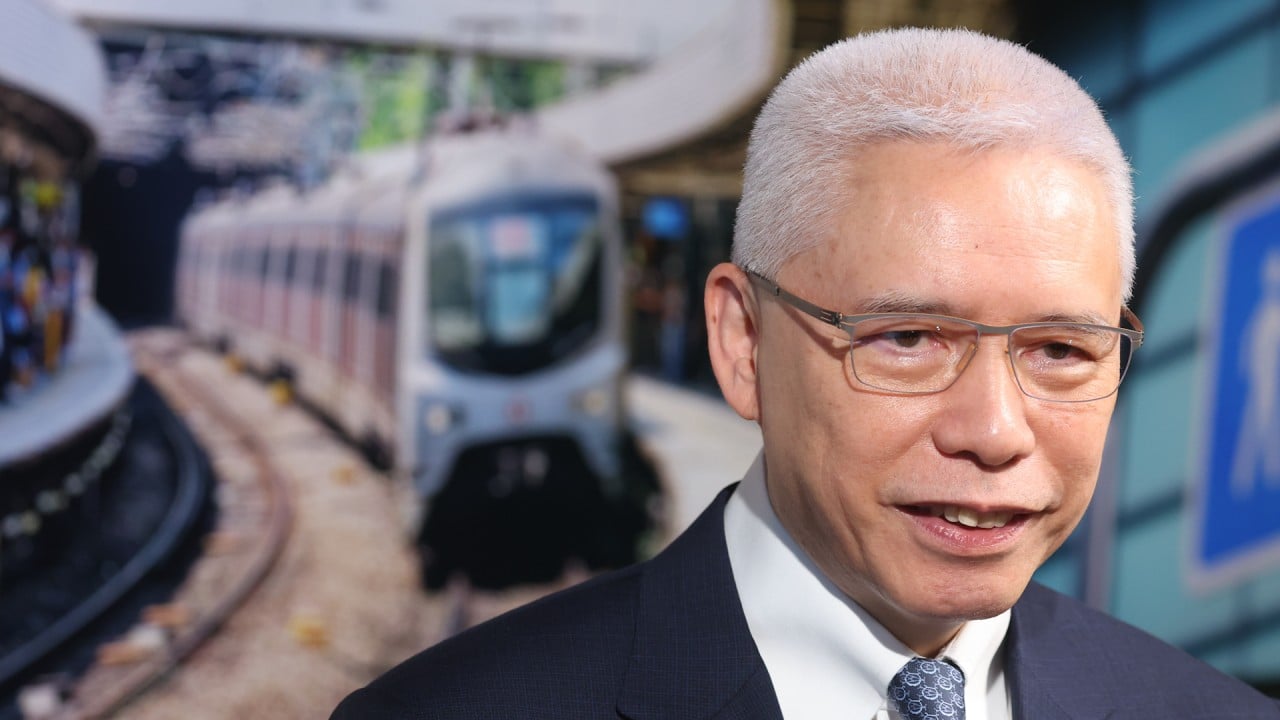

Similarly, one wonders whether Christopher Hui Ching-yu, Hong Kong’s financial services secretary, should be annoyed or amused by claims that the city’s days as a leading financial centre are numbered. Like Twain, perhaps Hui could be forgiven for any urge to gently ridicule these claims.

Hong Kong’s future as a financial centre is underpinned by five fundamentals that put the city in a position of unique strength.

It’s worth remembering that the Greater Bay Area represents more than 10 per cent of China’s gross domestic product, has a population of about 85 million people exhibiting meaningful average income growth and is rapidly climbing the value-added curve.

Hong Kong processes 73.16 per cent of renminbi payments, way ahead of the United Kingdom (5.51 per cent) and Singapore (3.81 per cent). This not only points to Hong Kong’s future role, but the city’s clear advantage over the Southeast Asian island state as a leading financial hub.

Hong Kong also remains a natural platform for China-based corporations seeking outward investment and expansion.

Of course these five fundamentals are no guarantee that Hong Kong is and will remain a leading financial centre. There is competition and sadly there are some with political motivations to diminish Hong Kong’s opportunities.

Further action is no doubt required of the government. This includes successfully guiding the city through the current period of global economic and geopolitical volatility. Coordination across all stakeholders, from the government to the investment sector to the wider community, is vital.

It was good to see the secretary for financial services and the treasury actively pushing back on some of the negative talk about Hong Kong’s status as an international financial centre. Building confidence in the city as a financial hub is an extremely important matter and the duty of all stakeholders who are invested in and benefiting from the city. Perhaps business could do more in this respect.

Damien Green is a Hong Kong based financial services executive