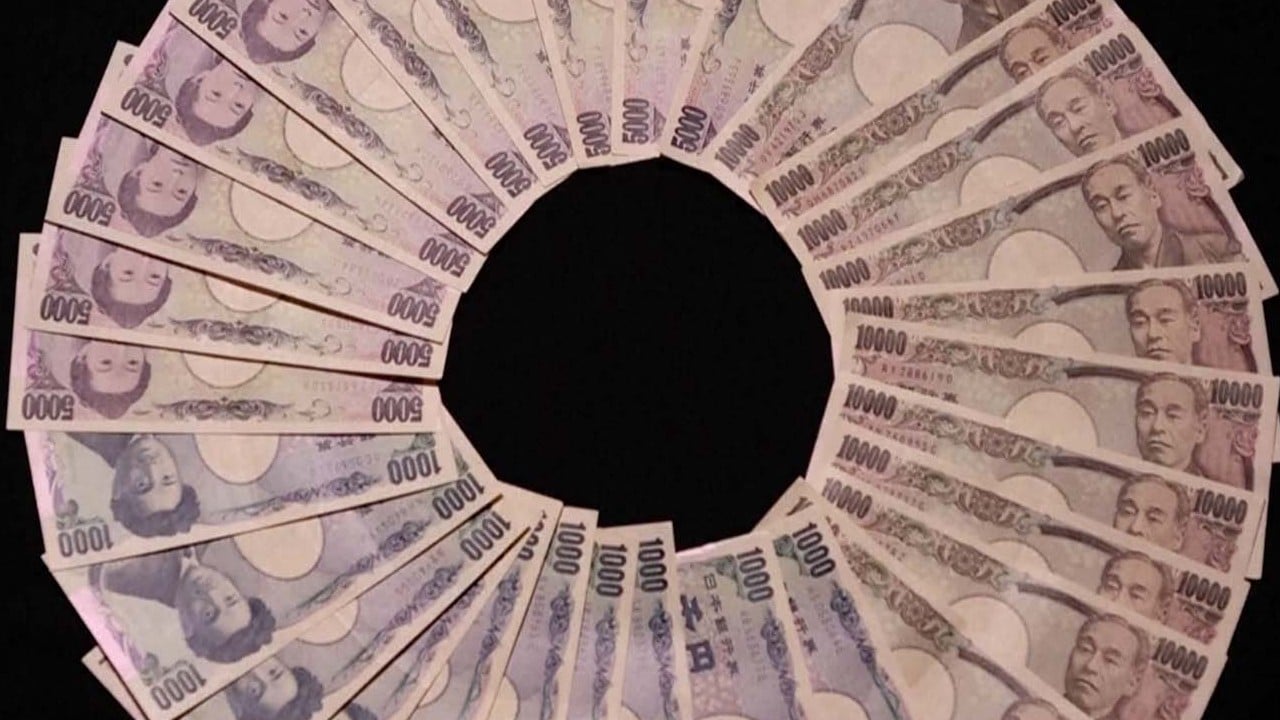

Strong dollar crisis: what we can learn from Japan’s ‘weak’ yen

- Rather than burning reserves to defend their currencies, countries should be conserving resources, given the looming debt and financial system crises

- Better to let their currencies depreciate and suffer short-term pain now, to avoid worse later

This is not the common narrative, especially among analysts who see the Bank of Japan and Ministry of Finance as being irresponsible by stubbornly refusing to raise interest rates and fall in line with US-dictated monetary policy. But Japan has good reason to avoid doing so.

That agreement (signed at New York’s Plaza Hotel) was one of a series of “Japan bashing” actions by the US in the 1980s. It was somewhat less crude than the ritual sledgehammering of imported Japanese cars by US auto workers but its impact proved to be more lasting and profound.

The yen, which traded at a daily average rate of around 240 to the dollar before the Plaza Accord, shot up to an average of 168 in 1986, a savage appreciation which hammered Japanese exports, hollowed out the nation’s industry and launched a long era of deflation.

The yen then went on to strengthen above 100 to the dollar in subsequent years but when it sank back below 150 very recently, many commentators (with lamentably short memories) reacted with horror to a depreciation which should rightly be seen as restoring yen equilibrium.

The dollar is at its highest since 2000, having appreciated by 22 per cent against the yen, 13 per cent against the euro and 6 per cent against emerging-market currencies this year, which has significant implications for most countries, given the dollar’s dominance in international trade and finance.

The upshot of all this, as the International Monetary Fund commented recently, is that for “countries fighting to bring down inflation, the weakening of their currencies relative to the dollar has made the fight harder”.

They are reaching for the easiest lever to hand and raising interest rates or intervening in currency markets in a vain effort to keep pace with the dollar upsurge, whereas they might be better advised to let their currencies depreciate and suffer short-term pain now, so as to avoid worse later.

As the IMF noted, “the dollar’s appreciation is reverberating through balance sheets around the world. [About] half of all cross-border loans and international debt securities are denominated in US dollars” and corporate sectors have high levels of dollar-denominated debt.

Unlike 1997, Asia’s currency defence is likely to be prudent and eclectic

Some countries are resorting to foreign exchange intervention, and foreign exchange reserves are falling as a result. The implication is that now may be the time to swallow bitter medicine to ensure recovery later.

The IMF argues that the higher price of imported goods (if currencies are allowed to depreciate) will help bring about the necessary adjustment to compensate for fundamental shocks because it will reduce imports, helping to reduce the build-up of external debt.

There are lessons to be learned beyond conserving reserves against a future shock. One is that only reduced global dependence on the dollar can prevent the kind of “strong dollar” crisis that is looming. Now is the time for concerted monetary cooperation, if only the world can rise to the challenge.

Anthony Rowley is a veteran journalist specialising in Asian economic and financial affairs