The great powers in history have tended to have one thing in common – size matters. While a large market does not guarantee dominance in other realms, it certainly helps, perhaps more than any other single factor. This was true of the United States, and now it applies to China. Beyond being a leading economic and trading power, China is increasingly becoming a global financial power.

Somehow, many economists in the West did not see this coming. Even a decade ago, few were bullish about the growth of China’s external financial strength, with sceptics highlighting the country’s vulnerabilities.

A rare exception is Brown University’s

Arvind Subramanian. In his 2011 book

Eclipse: Living in the Shadow of China’s Economic Dominance, Subramanian argued that China’s dominance was imminent and would be broader than virtually anyone expected, involving huge financial influence among the domains that China would reshape.

Given his prescience, the title of the Chinese translation of his book – The Big Forecast – might have been more apt.

Why did Subramanian see what many economists didn’t? His model, unlike the standard analytical framework of economics, included the variable of size.

A decade later, China’s financial influence is becoming impossible to ignore. In the 20 months beginning on April 1, 2019, 364 renminbi-denominated onshore

Chinese bonds – issued by China’s government and policy banks – were added to the Bloomberg Barclays Global Aggregate Index.

The first inclusion of domestic Chinese bonds in a major global index was a milestone in the opening up of China’s financial markets. More progress followed, with

J.P. Morgan adding Chinese government bonds to its flagship index in the first quarter of 2020.

FTSE Russell will follow suit later this year.

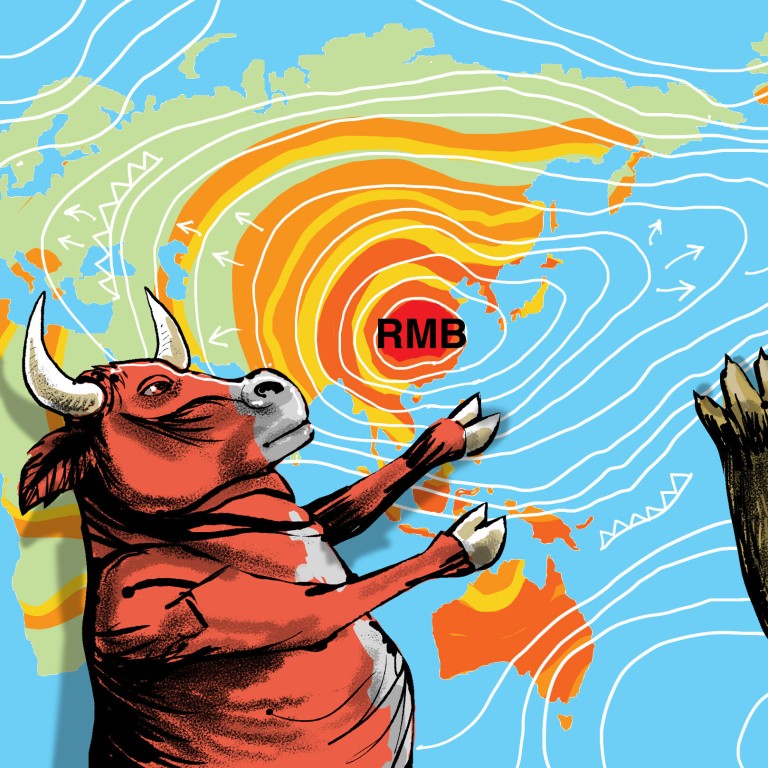

With that, Chinese bonds will be included in all three of the major bond indices tracked by global investors. It should not be surprising that the RMB Globalisation Index, which measures growth in offshore renminbi usage, reached new highs this year after three years of 40 per cent annual growth.

The rapid internationalisation of China’s bond market has accelerated the internationalisation of the renminbi – a process the government has long sought to facilitate. In 2010, China allowed central banks, renminbi offshore clearing banks and offshore participating banks to invest in China’s interbank bond market.

China launched the

Shanghai-Hong Kong Stock Connect in 2014 and the Shenzhen-Hong Kong Stock Connect two years later. The People’s Bank of China has allowed eligible foreign institutional investors to directly access the China Interbank Bond Market since 2016. In 2017, it established

China Bond Connect, which gives overseas investors access to fixed-income markets in mainland China via trading infrastructure in Hong Kong.

These efforts are bearing fruit. According to the Financial Times, overseas investors have bought a net US$35.3 billion worth of Chinese stocks through both stock connect schemes this year, an annual increase of about 49 per cent. As of July, they held more than US$228 billion in renminbi-denominated A shares of China-based firms through these channels.

Moreover, overseas investors have purchased more than US$75 billion worth of Chinese government bonds this year, up 50 per cent year on year, and about US$578 billion in Chinese bonds through China Bond Connect.

Foreign investors hold US$806 billion in Chinese stocks and bonds, up 40 per cent from a year ago.

A huge amount of money is flowing out of the United States and Europe amid

ultra-loose monetary policy meant to deal with the Covid-19 pandemic, and China is a safer destination than other emerging-market economies. That does not mean this is a short-term trend, though.

The annual Global Public Investor Survey, published by the Official Monetary and Financial Institutions Forum, shows 30 per cent of central banks plan to increase

their renminbi holdings in the next 12 to 24 months, compared to 10 per cent last year. In Africa, almost half of central banks plan to increase their renminbi reserves.

As a result, the renminbi’s share of global foreign-exchange reserves is on track to rise at an average annual rate of roughly one percentage point for the next five years. Research by Goldman Sachs and Citi predicts the renminbi will be among the world’s

top three currencies within a decade.

As China opens its capital markets, it is also pushing forward the development of its central bank digital currency,

the e-CNY. It is being tested in

several key cities, placing China well ahead of other central banks. While 80 per cent have begun to design a digital-currency system, only 17 per cent of them have reached the pilot stage.

While the e-CNY is being positioned as a cash-payment voucher, its potential is huge. As China’s

Belt and Road Initiative facilitates an increase in trade and investment flows, the e-CNY will expand the renminbi’s use in settling cross-border transactions, reduce dependence on the SWIFT network and lay the groundwork for the establishment of a more convenient regional digital-currency payment network led by China.

Most importantly, the e-CNY will help China internationalise its multi-trillion-dollar domestic debt, thereby creating a huge market to turn the renminbi into an internationalised currency.

Whatever challenges China faces, its financial rise can no longer be ignored. Subramanian’s decade-old prediction remains valid – it will happen faster and more comprehensively than most observers expect.

Zhang Jun, dean of the School of Economics at Fudan University, is director of the China Centre for Economic Studies, a Shanghai-based think tank. Copyright: Project Syndicate