Forget yuan devaluation, what if Donald Trump weaponises the US dollar?

David Brown says China should take the high road and let the renminbi’s rate be determined by market forces even if the US president escalates a currency war

The big worry for currency markets is where Trump really stands on US dollar policy. Is he a strong dollar man or happier to play the weak currency card? So far the jury is out.

Watch: Trump slams The New York Times op-ed as ‘gutless’

Past US presidents have been renowned for their US dollar policy ploys. Ronald Reagan hailed the “superdollar”, Bill Clinton was a strong dollar advocate, while North American manufacturers reputedly browbeat George W. Bush into a weaker currency bias to boost export-led growth.

Trump is threatening to step up his trade war with China, but the worry is that he will escalate pressure on Beijing with a currency war, too

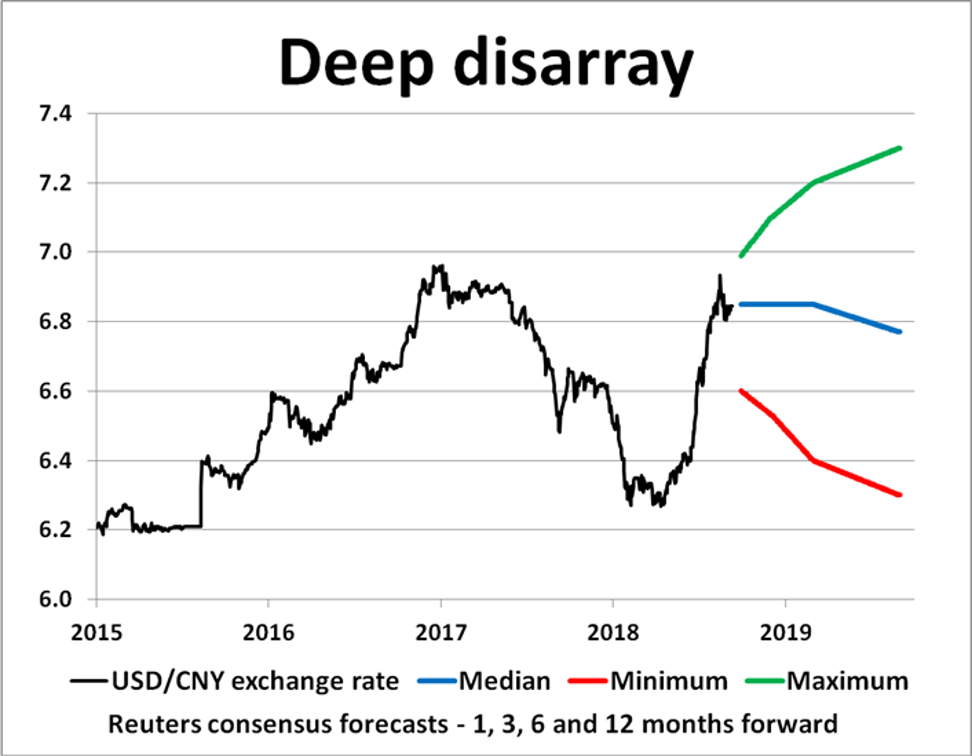

Right now, Trump is threatening to step up his trade war with China, but the worry is that he will escalate pressure on Beijing with a currency war, too. With China threatening to retaliate with countermeasures, the markets are in a deep quandary. Clearly, equity markets are rattled, but could the instability start feeding into foreign exchange markets, adding another element of risk for investors?

Currency polls are in a dither, with forecasters looking at a wide spread of future exchange rate projections for the renminbi against the US dollar, ranging between 6.30 yuan at the lower end to 7.30 yuan at the top end in a year’s time, according to market surveys compiled by Reuters.

The 15 per cent variance underlines the market’s deep-rooted uncertainty about the future. The growing policy conflict between Washington and Beijing is clearly creating problems in an already troubled world, further undermining economic confidence and global growth prospects.

If Beijing truly wants to internationalise the renminbi, it should go with the flow and let market forces prevail

If Beijing truly wants to internationalise the renminbi, it should go with the flow and let market forces prevail. Fighting a currency war with Washington is a zero-sum game and could set back the renminbi’s universal acceptance by years. Official currency tampering would be seen as a market anathema.

If Trump plays the cheap dollar card, markets could be looking at an opportunity for medium-term renminbi recovery. It could be early-2018 all over again with a return towards 6.30 yuan looking the more likely prospect ahead. Beijing should show its mettle through currency benign neglect and by setting a strong moral lead over the US.

David Brown is chief executive of New View Economics