Soy milk, toothbrushes and hair conditioner are biggest winners as more Chinese consumers opt for premium brands, says study

- Milk made from soybeans saw annual sales grow by half on average between 2016 and 18, according to a report by consultancy Bain & Company

What do soy milk, electric toothbrushes and hair conditioner have in common? They are among the biggest beneficiaries of China’s consumption upgrade, according to global consultancy Bain & Company.

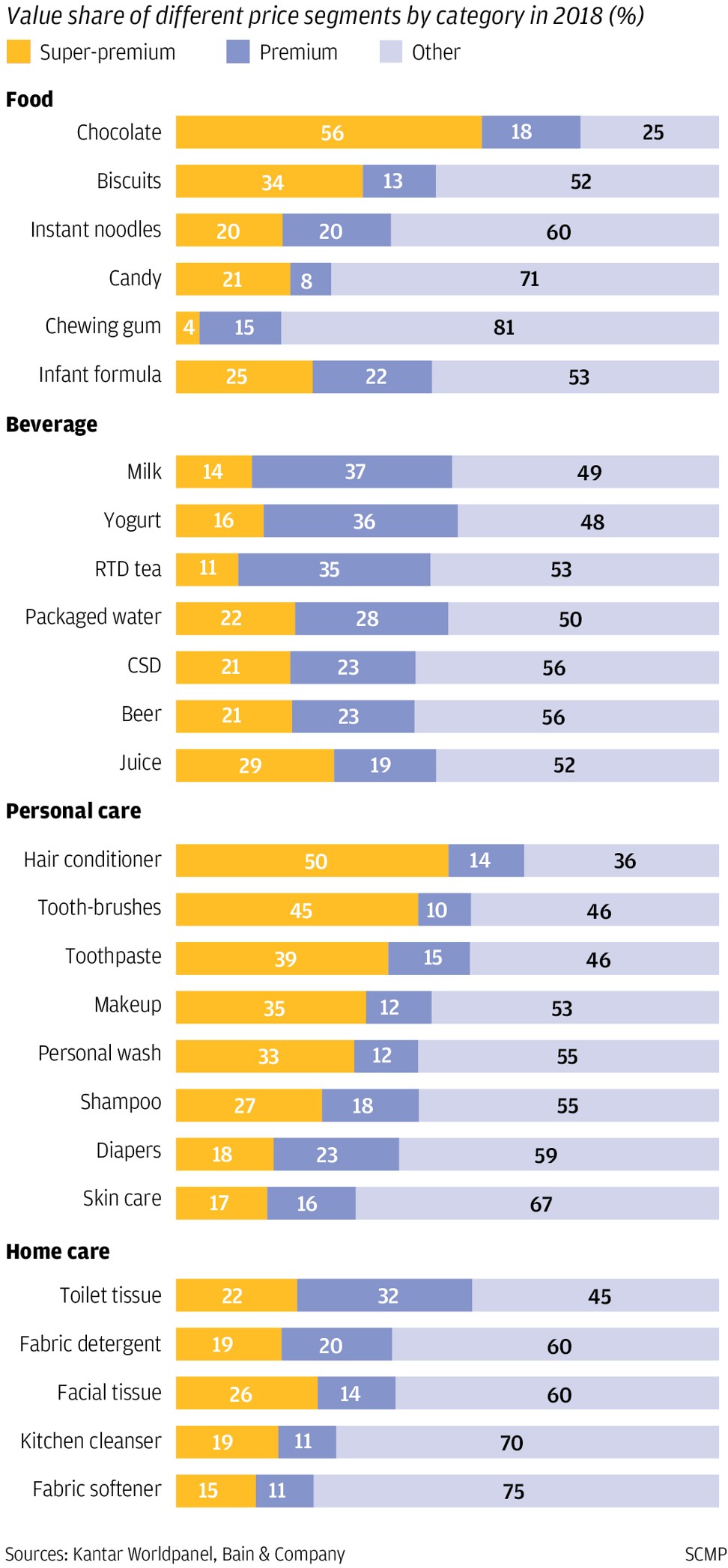

The shift in spending by China’s expanding middle class towards more expensive, premium goods has led to a large increase in sales of these and other items, the firm said in a report based on research by Kanta Worldpanel China, which tracks of 40,000 Chinese households’ spending.

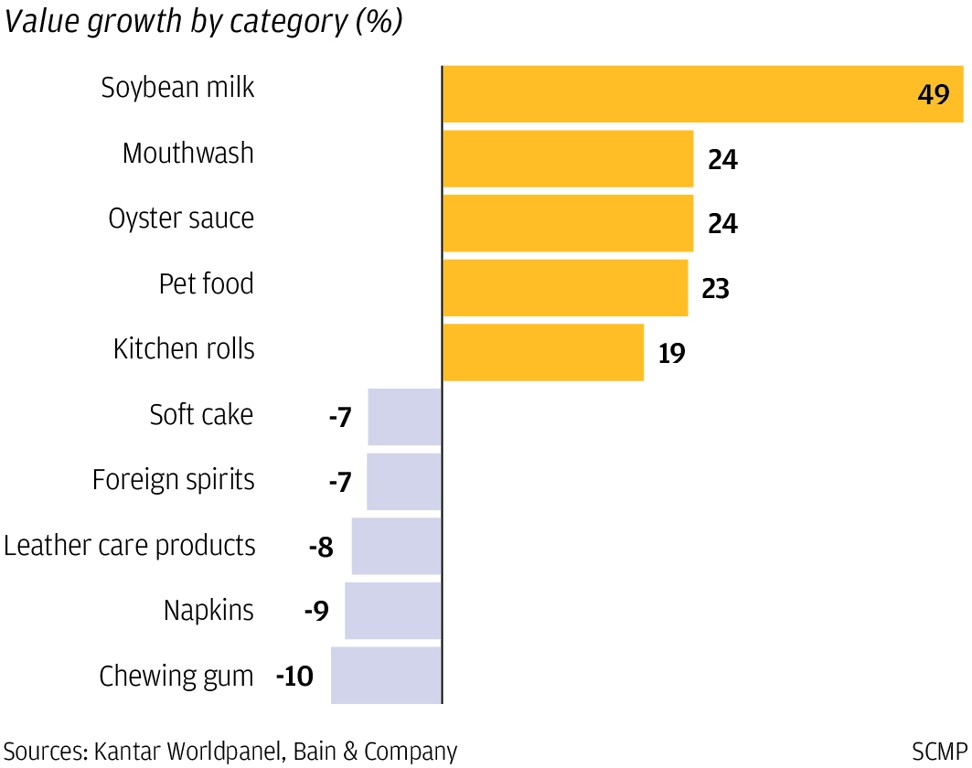

Soy milk, made from soybeans, as an alternative to traditional dairy milk topped all 20 goods monitored, with annual sales growing by half on average between 2016 and 18. This was driven by a 28 per cent rise in the volume sold and a 17 per cent increase in the average price.

“Toothbrushes’ typical price is less than 10 yuan each. But an electric toothbrush can be sold for a few hundred, or even a thousand yuan, which contributed to 60 per cent of the sales,” said Jason Yu, managing director of Kanta Worldpanel Greater China.

“Soybean milk started in China with just 30 per cent market penetration, but is growing fast because of a surge of new varieties with the ideas of ‘additive-free’ and ‘organic’, and the influx of foreign brands. Chinese consumers traditionally believe dairy milk is more nutritious but they are told plant-based milk is ‘healthy’.”

Chinese consumers will soon shop at home for half their luxury goods, says HSBC

The sales value of fast-moving consumer goods, including packaged food, beverages, personal care and home care items, grew 5.2 per cent in 2018, slightly higher than the 4.7 per cent gain in 2017. The increase was driven mainly by the 4.6 per cent growth in average selling prices, the report said.

In categories like cake and napkins, for example, volume declined by 9 and 17 per cent respectively but were offset by 3 and 10 per cent rises in price.

Fujian Dali Group and Hong Kong-based Vitasoy are among the major players in the soy milk market, while Oral-B and Philips Sonicare are the most recognised electric toothbrush brands in China.

Because electric toothbrushes are more likely to be marketed online than off, toothbrushes sold online are overall 89 per cent more expensive on average, with online promotions contributing 46 per cent to their total sales. This is followed by hair conditioner, which is 50 per cent more expensive online and e-commerce promotion drove 40 per cent of the sale.

Understanding the different consumption patterns between China and the West is the key for foreign brands seeking to crack the market with lower costs.

“In the US, consumers are more exposed to higher-end consumer products with plenty of established retailers, while in China such physical retailers are less developed and consumers’ demands are mainly met by online channels. This presents the most cost-effective way for foreign brands to expand quickly in China,” said Derek Deng, a partner with Bain.