US industry revival aids shippers as fewer empty containers cross Pacific

An increase in exports over the long run will reduce the number of empty containers shipped back to China but US trade gap remains wide

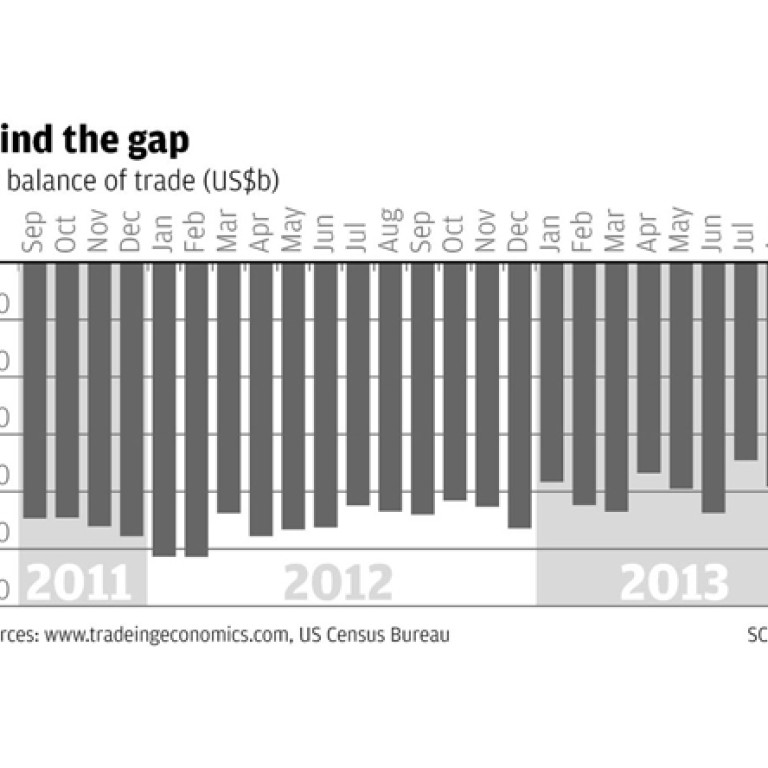

Shipping lines hope the return of manufacturing to the United States will correct the imbalance of cargo on vessels plying transpacific trade lanes, but the prospect remains distant with the US trade deficit remaining wide.

Hsieh said industries returning to the US would increase supply for domestic consumption and slow the growth of US imports in the short term. That would boost imports in the long run in tandem with a rise in exports.

Moreover, declining oil imports would reduce the US trade deficit, increasing the value of the US dollar and stimulating domestic consumption.

US exports rose 6.2 per cent last year, hitting a record US$110 billion following President Barack Obama's call for American companies to double their overseas sales in the five years to 2014. However, shipping lines continued to find themselves moving large amounts of empty containers back to Asia after goods were unloaded in the US.

"Many shipping lines hate delivering goods to inland ports such as Kansas or Detroit because you don't get much cargo back to Asia," said Issac Fung of freight forwarder Topocean Consolidation Service, which focuses on transpacific trade. "That means the US importer always has to shoulder the cost of the return leg and that increases the burden."

Ever since the cost of land and wages began to rise in China in the beginning of 2010, the US has been trying to lure manufacturers back, and there has been some success.

Whirlpool, for example, decided to move its production line of hand mixers from China to Ohio in 2010. Carmakers and aircraft manufacturers like Airbus, BMW and Mercedes Benz have also said they would make billions of US dollars of investment to build production plants in the US.

Still, America's trade deficit with China topped US$30 billion for the first time in July after shrinking to its lowest level in four years, partly due to increases in oil imports and prices.

For the first seven months of the year, the US trade deficit fell 15 per cent year on year to US$280 billion. While a trend was forming, Fung said most freight forwarders believed it would take many more years before the US could attain a more balanced trade relationship with China.

Hsieh said five major industries including machinery, computers and electronics, plastic and rubbers had already reached a tipping point. In those sectors, the total costs of producing in China will be on par with the US in 2015 after taking into account productivity rates and shipping fees.

That was also boosted by an increase in production of shale oil and shale gas, which reduced the cost and thus enhanced exports of petrochemical products. That helped reduce the US' reliance on net oil imports from 12.5 million barrels a day in 2005 to 6.8 million barrels in the first half of this year.