China’s antitrust regulator fines Ford’s Changan venture US$23.6 million for price violations amid worsening trade tensions with US

- Changan Ford’s penalty is the second since General Motors Corp was penalised 201 million yuan in 2016 for antitrust violations, seen as a warning shot to then President-elect Donald Trump

- China’s commerce ministry said last Friday that it was compiling a list of “unreliable” foreign businesses and individuals deemed to be hurting Chinese interests

China’s antitrust regulator slapped a US$23.6 million fine on Ford Motor Company’s Chinese venture for restricting sales prices in its hometown, taking the second such action against US carmakers in three years as trade tensions deteriorated between the world’s two largest economies.

Changan Ford Automobile, the 50:50 venture between Michigan-based Ford and Chongqing Changan Automobile, must pay a penalty of 162.8 million yuan (US$23.6 million) – equivalent to 4 per cent of the venture’s annual sales in Chongqing – for a business practice that restricted retail prices since 2013, according to a statement by the State Administration for Market Regulation.

The antitrust fine on Changan Ford is the latest salvo by China after the commerce ministry’s Friday announcement that it was compiling a list of “unreliable” foreign companies and individuals deemed to be hurting Chinese interests. While the ministry did not specify the consequences or provide additional details, the parameters were for entities that blocked or cut back supplies to Chinese companies for non-commercial purposes.

“It is not unusual that authorities uncovered wrongdoings by car companies to intervene into dealers’ selling prices,” said Tian Maowei, a sales manager at Yiyou Auto Service. “But the timing of fining a US carmaker now seems to have a connection with the trade tensions between the two countries.”

Relations between the US and China deteriorated since Trump took office, with tit-for-tat tariffs on each other’s products escalating into a full scale trade war that is spilling over into disputes over technology.

“If the US-China trade continues into the long term, it will accelerate the weakening of the US auto industry,” said Fu Bingfeng, executive vice-president of the China Association of Automobile Manufacturers, an industry guild, during a May 31 symposium on US-China trade relations. “I don’t want the US-China trade friction to continue. I hope the problems will be solved.”

The latest fine ticket followed China’s State Post Bureau’s revelation that it is investigating FedEx Corp. for “wrongful” deliveries after it received reports from Huawei Technologies that the courier redirected its deliveries to the US without its consent. FedEx apologised later for mis-routing, but insisted that no external parties requested it to transfer these packages.

The string of Chinese actions have stirred fear among US firms as they can be casualties in the rising bilateral political tension. The US-China Business Council (USCBC), which represents about 200 American companies that do business in China, told Reuters that anxiety among its members was on the rise.

“At the moment many of our companies are wondering whether this is an attempt by the Chinese government to increase their potential leverage in the trade negotiations, or if it’s an actual effort to force companies into an unenviable position of choosing between the two markets,” said its vice-president of China operations, Jacob Parker.

“Changan Ford respects the decision taken” by the regulator, the carmaker said in a statement, adding that it has “taken corrective action in its regional sales management together with its dealers”.

“Changan Ford will continue to ensure its business activities contribute to a free and fair competitive environment,” said the carmaker.

Ford's 2018 sales in China declined 36.9 per cent to 752,243 units in a shrinking market, where overall sales declined 2.8 per cent in the first annual contraction since 1992.

The US carmaker was conducting a transformation in management structure and working on new models based on insights into mainland drivers’ demands to “turn the ship around,” Ford China’s chief executive Chen Anning said in April.

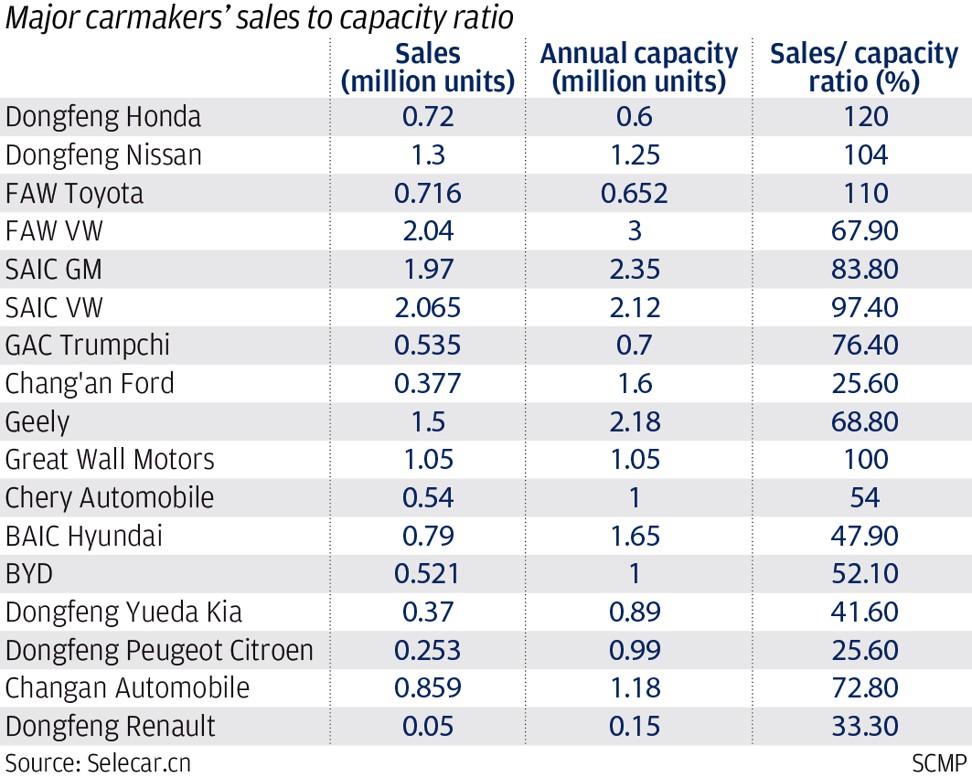

Changan Ford sold 36,800 vehicles in the first quarter, down 71.8 per cent from the same period last year, as China’s trade war with the US and the slowest economic growth pace in three decades deterred consumers from committing to big-ticket purchases.

“Many people ask me when China will start selling more cars to the US,” Fu said. “Actually, I don’t want to go to the US to sell cars, I want to open technology centres, and if the US-China trade relations normalise, I believe that all Chinese auto companies and parts companies will open tech centres in the US.”

Additional reporting by Keegan Elmer in Beijing