Credit Suisse sees trade tariffs as a temporary blip, expects Chinese equities to head up in second half

Chinese equities will resume growth in the second half as they will be supported by strong corporate earnings, reasonable valuations and proactive government measures, according to Credit Suisse after stocks hit two-year lows amid escalating trade friction between the US and China.

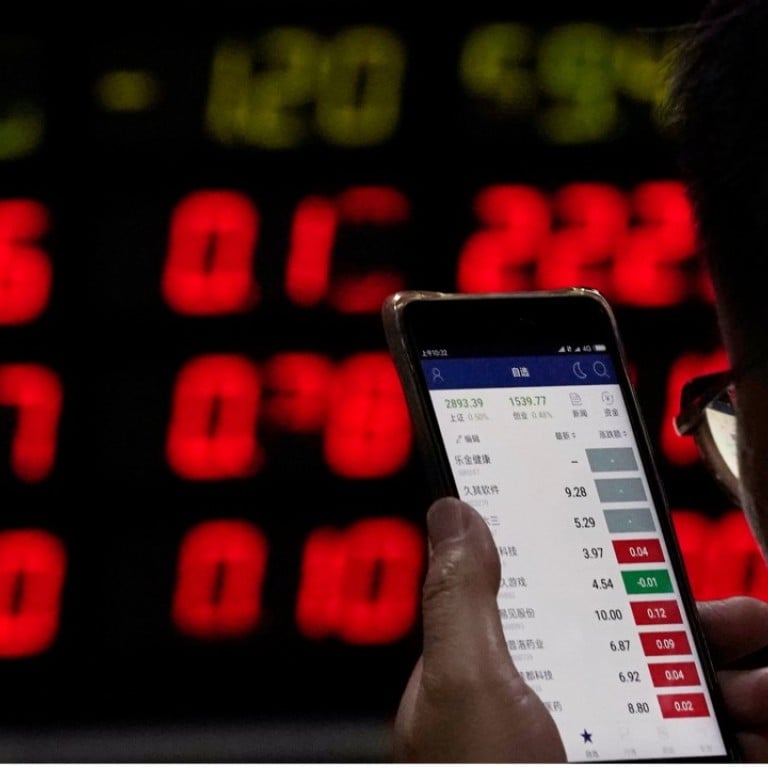

US President Donald Trump earlier this week threatened to impose tariffs on another US$200 billion worth of Chinese goods, which affected trading sentiment and pulled the benchmark Shanghai Composite Index to a low of 2,872.16 on Wednesday morning – its worst intraday level since June 27, 2016. The market reversed losses in the afternoon and closed up 0.3 per cent at 2,915.73, ending a four-day sell-off.

The impact of the tariffs on Chinese companies is expected to be muted because the economy is now less reliant on exports than it has been in the past.

Yi Gang, governor of the People’s Bank of China, said in a statement on the central bank’s website on Tuesday, that China’s reliance on exports was only 33 per cent last year versus 64 per cent in 2006, giving it more room to manoeuvre as trade frictions continue to simmer.

“The trade war will have a limited impact on the Chinese market as the tariffs will only affect one to two per cent of Chinese companies’ corporate earnings because they make most of their profits from the domestic market,” said Jack Siu, senior investment strategist for Asia-Pacific at Credit Suisse, said at a press conference to announce the bank’s global outlook for the second half of 2018, on Wednesday.

Even UBS Group said the current tariff plan will have limited affect on corporate earnings, probably chipping away between 0.6 and 1.6 percentage points from earnings growth for non-financial listed Chinese companies.

Siu said that even though the A-share market saw low trading volumes despite the MSCI inclusion in the first half and suffered from the trade tension, the setback would not last long.

He added that the PBOC will adopt more accommodative policies to prop up the market in the event of rising volatility, including injecting more capital to improve liquidity and possibly even cut the reserve requirement ratio by the end of August.

The bank’s outlook for Chinese equities remains robust with consensus expectations indicating 17 per cent earnings per share growth in 2018, the highest in seven years.

In terms of sectors, Siu is upbeat on energy, financial, IT sectors, together with emerging market banks and Chinese domestic lenders in the second half.