Beijing may extend these three policy ‘gifts’ as part of handover anniversary celebrations, analysts say

A number of favourable policies could be announced in the coming days, in accordance with a tradition since 2003 that has seen Beijing unveil administrative measures around the July 1st handover anniversary that are designed to help boost Hong Kong’s economy.

Analysts expect an emphasis on the planned Palace Museum, the Hong Kong-Shenzhen Tech Park, and the role of Hong Kong as an international financing centre in China’s “Belt and Road” initiative.

“It is customary for the central government to announce some favourable policies for Hong Kong around this time every year,” said Vincent Chan and Hu Shen, analysts at Credit Suisse, in a recent research note.

In 2003, when Hong Kong’s retail and property sectors were heavily hit by the Sars outbreak, Hong Kong received a big “gift” from Beijing — Closer Economic Partnership Arrangement (Cepa), the first free trade agreement between the mainland and Hong Kong.

During the same year, Beijing launched the individual visit scheme (IVS) to allow residents from 49 Chinese cities to visit Hong Kong on an independent travel permits rather than as members of tour groups. The move was seen as a great boost to Hong Kong’s tourism and retail industries.

Since 2003, the Chinese government has extended the Cepa policy framework with supplemental measures each year.

In 2005, mainland China surpassed the US as Hong Kong’s top export destination.

Separately, in 2011, the Chinese government issued 20 billion yuan worth of government bonds in Hong Kong. It also encouraged non-financial institutions from mainland China to issue yuan-denominated bonds in Hong Kong.

In 2014, the landmark Shanghai-Hong Kong Stock Connect kicked off, allowing international individual and institutional investors to access Shanghai-listed stocks through Hong Kong for the first time. Mainland retail investors could also trade Hong Kong stocks through the southbound mechanism of the scheme.

Last year, the launch of the Shenzhen-Hong Kong Stock Connect granted investors further access to the tech-heavy Shenzhen Stock Exchange.

Analysts said China was likely to accelerate policies already under discussion.

Looking at the history of favourable policies, Chan found three patterns. Firstly, anniversaries that recur every five years do not guarantee big policy announcements.

“Quinquennial anniversaries are not promises of potent measures,” Chan said. “Instead, they usually come in the case of a strong consensus between the central government and Hong Kong, or a mature arrangement after long-term discussions.”

Secondly, Chan found that major measures were often revealed in ordinary years, such as the individual visit scheme, or after studied arrangement, like Cepa, which had been under negotiation for one and a half years.

Lastly, the most meaningful supportive measures were related to capital-account opening and the establishment of an offshore renminbi trading hub in Hong Kong.

“It’s now more difficult to find policies that will be universally welcomed,” Chan said.

The planned Hong Kong Palace Museum, which will exhibit artefacts from Beijing’s Palace Museum, was first announced in late 2016 and hailed by Hong Kong Chief Executive Leung Chun-ying as a “great gift” to celebrate the 20th anniversary of Hong Kong’s return to China.

“As the only Palace Museum outside of Beijing and Taipei, the one to be established in Hong Kong will hence honour Hong Kong from the central government’s perspective,” Chan said. “It will carry a lot of political meaning.”

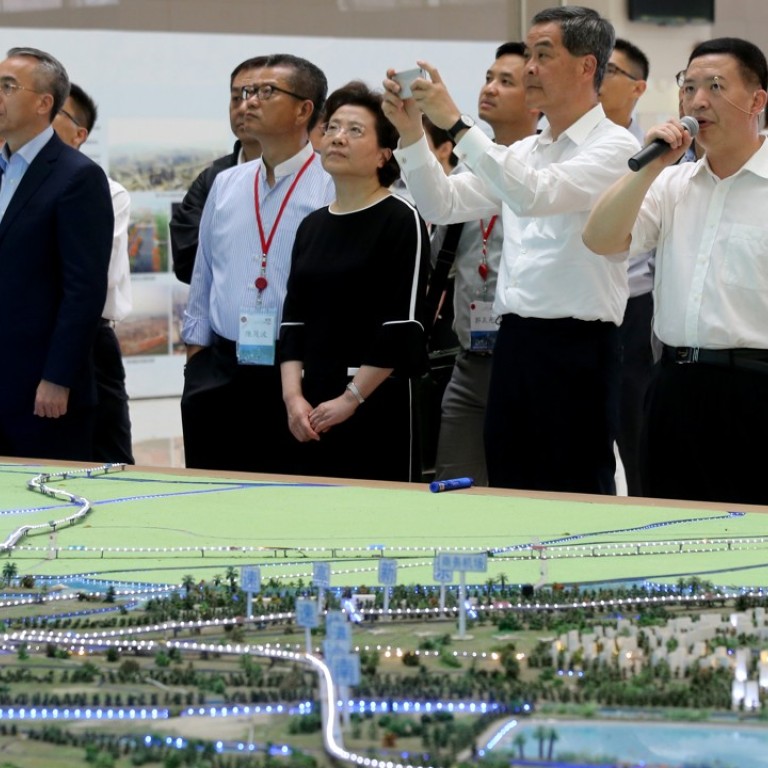

In January this year, Hong Kong and Shenzhen signed a deal to jointly develop an innovation and technology park at the border between the two cities.

The Hong Kong-Shenzhen Tech Park is intended to encourage foreign companies to set up research and development centres in China and could position Hong Kong as an international hi-tech research centre, Chan said.

Investors should also expect favourable policies related to Hong Kong’s role as an international centre in China’s belt and road initiative, China’s ambitious development strategy to boost economic co-operation among countries covering Asia, Europe and Africa.

“The most important role for Hong Kong in the initiative is probably as a financing centre,” Chan said.

Chen Guo, an analyst with Essence Securities, said Beijing will likely unveil favourable policies in relation to the Greater Bay Area Initiative.

The initiative, introduced by Premier Li Keqiang in March, is designed to create a super city cluster and increase connectivity between the mainland and Hong Kong.

Chen expected possible measures to include allowing more Hong Kong firms to set up or expand in the Qianhai free trade economic zone in Shenzhen.