FII conference: world’s ‘economic centre of gravity is moving towards Asia,’ says Hong Kong tycoon Victor Fung

- Shifting geopolitics and Asia’s ascent are driving regional economies to collaborate more, business leaders hear

- ‘Asia will represent a bigger proportion of the world as we go forward,’ HXEX boss Aguzin tells forum

“Asia will represent a bigger proportion of the world as we go forward, and that creates an environment where people need to recalibrate their portfolios and think about how they invest in the context of geopolitics.”

Themed “Megatrends Shaping Humanity” and held in partnership with the city’s government and bourse operator Hong Kong Exchanges and Clearing (HKEX), the conference comes as Saudi Arabia and China forge closer ties that are likely to shape global transformation.

“We’re seeing not just connectivity outside Asia, but inside Asia is intertwining, getting closer and closer together,” said David Liao, co-chief executive of HSBC Asia-Pacific, during the same panel discussion.

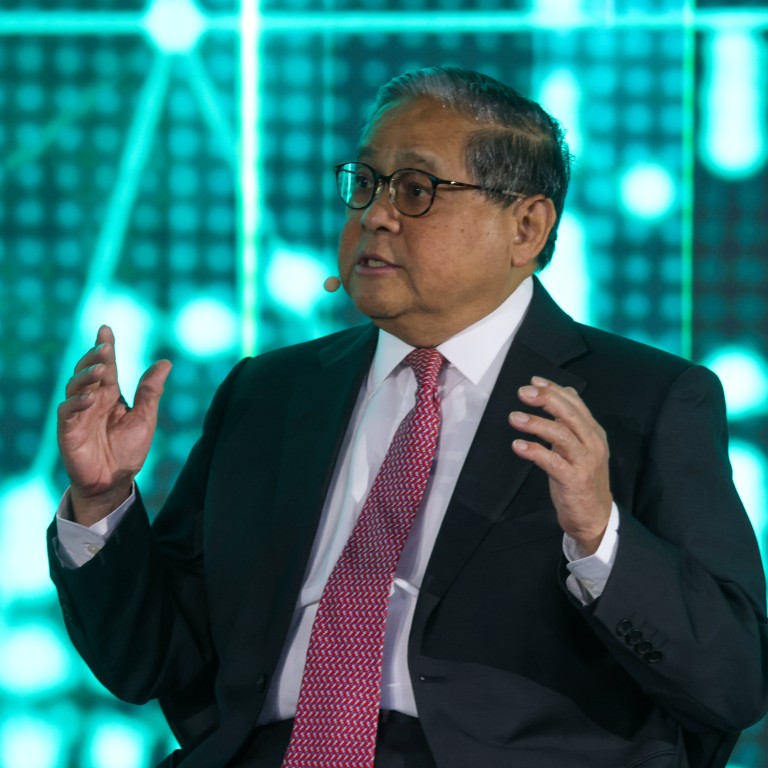

“The economic centre of gravity of the world is moving towards Asia,” and an inclusive, open regionalism is going to enable its continued growth, said Victor Fung, chairman of the Fung Group, a Hong Kong-based multinational conglomerate.

“Hong Kong is dealing [with] orchestrating global supply chains, especially in this region. We are an international finance centre,” Fung said. “We’re actually the centre for Asia, [and that should] help close the trade finance gap.

“I think that is really something that we can very practically work on given Hong Kong’s nature and leadership.”

The summit sees the continuation of conversations that took place at FII7 in Riyadh in October, seeking workable solutions to unlocking environmental, social and governance (ESG) flows to the Global South – a term that loosely refers to poorer, less developed countries – driving global alignment on AI regulation, and investment for more equitable access to education and healthcare.

Participants at the event include Hong Kong tycoon Ronnie Chan, founder of Hang Lung Capital, Goldman Sachs’ Asia-Pacific president Kevin Sneader, Sequoia China’s Neil Shen and Fang Fenglei, the founder and chairman of Hopu Investment Management.