China’s crackdown on high-flying finance executives sends jitters across brokerage industry

- Executives in the China’s top brokerages have taken massive pay cuts after the finance sector came under scrutiny from regulators

- The Communist Party’s top disciplinary watchdog warned that pay in the finance sector was higher than other industries and asked executives to maintain a low profile

When a Chinese woman flaunted her banker husband’s 80,000 yuan (US$11,562) a month salary on social media last year, she quickly drew the ire of common folk and the attention of regulators towards financial elites like her spouse.

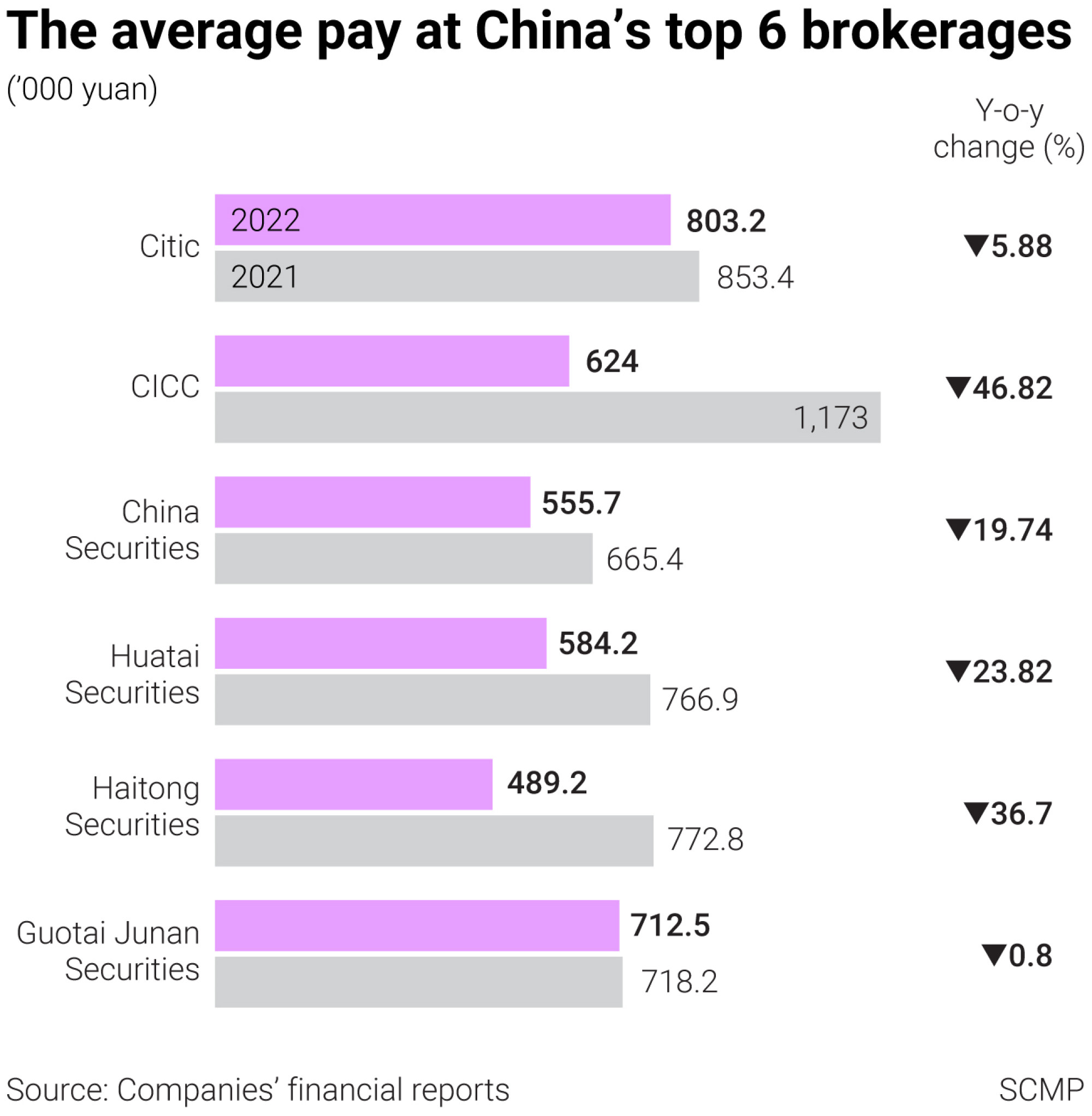

The young CICC banker and his colleagues soon paid a heavy price for the folly, taking a pay cut of almost 50 per cent. This quickly spread across the sector, with employees taking pay cuts of some 20 per cent to 30 per cent last year, according to data compiled by the Post.

“Many departments saw a pay cut or pay freeze,” said an employee of Citic Securities, China’s largest brokerage company, who did not want to be named. “People feel that we earn much more than average, and the tone became quite vicious after the CICC social-media incident.”

“Now the core message is to cut costs wherever we can, from allowances to salaries to travel benefits,” the employee said, adding the brokerage’s parent, Citic Group, has instructed staff to only fly economy class for travel times of less than five hours, while cutting or even denying staff bonuses for the last financial year.

This comes after Citic Securities cut staff remunerations last year, paying its 35 executives and directors 104 million yuan, compared with 166.5 million yuan for 28 individuals the previous year. The brokerage’s staff on the whole took a pay cut of 6 per cent on average.

China’s regulator to look into brokers’ financing needs after Huatai share plan

Staff at Haitong Securities took a 36.7 per cent cut to their pay cheque on average. Some dissatisfied employees recently resigned on top of a few lay-offs, an employee told the Post.

“The only good thing about working at an investment bank is the attractive remuneration package” the employee said, requesting anonymity. “If that is gone, then what’s the point? Bankers won’t see a return to the glory days even if the market recovers because the sector is now under scrutiny.”

CICC, Citic Securities and Haitong Securities did not respond to the Post’s requests for comment.

The pay cuts in the financial industry were partly the result of Chinese President Xi Jinping’s push for “common prosperity”, said Frank Xie, a marketing professor at the School of Business Administration at the University of South Carolina Aiken.

“Dissatisfaction from the masses over exorbitantly high salaries and affluent fringe benefits such as sumptuous work lunches for those gold-collar employees fuelled the hostility and distrust between the government workers and the public,” he said.

Beijing’s anti-corruption drive has netted a host of government officials. Hao Gang, a former deputy director of Beijing city’s financial regulator, was the latest to be put under investigation on Thursday.

Since Xi’s new cabinet took power in mid-March, at least 12 financial executives or regulatory officials have been investigated. These include former chairman of Bank of China Liu Liange, former chairman of China Everbright Group Li Xiaopeng, and others from China Investment Corp and China Development Bank.

The regulatory moves reinforced market speculation that even high-ranking cadres were not safe from investigation.

State-owned brokerages, especially those that have a higher salary level, will have to “bear more social responsibilities and wider pay cuts”, said Wang Chen, a partner at Xufunds Investment Management in Shanghai.

“Next we should see their salary return to a reasonable level accepted by the market and linked to their performance.”

China Merchants Securities told investors on April 6 that rationale behind their salary system was simple: when the profit goes up, salary goes up; when the profit goes down, the salary goes down.

Last year, net income plunged some 28 per cent at China’s top 10 brokerages by market cap. Underperforming initial public offering (IPO) and equity markets in Hong Kong and mainland China due to soft economic growth weighed on the financial sector, hurting the bottom line of brokers and money managers.

Both the Hang Seng Index and the Shanghai Composite Index lost at least 15 per cent in 2022. Fundraising in Hong Kong slumped by 70.5 per cent year on year to US$12.69 billion, the lowest since 2012, data from Refinitiv showed.

This was compounded by a long list of defaults by China’s junk bond issuers that worried the fixed-income market.

“Financial professionals could see further pay cuts this year as the Chinese economy continues the nosedive,” Professor Xie said, adding that the tech sector could also see a slowdown in IPOs due to large-scale lay-offs at home and blockade enforced by the US.

The ongoing crackdown on the financial sector will also lead to a loss of talent to Hong Kong, Taiwan, and Singapore, he warned.

Hong Kong’s Bright Smart suspends mainland Chinese clients’ accounts

However, Xufunds’ Wang believes the impact of the crackdown will be limited.

“Despite the pay cuts, it is still an industry that pays better than average,” he said. “A performance-based salary system won’t have a substantial impact on drawing talent to this industry as long as there is a reasonable remuneration policy and enough incentives.”

Looking ahead, he said China’s ongoing economic recovery after the Covid-19 pandemic should revive IPO activity and lead to higher market turnover.

“Brokers’ profits should grow amid such stability,” Wang said. “This won’t be a bad year.”