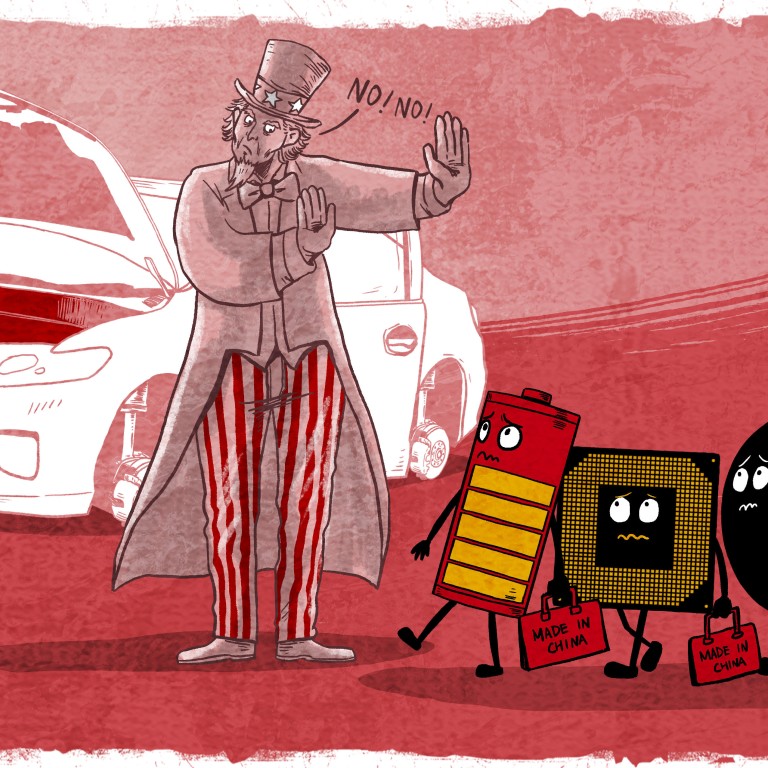

Electric vehicles: why the West needs China’s battery prowess as it moves to build supply-chain capacity

- The process of deglobalisation for Western battery producers is likely to be lengthy and turbulent, with challenges at each stage of the supply chain, says analyst

- It will be interesting to see how Chinese players and global carmakers balance need for supply-chain security with geopolitical risks, says Fitch executive

At the Shanghai Auto Show, Fuzhou Lianhong Motor Parts’ sales director Chen Zhiqiang performs the final tests on the eight-way movements of his company’s flagship car seat before clearing it for display.

Chen, exhibiting his company’s products for the third time, is betting on white-hot competition in China’s electric vehicle (EV) industry to push more carmakers to reach for Lianhong’s catalogue, as they increasingly market their vehicles as smart cars.

“Chinese automotive firms are leading the development of the global industry,” said Chen, whose 184 sq ft exhibition space is squeezed between ride-hailing giant DiDi Global and state-owned China non-ferrous Metals (Tianjin) New Material Technology.

“Our seats are of a better quality and are cheaper, [so] we deserve more orders.”

Lianhong, founded in the Fujian provincial capital almost three decades ago, is one of the thousands of vendors and suppliers that are exhibiting at the marquee trade fair in the world’s largest vehicle market.

Chinese vendors already supply almost half of the world’s vehicle parts, selling US$710 billion out of the US$1.51 trillion worldwide total in 2021, according to a February report by Beijing-based Insight and Info Consulting.

China dominates the EV supply chain as more than three-quarters of the world’s production capacity for batteries – they make up 40 per cent of a typical EV’s sticker price – is in the country, with Contemporary Amperex Technology Limited (CATL) and BYD among the world’s top three producers.

The country also controls more than two-thirds of the components needed to make them – an advantage the United States, the European Union, Japan, South Korea and Indonesia are desperately trying to chip away at through protective legislation, subsidies and research.

Mike Gallagher, the Republican House representative for the state of Wisconsin and chair of the House Select Committee on the Chinese Communist Party, said Tesla’s investment in China “seems very concerning”.

“I would just be curious to know how Elon Musk balances” the US government’s “largesse via tax breaks” for his Space X endeavour with “access to the Chinese market and the deals [Tesla] strikes” in China, the Congressman said in an emailed reply to queries by the Post.

China’s supply chain is a hard habit to break, analysts said, as international carmakers need the country’s low-cost batteries to be competitive in the global market, which is expected to quadruple to US$693.70 billion by 2030 from last year’s US$193.55 billion.

The Chinese battery maker at the forefront of revolutionising EVs

“It’s a kind of dilemma [for US carmakers] at the moment,” said Yang Jing, director of Asia-Pacific corporate research at Fitch, the ratings agency.

“Previously, the US market did not pay a lot of attention to electric vehicles, [but now] they’re realising that China has this dominance over the whole supply chain.”

“If they just sell EVs without building their own supply chain, the dependence on Chinese companies will be very high,” Yang said.

On the other hand, if Chinese EV companies avoid the US market, “they will definitely lose market share globally”, Yang said.

“It will be interesting to see how Chinese players and global carmakers balance the need for supply-chain security with geopolitical risks.”

Tesla’s Megapack batteries facility, which is expected to churn out 10,000 Megapacks every year with 40 gigawatt hours of combined energy storage, marks a second watershed in the Texas carmaker’s presence in China.

China’s EV war: BYD, Nio, Xpeng snap at Tesla’s heels with made-for-China models

Although the Megapack is designed as a source of backup power for buildings, it shows that “every EV manufacturer is trying to have as much control over their cost curve as possible”, said BNP Paribas’ Asia-Pacific equity research head Manishi Raychaudhuri.

“BYD already manufactures its batteries, so Tesla is possibly trying to go in that direction.”

There are enough economic and strategic reasons for the US and the world to develop their own EV verticals. China is home to 76 per cent of global EV battery production capacity, while Fujian-based CATL alone controls a third of the entire global battery market.

China is also home to 70 per cent of the global production capacity for cathodes and 85 per cent for anodes, both key battery components, according to the International Energy Agency (IEA). Over half of the world’s lithium, cobalt and graphite processing and refining capacity is located in China.

Europe has over a quarter of global EV assembly, but is home to very little of the supply chain. The US has an even smaller role, with only 10 per cent of EV production and 7 per cent of battery capacity, according to the IEA’s July 2022 report.

The world – particularly the EU – recently saw how upheavals can break supply chains. The invasion of Ukraine by Russia, the biggest supplier of Class 1 battery-grade nickel, disrupted the upstream supply chain of minerals critical to the manufacture of power cells.

Nickel prices nearly tripled from about US$1,600 a tonne in January 2021 and peaked at about US$4,800 in June 2022, according to LME data. Lithium prices soared in response as well, surging sevenfold in May 2022 from early 2021.

China’s EV production has a cost advantage of 20 per cent compared with the West, said Nio’s co-founder and CEO William Li on Monday. That is because the complete supply chain lowers costs in logistics, labour and land.

The cost advantage translates to sticker prices. Tesla’s basic Model 3, made at its Shanghai Gigafactory, sells for 229,900 yuan (US$33,388), the cheapest price for the model worldwide. The entry-level Model 3 sells for US$41,990 in the US, and US$40,241 in Japan.

“The country’s [complete] supply chain benefits carmakers based in China,” said Nio’s Li. “But … from Day 1 when Nio was set up, we definitely looked to expand abroad.”

The US and EU want to change the status quo. In March 2021, US President Joe Biden proposed a US$174 billion plan to win the EV market. This plan included point-of-sale rebates and tax incentives, and a national network of half a million EV chargers by 2030.

The 2022 Inflation Reduction Act supports American EV producers by declaring vehicles made with components manufactured in “foreign entities of concern” – including China – to be ineligible for tax credits after 2024.

‘The advantages are obvious’: how China’s BYD became the world’s No 1 EV maker

The EU’s automotive industry provides 13 million jobs, 11.5 per cent of the bloc’s manufacturing manpower, according to the European Automobile Manufacturers Association.

“Simpler EVs with fewer moving parts, [without] internal combustion engines, threaten this,” said Graham Evans, director of supply chain and technology at S&P Global Commodity Insights.

“This led to the introduction of what may be deemed protectionist policies to secure local supply chains for EVs.”

The process of deglobalisation for Western battery producers may be a lengthy and turbulent one.

“Each stage of the supply chain will present its own challenges, particularly in maintaining sustainability and a low emission profile, which may not be the most cost-effective approach,” said Egor Prokhodtsev, senior research analyst at Wood Mackenzie.

South Korea, which accounts for 5 per cent of global production capacity, and Japan (4 per cent), recently launched large funding packages to bolster the competitiveness of their battery and EV industries.

If these policies, announcements and investments are realised, a quarter of battery production capacity will be located in Europe and the US by the end of this decade, IEA said.

Two-thirds of the 10 million EVs sold worldwide last year were in China, helped by a slew of government policies dating back to 2009 that include subsidies, tax breaks and procurement contracts.

The global market share will be more balanced by 2035, where China’s share will fall to about a third, while Europe makes up 28 per cent and the US increases to 25 per cent, Moody’s said on April 11.

In the near term, with manufacturing technology predominantly limited to Chinese firms barring one or two companies in the US, it is difficult to see how the reliance on China will be circumvented, said BNP’s Raychaudhuri.

Chinese EV battery suppliers have proactively adapted to the changing global market by focusing on technological breakthroughs, diversifying their customer bases and strengthening international partnerships.

Ford Motor announced a plan in February to cooperate with CATL on a US$3.5 billion EV battery factory in Michigan.

Unlike typical ventures Ford will own the plant outright and produce CATL’s low-cost lithium ferrous phosphate battery under licence. This structure could make Ford eligible to receive benefits from the Inflation Reduction Act.

“If this proceeds well, [it would be] remarkable for both parties and impactful for the businesses,” Fitch’s Yang said.

Chinese EV battery makers out to prove they can go the distance

China has also made breakthroughs and strides in other vehicle components, said Yuan Feng, general manager of GAC Capital, the investment arm of the Chinese carmaker GAC.

“The EV market will depend on intelligent systems, with many Chinese companies such as artificial-intelligence [AI] chip maker Horizon Robotics representing the country in the global supply chain,” Yuan said last month in Guangzhou.

Horizon, founded in Beijing in 2015, provides energy-efficient computing solutions for advanced driver assistance and autonomous driving systems for GAC, BYD, Audi, Continental, Li Auto and SAIC Motor.

SenseTime, China’s largest AI firm, which is backed by the Post’s owner Alibaba Group Holding, already counts more than 30 carmakers as customers of its SenseAuto Cabin and SenseAuto Pilot solutions in more than 80 models.

“We spend a lot of time making sure that we offer a combination of the best of performance, the best of quality and very affordable pricing,” David Li Yifan, the co-founder and CEO of Shanghai-based Hesai told the Post.

“The entire automotive industry is built upon the concept of sharing supplies, so I will be surprised if – in the end – the world is dominated by one or two suppliers.”

Additional reporting by Martin Choi and Iris Deng