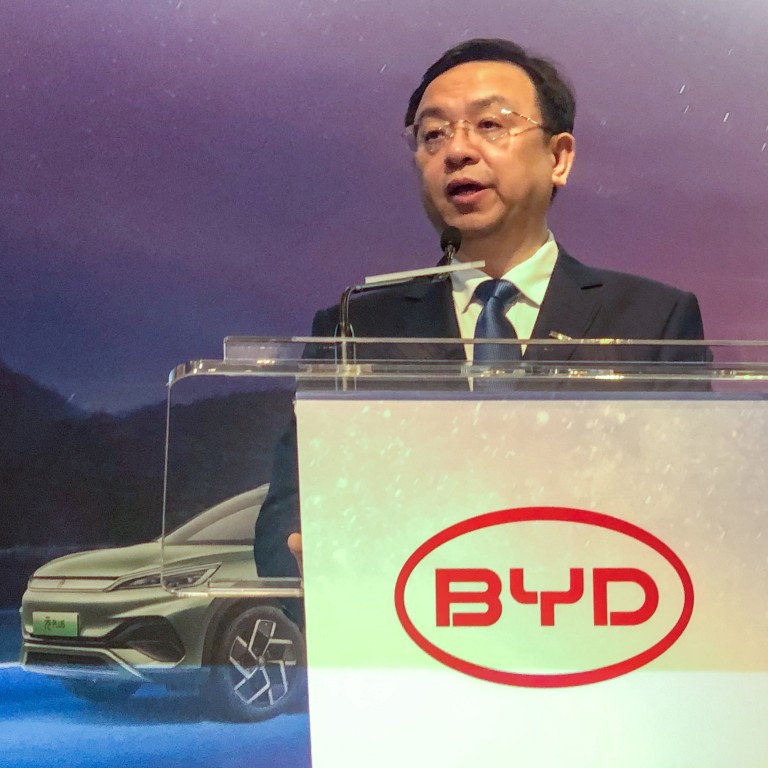

Chinese EV market in consolidation stage, BYD chief says, with some players being knocked out, others grabbing bigger slice of the pie

- A price war was inevitable, as the supply of EVs in China is bigger than demand, BYD founder Wang Chuanfu says

- BYD’s EV sales to rise by more than 80 per cent year on year in the first quarter of 2023

“We have maintained strong growth and we will try to maintain our price tags and profit margins [amid the price war],” Wang said, highlighting that BYD’s brand and scale gave it an edge over its peers.

BYD bets nearly US$1 billion on EV battery plant despite concerns of oversupply

Most of BYD’s vehicles are priced below 200,000 yuan (US$29,054), compared with about 300,000 yuan for so-called smart EVs. The sales of its pure electric and plug-in hybrid cars started to climb in the second quarter of last year, as more middle-class consumers in China drifted towards cheaper models assembled by the likes of BYD and moved away from premium cars built by Tesla and its mainland Chinese rivals such as Xpeng, Li Auto and Nio.

BYD ended up more than tripling its 2022 sales to 1.86 million cars. And not only were its sales the highest among EV makers in China, they also helped it dethrone Tesla as the world’s largest EV firm.

Tesla delivered about 1.31 million EVs globally last year. While that total was up about 40 per cent from 2021, the US carmaker failed to reach its 2022 goal of delivering more than 1.4 million units.

The development of EVs will lead to a reshuffle in the global automobiles industry, Wang said, and the trend of switching from petrol-powered cars to EVs is inevitable.

BYD has been expanding its footprint beyond China over the past few years, but the company currently has no plans of tapping the US passenger car market, Wang said. “Global demand is booming, and we currently only export to Europe, Southeast Asia and South America.”

BYD launches four EVs in Jordan, eyes further expansion in Middle East

“Whether we can have the last laugh, it is hard to say,” he added.

“But BYD is confident that we have a lot of advantages in the current round of electrification. Of course, we will need to work hard.”