Corporate China hit by worst earnings on record in 2018, as trade war bites

- Losses related to goodwill soared to a record 166 billion yuan (US$24.65 billion) last year

- Technology among sectors worst hit, but construction materials, defence make gains

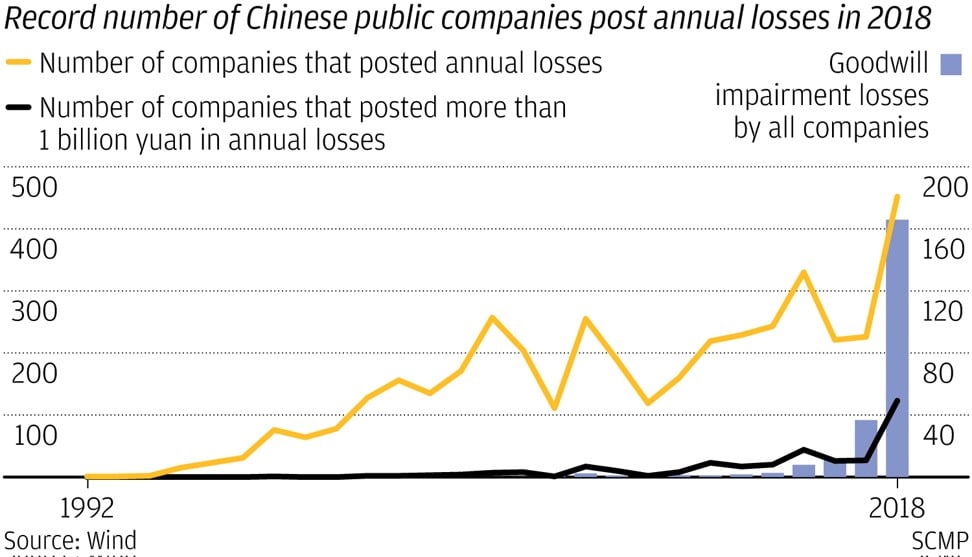

This is the worst annual earnings season ever for China’s corporate sector, with a record 452 out of 3,602 public companies incurring annual losses, as the effects of the year-long US-China trade war seep into corporate earnings.

By the end of April, the number of loss-making companies had doubled from 2017, while the proportion of such companies also hit an all-time high of 12.5 per cent, according to data provider Wind. The combined net profit of companies listed on the Shanghai and Shenzhen stock exchanges reached 3.383 trillion yuan (US$502 billion) for 2018, down 1.7 per cent from the previous year.

Losses related to goodwill – the intangible asset that arises when a company acquires another business – also soared to a record level of 166 billion yuan (US$24.65 billion), tripling the amount from the previous 11 years combined, at 871 companies. This is because a record number of companies that were ambitious and pushed up the goodwill value of acquired assets during the boom years, are now rushing to write down these values, as the trade war and a government deleveraging crackdown bite into their profitability and worsen their financial woes, according to analysts.

And the worst may not be over.

“We don’t know if it’s the bottom of corporate earnings yet, as the final result of the trade war is pending and the macroeconomy is still in a downward trend,” said Chen Xikai, an analyst with Shanghai-listed Industrial Securities.

“It also takes time for the intended effects of liquidity easing to reach the real economy. Don’t feel happy too soon about the short-term rebound,” he added.

Chinese banks to post slow profit growth for fifth straight year

The trade war has added to China’s slowest economic growth rate in three decades, hurting the bottom lines at more Chinese companies. This puts pressure on the government to ease the tax burden and pour in fiscal stimulus to keep businesses running and employment humming.

Zhao Guang, an analyst with Beijing-based Capital Securities, said investors should be cautious until an overall improvement in corporate earnings is achieved, as it takes time for stimulus measures to filter down.

“The turning point [in corporate earnings] could occur in the third quarter. It will support a comprehensive and solid rebound in the stock market. Still, before that happens, the possible launch of the Shanghai Technology Board around June might preheat the market,” he said.

The technology, media and telecoms (TMT) sector was worst hit. Profits declined by 140 per cent, as technology and telecoms companies bore the brunt of US export controls on a wide range of technologies and restrictions on Chinese imports.

ZTE, the world’s fourth-largest telecoms equipment maker, posted a record 6.98 billion yuan loss for 2018, due to a fine it paid to the US authorities for violating US sanctions against Iran and North Korea, and a brief ban on doing business with US companies.

China’s technology sector is heavily reliant on American technology, especially semiconductors.

Goodwill impairments were another drag on earnings, besides the trade war. Goodwill had soared 15-fold in the past decade, from 99.3 billion yuan in 2010 to 1.45 trillion yuan by last September. It rose more quickly during the boom years of mergers and acquisitions in 2014-15, as companies pushed up the values of acquired assets as capital in their books.

Things took a sharp turn for the worse in 2018.

Companies that overpaid for acquired assets faced significant writedowns, as an economic slowdown and the government’s deleveraging campaign bit into their profitability, and the government tightened accounting regulations, said Chen Letian, an analyst with BOC International.

TMT was the most acquisitive sector during the boom years, thus, it was hit hard. Dalian Zeus Entertainment, which has acquired 12 companies since its 2014 IPO, said it would write off 4.9 billion yuan in goodwill, three quarters of its total goodwill value, in its 2018 results.

China stocks fall as corporate earnings worsen amid economic slowdown

Macroeconomic risks, tightened regulation in the gaming sector and worsening competitive environment were the major reasons, it said.

Industrial conglomerates were the second-worst hit industry, with profit down 112 per cent from the previous year.

But not every company had been losing out.

The construction materials sector outshone all others, with 60 per cent growth in profit for 2018, according to Wind. Cement makers were the biggest stars, generating an all-time high of 154.6 billion yuan in profit, more than doubling from 2017. Anhui Conch Cement, the largest cement manufacturer in Asia, recorded a 88 per cent increase in profit.

The growth in profit was mainly down to rising cement prices, after the government’s supply-side reform to reduce excess capacity eliminated many smaller companies, leaving the bigger players to benefit, according to Li Huafeng, an analyst with Industrial Securities. Demand is also growing for building materials, as infrastructure investment has rebounded since last year.

Military enterprises were also booming, with the industry’s profit rising 20 per cent in 2018. China’s defence budget for 2019 increased by 82.9 billion yuan to 1.19 trillion yuan, an acceleration over the 62.6 billion yuan increase in 2018.

Analysts said they expected the sector to benefit from a relaxation in regulation by Beijing meant to spur private investment in defence and deepen reforms in state-owned enterprises.

“Mobilising private capital to develop advanced technologies for potential military use can help modernise the sector, ” said Shen Fancheng, an analyst with Shenzhen-listed China Great Wall Securities.

“Developing military technology with self-owned intellectual property rights has a particular significance against the backdrop of the US-China trade war,” he said, recommending that investors focus on Changsha Jingjia Microelectronics, which manufactures graphics chips for military use, and Shenzhen H&T Intelligent Control, which produces intelligent controller products.