Why China’s plan to launch the highly touted CDR scheme is still on hold

Tech firms’ unwillingness to accept certain terms related to the issuance of CDRs, a stock market rout and weakening yuan in the face of trade war with the US, has forced Beijing to indefinitely the launch plans on hold

It was meant to celebrate four decades of China’s embrace of capitalism.

But Beijing’s pet scheme to lure the country’s best tech companies listed in the US as part of capital market reforms has been indefinitely put on hold amid a stock market slump and negotiations with tech firms that remain deadlocked.

Sources at the securities regulator and tech firms involved in the negotiations said they were still working out issues related to the size and pricing of the Chinese depositary receipts (CDRs) – securities underlying the US-listed shares of Chinese companies. Other serious issues that remain to be sorted out include rules governing post-listing information disclosure, dividend payment, employee stock ownership plan and, most importantly, accounting standards.

“Initially it was agreed that they [the US-listed Chinese tech giants] would adjust their financial data from US GAAP to Chinese accounting standards for A-share disclosures,” said a senior official with the China Securities Regulatory Commission (CSRC), who did not want to be named as he was not authorised to reveal the details of the negotiations to the media. “But later there was an argument on how many items the readjustment should apply to, making it very hard to reach a consensus,” adding that there was “no longer a timetable” to kick off the scheme.

“The embarrassing fiasco of Xiaomi should remind all investors in China of the vagaries of the nation’s reforms,” said Fraser Howie, co-author of Red Capitalism: The Fragile Financial Foundations of China’s Extraordinary Rise.

The scheme was introduced for enhancing reform and opening up, but in practise it was going to be implemented in the same old way which prioritises administrative intervention over market-based selection, he said.

China’s CDR share plan to lure big tech firms back home may prove a hard sell to retail investors

“The CSRC needs to understand that the underlying disclosure, pricing and share structures for CDRs have to be fundamentally different from those for mainland IPOs. CDRs can work if the differences are embraced,” he said.

More importantly, the macro environment for pushing a CDR reform has turned from stable and favourable to volatile. Domestic stocks are at multi-year lows, a US -China trade war has started, the yuan has fallen significantly against the dollar and economic data has weakened.

“It is not an environment which would encourage the authorities to take risks with CDRs or other new products,” said Howie.

China’s stock market experienced its worst stock rout in the summer of 2015 since 1992, when a debt-fuelled bull run collapsed and wiped US$5 trillion in market value within a few weeks.

The market recovery has been slow, with the benchmark Shanghai Composite Index recovering to around 3,559.5 points in January this year.

The inclusion in June of 234 A shares by index compiler MSCI into its global and regional indices, including the MSCI Emerging Markets Index, briefly spurred stocks until the US-China trade negotiations failed and tensions quickly escalated.

China’s tech firms are getting dressed to issue depositary receipts, but where’s the party?

Shanghai stocks have fallen more than 20 per cent down – the definition of a bear market – from their highs in late January, almost erasing the gains of the past two years.

The pressure of additional duties on Chinese goods by Washington is also weighing on China’s currency, as offshore yuan hit a 11-month low of 6.7332 last Tuesday.

It is not an environment which would encourage the authorities to take risks with CDRs or other new products

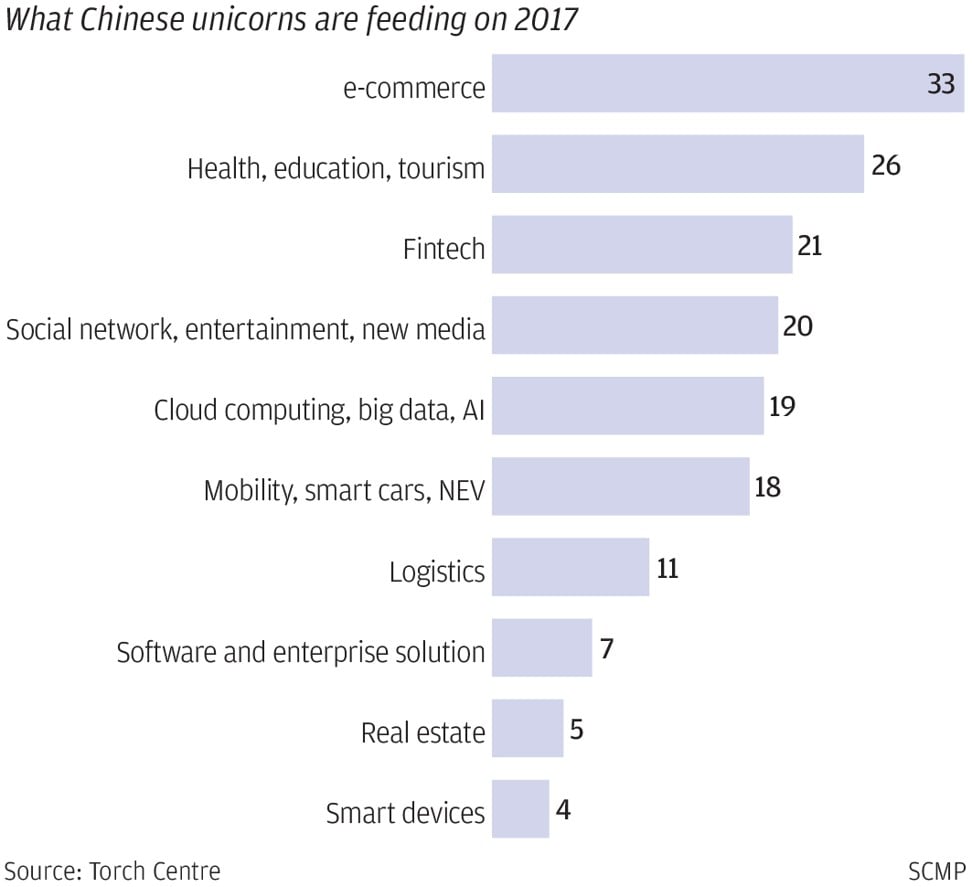

Besides echoing a call from the top leadership of upgrading China’s economy with the most advanced technology in big data, artificial intelligence, smart manufacturing and biotech, the CDR scheme was meant to celebrate four decades of communist China’s adoption of capitalist methods and reforms.

The government was also keen to showcase CDRs as a way for the country’s investors to partake in their largest – and most highly valued – corporate successes, said people familiar with the project.

The programme was modelled on the American depositary receipts (ADRs), first sold in the late 1920s for non-US domiciled companies to raise funds onshore. It was meant to lure back overseas listed tech giants and make them tradeable in mainland China.

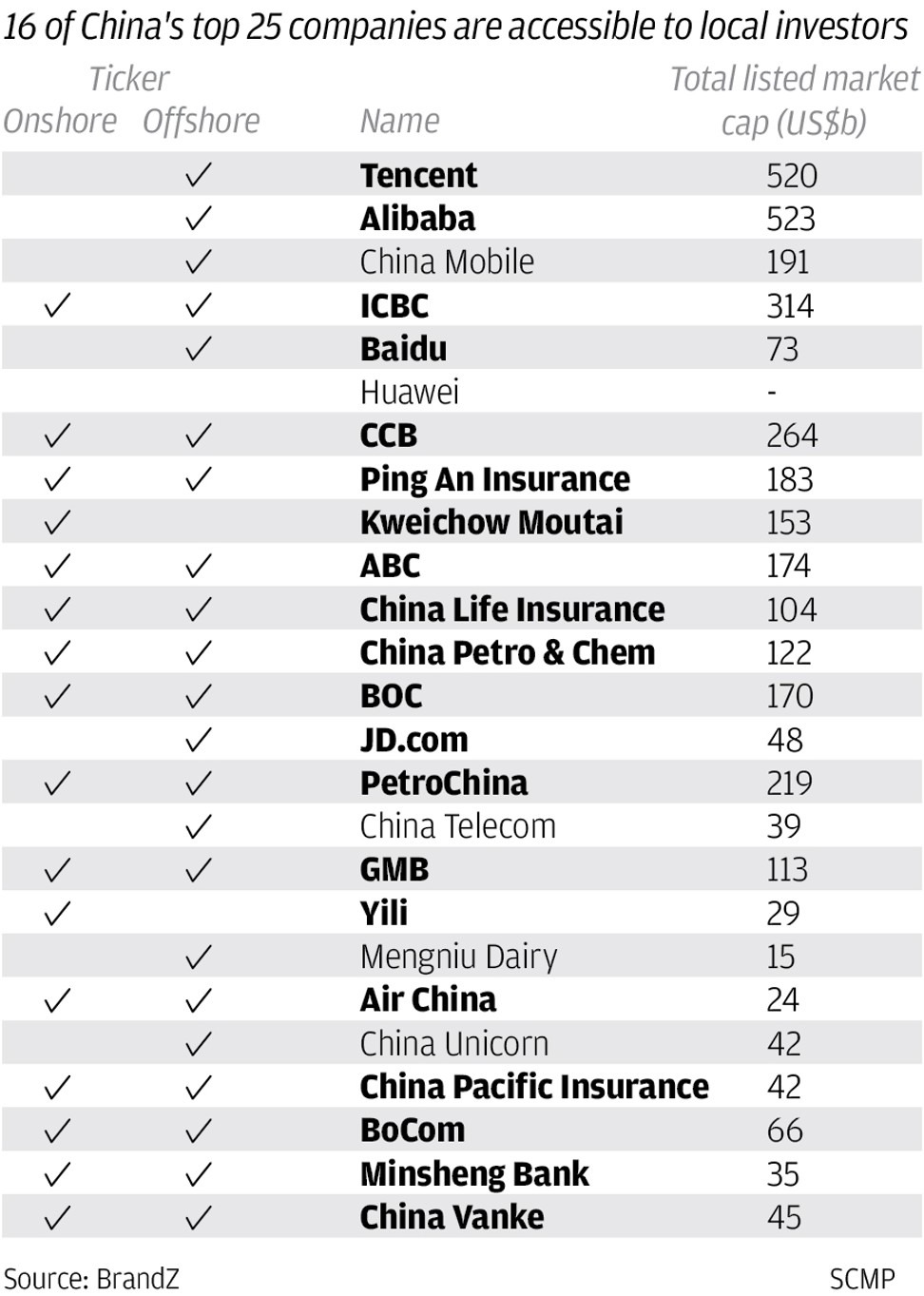

China has no dearth of tech heavyweights. But Chinese investors, who on a daily basis use the services of Alibaba Group Holding, Baidu or JD.com, have no means to invest in these companies even though they are the companies’ revenue base.

The market cap of Chinese tech firms listed offshore is nearly US$1.5 trillion, according to Bloomberg data.

Almost all the tech giants prefer to list overseas to avoid strict financial requirements and a notoriously slow and unpredictable process for listing in the domestic market.

Besides, China also does not accept initial public offering applications by variable interest entity (VIE) structured firms. VIE is a corporate structure used by most of China’s best tech firms to get around restrictions imposed by the authorities on foreign ownership in the internet service sector.

Xiaomi set to float Chinese shares in early July

Analysts from Goldman Sachs originally expected the first batch to include the country’s five biggest internet giants by market cap – Tencent Holdings, Alibaba, Baidu, JD.com and NetEase, together with Xiaomi to raise US$60 billion between them through CDRs, assuming each company would raise the equivalent of 5 per cent of its market value.

Alibaba is the owner of the South China Morning Post.