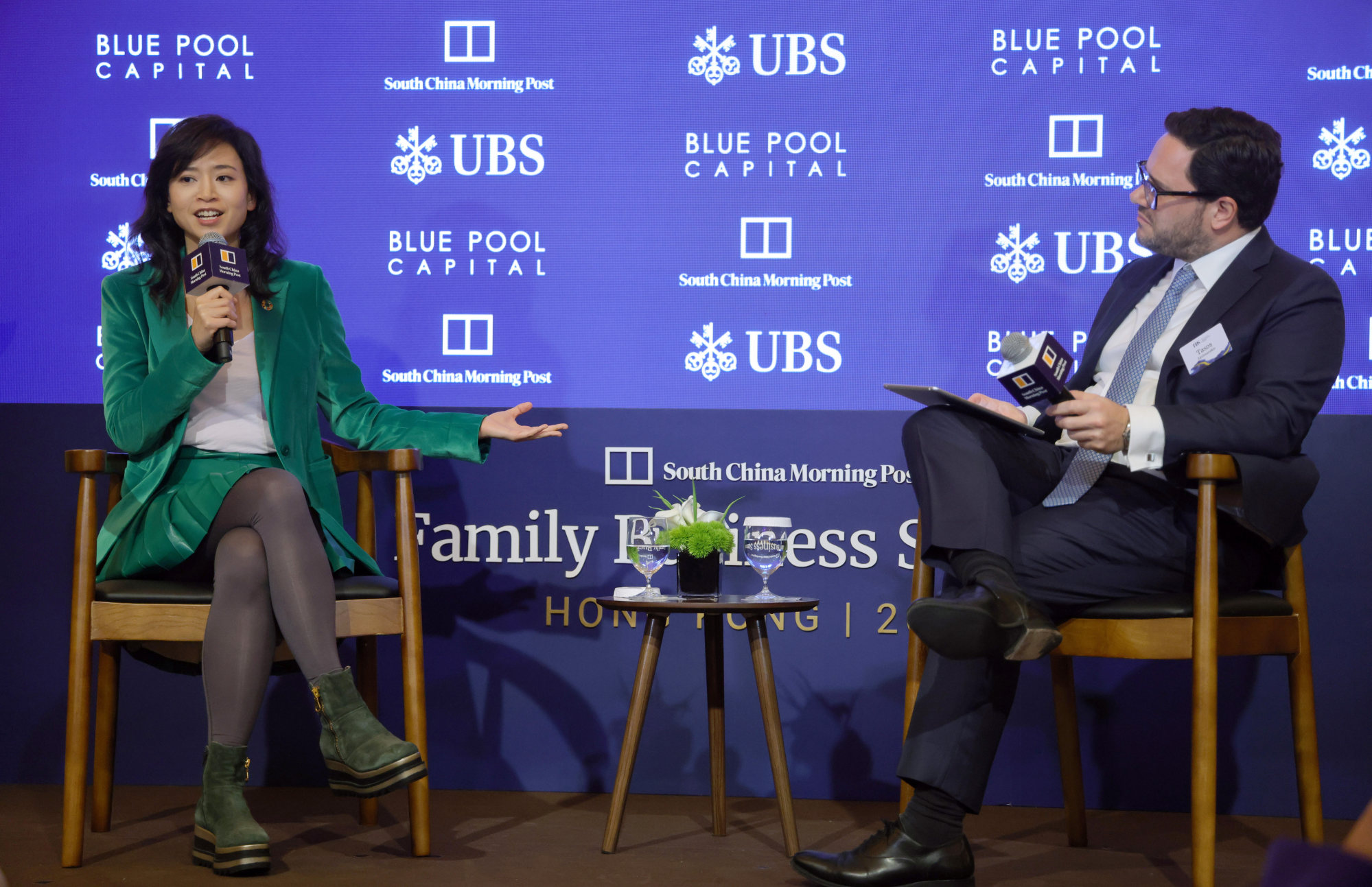

Family offices need to invest with purpose and values to secure future for next generation, Regal Hotels’ vice-chairman tells summit

- ‘In life the most important decisions, including marriage, are made with the heart. Investment decisions also,’ says Poman Lo at Family Business Summit

- Family offices have been increasingly trying to maximise the impact of their sustainable investments, according to a recent report by UBS

“It is very important that [family offices] invest with purpose, and that we embrace purpose at the core of everything we do,” said Regal Hotels International vice-chairman Poman Lo.

Attendees of the full-day conference at The Peninsula hotel comprised family-business owners and managers from Hong Kong, Southeast Asia, Europe, the Middle East and the United States.

“In life, the most important decisions, including marriage, are made with the heart. Investment decisions also,” said Lo.

“Of course they need to be a combination of art and science, but it is also important that we invest with purpose. If we are prudent enough, we should be able to see the ability to drive impact alongside return. That is a mindset change.”

The report highlighted a move from exclusion-based strategies that eliminate entire sectors or individual companies into environmental, social and governance (ESG) integration as well as impact investing in the next five years.

Pinduoduo worst among China’s e-commerce vendors in climate plans: Greenpeace

“It’s likely that families will have more detailed discussions on sustainability with the next generation and investment advisers going forward,” said UBS in the report, which surveyed 230 of the Swiss bank’s family office clients across more than 30 countries worldwide, between January 19 and March 5. A fifth of those surveyed were from the Asia-Pacific region.

Family offices with sustainable investments currently allocate an average of 37 per cent to exclusion-based investments, but this was seen dropping to 24 per cent in five years’ time.

While ESG integration investing is expected to hold steady at just over a fifth of sustainable investments by family offices in the same period, impact investing is set to grow slightly to 11 per cent from around 8 per cent now.

“In the past it’s always been just traditional investing, but now we’ve been seeing more of a rise in the spectrum of capital that is needed across different projects, from ESG investing that tries to avoid … the externalities, to impact investing which is a fine balance of impact and return,” said Lo.

“Now is the time for purpose-driven investing. Of course there are some projects that will require philanthropy as well, where the business model would require grants or some blended finance.”

“We are at a crossroads here,” said Lo. “We can choose to continue to fight for our own personal interests, maximise profits for the short-term, continue to bicker and tear our world apart.

“Or we can come together and try to collaborate and save this one and only Earth that we all share. We only have one planet, let’s save it for our children.”