Hong Kong exchange thinks it has a shot as world’s fundraising hub, tapping China’s trillions in savings. Does it?

- In its three-year strategic plan, the HKEX is tapping a wider range of financial products to widen its lead over rival exchanges, and to transform from a regional course into a global financial market place

Hong Kong Exchanges and Clearing Limited (HKEX) may be on the verge of a breakthrough innovation in its transformation from a regional bourse into a global financial market place.

The operator of Asia’s third-largest stock market, which gets 61 per cent of its revenue from equity-related trading, 19 per cent from futures and 17 per cent from its stake in the London Metal Exchange (LME), is looking at the potential of turning data into a new asset class that can be bought and sold in a financial market place.

“In the age of data and AI (artificial intelligence), automated financial exchanges will seriously have to consider the prospect of data becoming a new asset class for the financial market,” said chief executive Charles Li Xiaojia, during an interview with South China Morning Post. “Data sharing, trading and monetisation are going to increasingly become a key part of our lives, because data will generate tremendous value when properly shared and used together, rather than in isolation.”

The exchange will also double down on its advantageous position as the offshore financial hub for the world’s second-biggest economy, as it widens several so-called Connect schemes to let more capital flow into and out of the Shanghai and Shenzhen exchanges via Hong Kong.

More financial instruments and options will be on offer for investors, including exchange-traded funds (ETFs), as well as contracts in ferrous and rare metals, and currencies, according to Li’s plan.

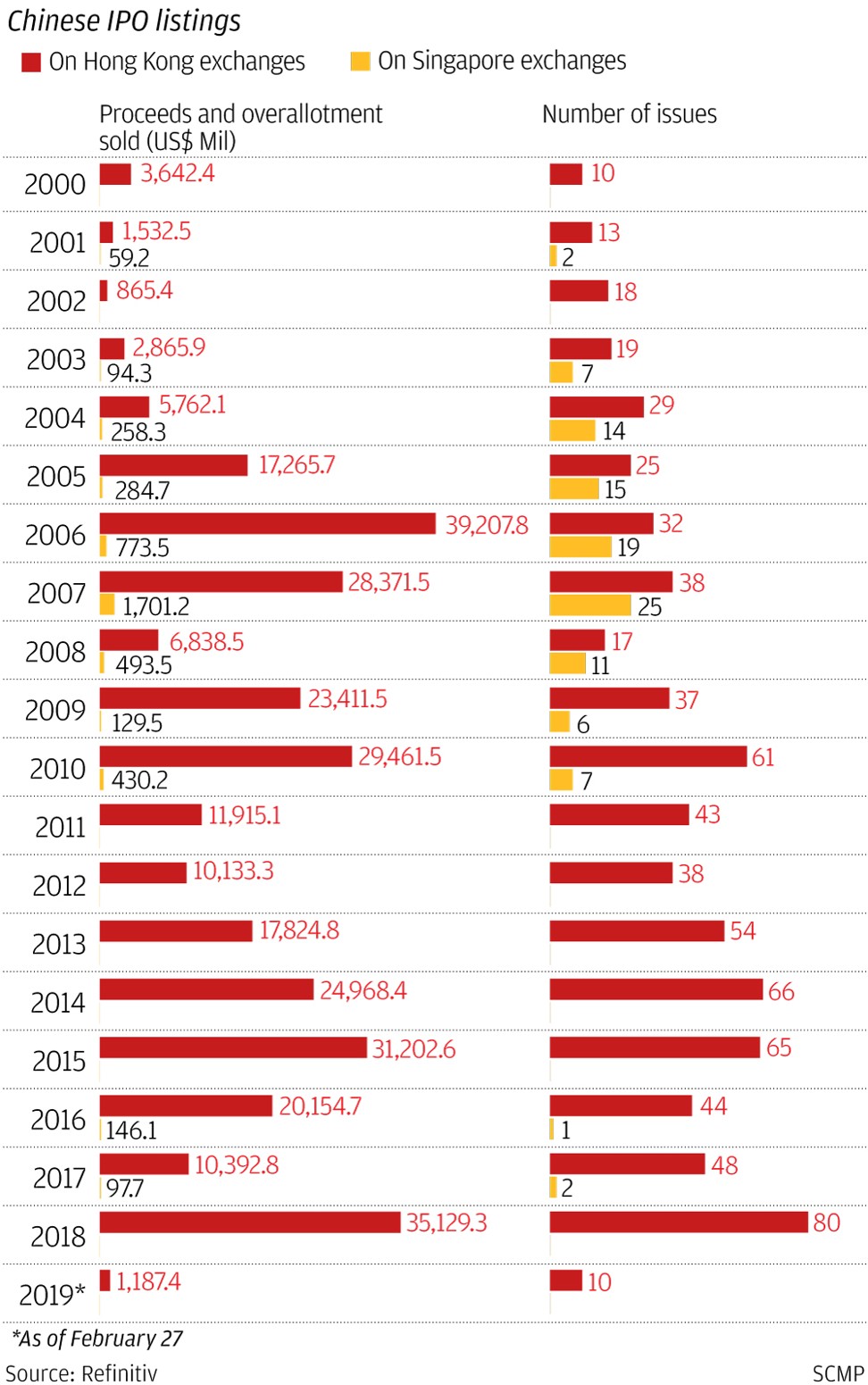

Under China’s capital controls, a tiny fraction is allowed to flow offshore to pay for imports, or to be used for acquisitions and investments. That is likely to change in the coming years, providing a potential bonanza for global initial public offerings to tap Chinese funds through Hong Kong’s exchange.

“In the future, it’s going to be global money here for Asia-Pacific securities, and it’s going to be Chinese money for global [financial] products,” Li said. “The whole point of the Chinese coming to Hong Kong is because that’s where global investors can meet them.”

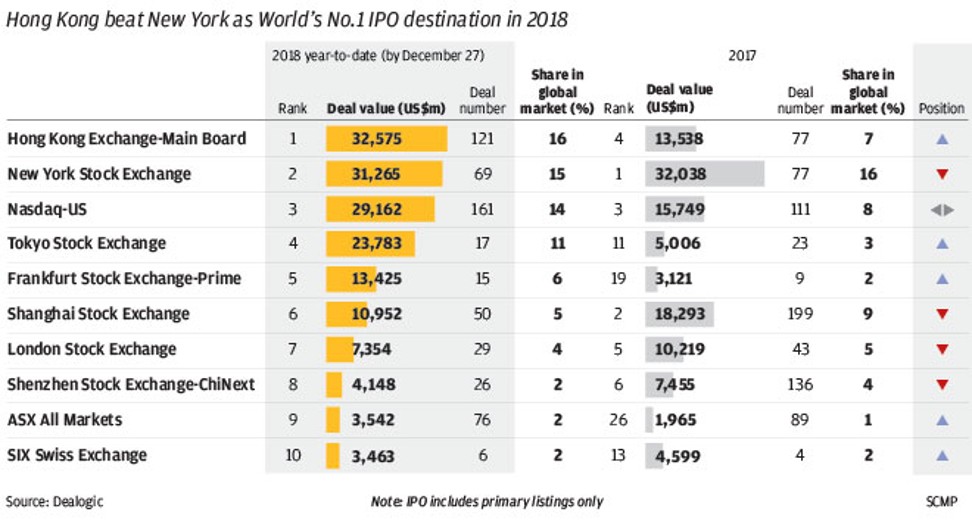

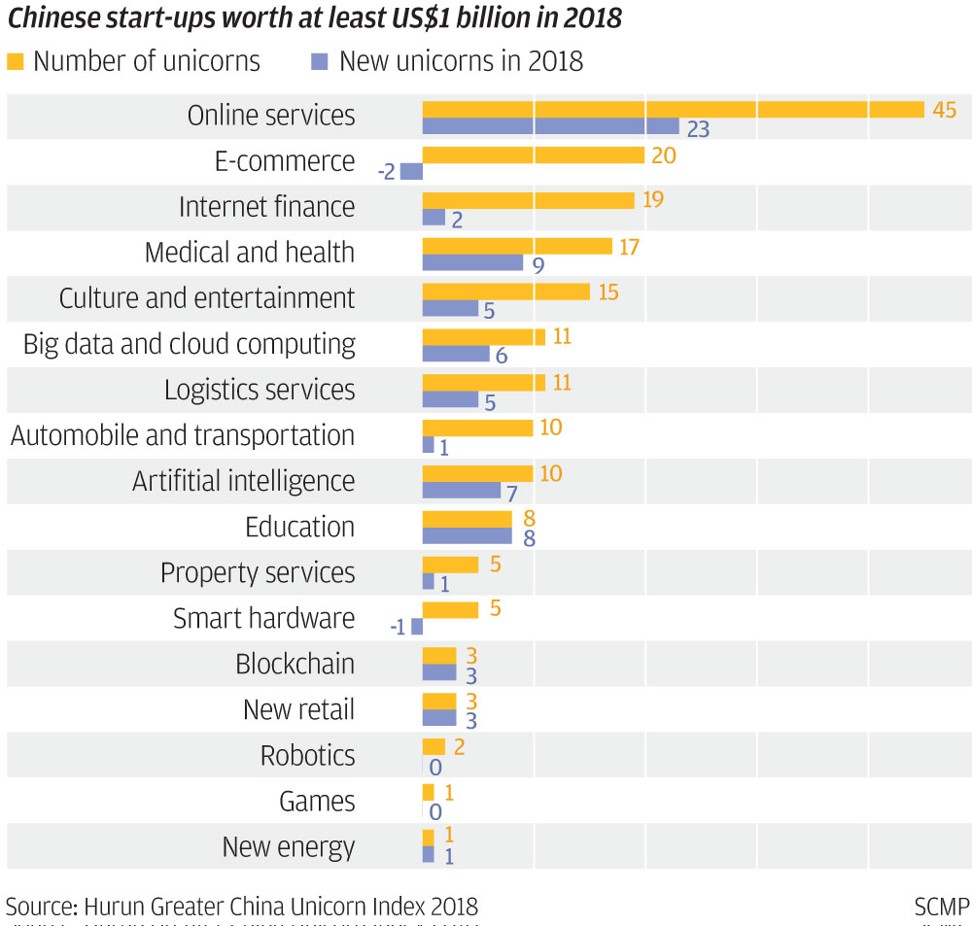

The exchange does face potential competition from global bourses, principally from New York and Shanghai, which both surpassed Hong Kong in 2017 in the global IPO ranks. The number of Chinese companies that will raise capital in New York this year may increase by 10 percentage points to 30 per cent of all offerings, according to a forecast by JPMorgan Chase & Co, because “American investors have a better understanding of some sectors, such as high technology, biotechnology, and electric vehicles,” which means better valuations for companies that are seeking to raise capital, said the bank’s head of investment banking in China, Houston Huang Guobin.

“The tech board is in China, which has a different composition of investors than Hong Kong and US markets,” JPMorgan’s Huang said. “The three markets can supplement each other, cooperate, and help each other.”

Hong Kong has done well tapping the resources of China. Nine of every 10 companies that raised capital in Hong Kong last year – such as China Tower, Xiaomi and Meituan-Dianping – was a mainland company with Chinese shareholders or domicile. Chinese companies also make up more than half of the US$12 billion of securities that change hands everyday in Hong Kong.

That’s a profile that the HKEX wants to change, as it rolls out the welcoming mat for global issuers to raise capital in Asia’s third-largest capital market. Hong Kong’s stock market capitalisation, at US$5.4 trillion, was 10 times bigger than Singapore last year, behind Japan’s US$6 trillion and China’s US$6.36 trillion, according to Bloomberg’s data.

“Southeast Asian companies can tap a bigger pool of international investors if they list in Hong Kong,” said Laurence Li Lu-jen, chairman of Hong Kong’s Financial Services Development Council, an advisory body. “The investor base in Hong Kong will widen further if China agrees to set up the Primary Connect, to allow mainlanders to invest in initial public offerings in Hong Kong.”

As a company, HKEX itself is listed on Hong Kong’s exchange. The operator’s stock price has risen 81 per cent since Li took over as chief executive in 2010, boosting its market value to HK$333.4 billion.

If Li’s strategic plan works, Hong Kong could become the go-to destination for global companies even if they are not listing on the HKEX.

“I would love to see a day when a Silicon Valley company going public on the Nasdaq, having very little business in China, feels the need to come to Hong Kong to tap into some Hong Kong funds,” said Alibaba Group Holding’s vice-chairman Joe Tsai, who also chairs this newspaper’s board. “If that were to happen, that means those funds sitting in Hong Kong are really looking globally.”