Hong Kong launches academy for wealth legacy as finance secretary hails city’s ‘thriving’ family office sector

- Some of the richest families in the city and the region attended a ceremony to launch the Hong Kong Academy for Wealth Legacy (HKAWL)

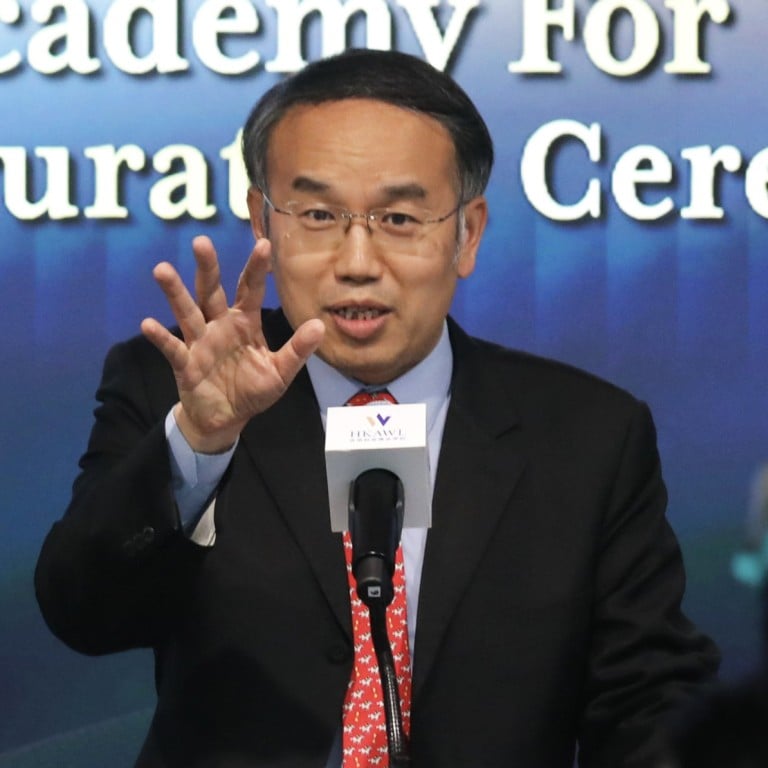

- It will serve as a training hub to ‘bolster the sustainable growth of the entire family office ecosystem in Hong Kong,’ says treasury chief Christopher Hui

Inclusivity and empowerment were among the themes that were emphasised at the ceremony as Hong Kong aims to burnish its pre-eminence as a global family wealth hub.

“The establishment of the Hong Kong Academy for Wealth Legacy is one of the eight initiatives of the government’s policy statement on developing a vibrant ecosystem for global family offices and asset owners.

“The academy will serve as a training hub offering continuous knowledge exchange and networking sessions, bolstering the sustainable growth of the entire family office ecosystem in Hong Kong.”

Hong Kong is tipped to grab a lion’s share of the fast-growing wealth creation industry in Asia, according to JPMorgan Hong Kong.

The Asia-Pacific region is expected to experience the biggest growth in wealth among ultra-high-net-worth (UHNW) individuals by 2026, according to Knight Frank’s Wealth Report 2022.

Hong Kong’s affluent become millionaires by the age of 33: HSBC survey

Hui said that assets under management in Hong Kong achieved the highest cumulative average growth, at 13 per cent, among wealth centres between 2017 and 2022

“Hong Kong is also projected to become the world’s largest booking centre by the year 2025,” Hui said, referring to wealth hubs with tax-friendly policies.

He said “The Wealth for Good in Hong Kong Summit” held in March will have a follow-up next year with the theme of “growing with certainty amid growing uncertainty”.

There are more woman board members and entrepreneurs than at any other time in recent history

“Today we are faced with a number of factors that will decidedly transform the global wealth management landscape for the coming decades,” Cheng said.

As women increasingly take on leadership roles, they are also likely to influence the global wealth management environment, he added.

“There are more woman board members and entrepreneurs than at any other time in recent history, which presents changes and opportunities [in terms of] the demand for financial and wealth management services,” Cheng said.