Soho China dangles 30 per cent discount on commercial properties to trim debt after aborted Blackstone deal

- Soho China plans to sell about 32,000 square metres from its portfolio in Beijing and Shanghai

- Proceeds from the sale will be used to cut debt, says chairman Pan Shiyi

The developer will sell about 32,000 square metres from its portfolio in the two cities at a 30 per cent discount, East Money Information reported on Thursday, which cited chairman Pan Shiyi as saying in a presentation to investors.

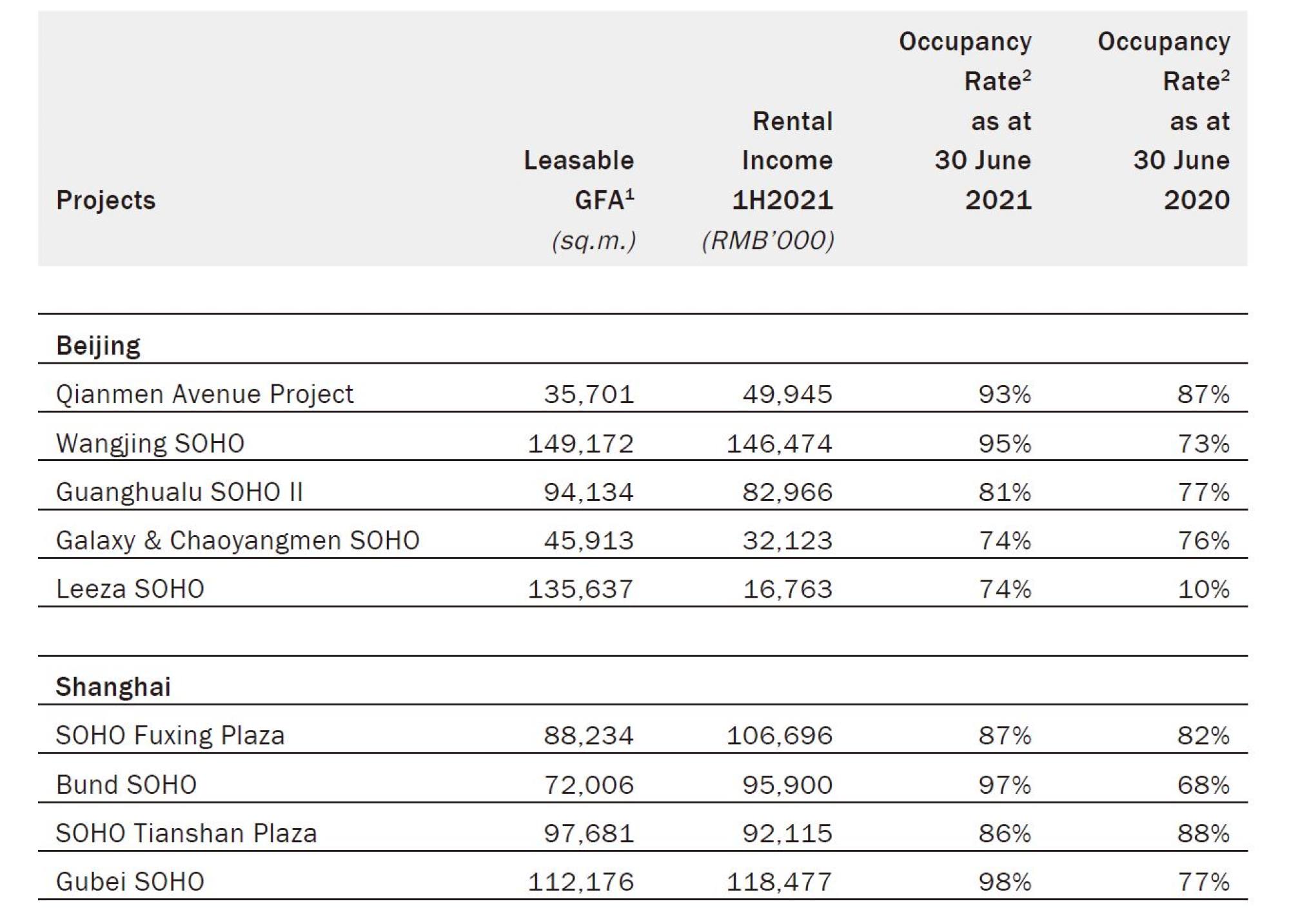

The size amounts to less than 4 per cent of its combined assets of 830,654 sq m in nine office and serviced apartment projects at the end of June 2021, according to the company’s interim report published in August.

“All the proceeds will be used to cut debt,” Pan was quoted as saying in response to market concerns about the group’s asset-sale plan and debt burden. To accelerate sales, Soho China would increase the agent commission fee to 4 per cent of the transaction value, he added.

The stock jumped 9 per cent to HK$1.58 in Hong Kong on the news, after earlier surging as much as 21 per cent. The price values the company at HK$8.22 billion (US$1.05 billion). Still, the stock has declined 8 per cent this year, following a 26 per cent slide in 2021.

Pan, who together with his wife Zhang Xin controls 63.9 per cent of the Beijing-based developer, is making the move after two failed attempts to sell their stake to US private equity giant Blackstone Group at a US$3.34 billion valuation.

Soho China had 18.5 billion yuan (US$2.9 billion) of total debt as of June 30, including 1.2 billion yuan due within 12 months and another 1.6 billion yuan by June 2023. Its net gearing ratio stood at 43 per cent.

The company’s interim report indicates the local property market has made some recovery after a rotten year in 2020 as Covid-19 spread, citing its geographical advantage and operational capabilities. Average occupancy rate rose to 90 per cent from 78 per cent a year earlier.

Still, the latest discount offer underscores concerns the market is vulnerable to new supply in the coming years. Grade A office vacancy rate remained high at 17.5 per cent in Beijing and 18.8 per cent in Shanghai, the company said. About 8 million sq m of new office supply will enter the Beijing and Shanghai markets by 2025, it estimated.

The Beijing office market will usher in the peak supply of up to 1.5 million sq m in 2022, according to DTZ, a real estate consultancy.

“The discount sale shows its eagerness to generate cash flow,” said Raymond Cheng, head of China and Hong Kong research at CGS-CIMB Securities.

In a buyers’ market coupled with ample supply of office space, Soho needs to offer competitive prices to attract interest, he added.