A more open China can avoid a no-win trade war with the US

A trade bust-up promises only losers: American consumers, Trump himself and China’s export-oriented economy. But Xi’s Boao Forum speech offers hope of a mutually beneficial way out

The goal of a war, be it hot or cold, about trade, territory or anything else, is destruction.

And destruction means not only the loss of lives, but the destruction of any assets tangible or intangible, as can be seen in the simmering trade war between the United States and China.

The spectre of a full-blown trade war between the world’s two largest economies threatens the worst disruption to, and destruction of, the global economy in modern times. Basic economics suggests any such conflict will incur losses all around.

Nevertheless, fears that we are indeed headed for such a scenario are growing, fuelled by continuing tit-for-tat threats between the world’s largest traders. Washington and Beijing have each announced US$50 billion worth of punitive tariffs against each other and the US has raised the prospect of a further tariff of US$100 billion on goods.

Has Trump tweeted us back to the cold war?

As there will be no winner in a trade war, the question shifts to who will be the biggest loser.

From an economics perspective, US multinationals and consumers themselves will be the first to be hit by US President Donald Trump’s punitive tariffs.

Most Chinese exports to the US fall into two categories. First up are those concerning US-branded products – supply chains in which US firms are involved, such as consumer electronics (think iPhones and laptops where the brand is American, but the parts involved are Chinese). The second category involves labour intensive consumer goods, such as toys and clothes, which cannot be produced as cheaply in the US. In both these areas, American consumers will pay for Trump’s additional tax.

However, China’s export-dependent economy has far more to lose from a trade war than America’s more self-sufficient one does. China’s exports to the US account for 19.1 per cent of China’s total exports of goods, while only 8.4 per cent of US exports go to China.

Last year, China exported more than US$505 billion worth of goods to the US while only importing US$130 billion worth of American goods, hitting a record trade deficit of US$375 billion. It is therefore difficult for Beijing to match Trump in threatening more punitive tariffs.

All of Beijing’s options for retaliation are limited because its exports to the US are consumer products for which substitutes can easily be found elsewhere.

Most economists agree that even if China followed through on its threats to sell off its massive stash of US treasury holdings, the move would not have a significant impact on the US economy.

On the other hand, some US exports are crucial to China’s economic and social development and substitutes for them are not always easy to find. Take aircraft as an example, China’s major target for retaliation. The only major alternative Beijing has to buying from the American firm Boeing is to turn to the European company Airbus, but Airbus could not meet the huge demands of China, which requires about 300 planes annually. Furthermore, if an all-out trade war does break out, the European Union will in all probability join hands with the US. Recently, both Japan and the EU joined the US in acting against China in the World Trade Organisation.

Did Trump really need trigger-happy Bolton and Pompeo?

So while Beijing might be able to inflict some pain on US companies and ordinary consumers, China and ordinary Chinese would be guaranteed even more pain without some of America’s best-known brands – such as Microsoft, Intel, Qualcomm to name just a few. Imagine a China without Boeing or Airbus.

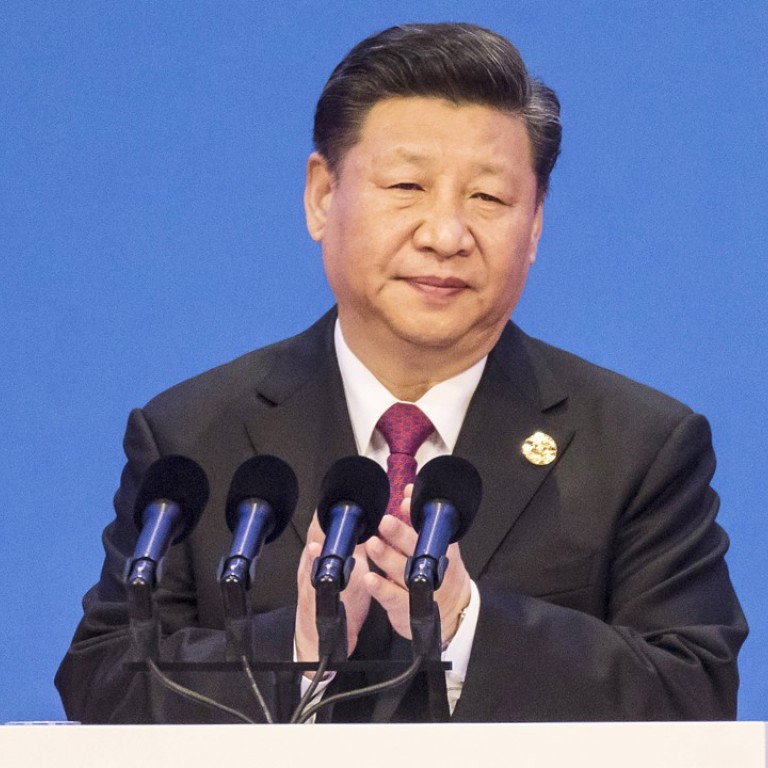

It might well be for these reasons that while state media and officials have been talking tough, Xi used a speech at the Boao Forum in Hainan on Tuesday to strike a conciliatory tone in an effort to de-escalate tensions. The strongman leader pledged to take swift and urgent actions to address most of Trump’s complaints, vowing to open the Chinese market further, to reduce tariffs on US imports, to better protect intellectual property and to grant foreign firms in China a level playing field. All these are commitments China made in its admission to the WTO almost two decades ago.

The trade dispute reflects deep differences between China and the free economies. The best solution is for China to accelerate its domestic reform to contain its differences with the US and other free economies, not only in terms of market openness, intellectual property protection and internet security, but also in terms of ideology, values and geopolitics – areas in which China has been diverging from the West in recent years.

A trade war, like any other war, is essentially destructive. The constructive approach, for all involved, is for the US and China to work together to prevent such an occurrence. Xi’s speech at the Boao Forum may be one of the first signs the two countries can be steered towards a mutually beneficial outcome. ■

Cary Huang, a senior writer with the South China Morning Post, has been a China affairs columnist since the 1990s