Topic

- The Central Financial Commission, a newly established arm of the Communist Party, has promised regulatory predictability in a recent article

- Reassurance comes as foreign investors leave China in droves, with FDI figures at record lows as policy environment looks uncertain

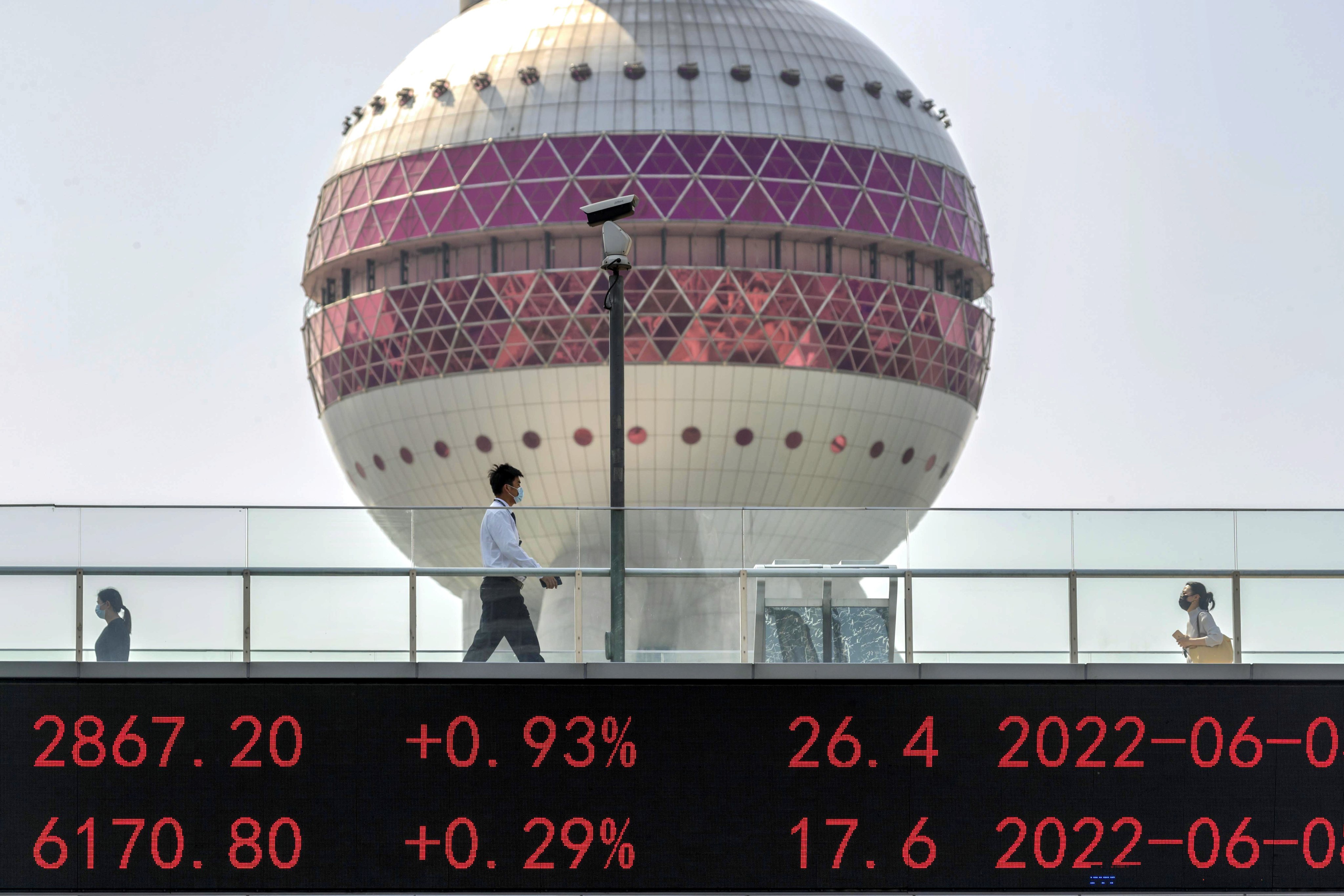

The Chinese securities watchdog’s new head, “Broker butcher” Wu Qing, has lost no time in tackling the turmoil that has rocked the country’s stock market, after it hit five-year lows this month, unveiling a slew of proposals aimed at reviving market confidence.

China will have to do more to convince stock investors about the sustainability of the market rally spurred by recent rescue measures, fund managers Pictet and Saxo say.

Wu Qing, a Shanghai official with experience in the city’s stock exchanges, has been appointed to head up China’s securities regulator as the country lays out measures to bring its markets under control.

A bull market is vital for China’s slowing economy because stock valuation has slumped to about 54 per cent of national output, from a record 79 per cent in 2021.

Stocks in Hong Kong and mainland China surged again as China delivered on its promise to calm the market with a US$140 billion liquidity injection plan. Buying by corporate insiders lifted Alibaba by the most in six months.

The China Securities Regulatory Commission’s latest action is expected provide a boost to the nation’s US$11.5-trillion stock market, a laggard among the key benchmarks in Asia this year.

Fang Xinghai said foreign capital will continue to pour into mainland-listed equities as long as handsome investment returns can continue be generated.

Long-term value investing is the key to delivering stable returns in China’s US$11.5 trillion stock markets, Yi Huiman, chairman of the China Securities Regulatory Commission, said at the Lujiazui Forum in Shanghai.

The proposal to improve banks’ valuations and develop index funds was outlined to executives of state-backed lenders by Cai Jianchun, the exchange’s general manager.

Vice-Premier He Lifeng oversaw the inauguration ceremony of China’s new regulator, the National Financial Regulatory Administration (NFRA), on Thursday in Beijing.

The yuan-traded shares of 150 dual-listed companies commanded a 42 per cent premium over their Hong Kong-listed shares this month, versus a 10-year average of 26 per cent.

China’s new leadership team is racing to defuse financial risks, including at top banks and state-owned industrial giants, against a backdrop of slowing economic growth and an overseas banking crisis.

Central government’s comprehensive jurisdiction over Hong Kong goes hand in hand with the ‘high degree of autonomy’, Chief Executive John Lee says.

The undervaluation of state-owned enterprises risks eroding their ability to raise funds via the markets, which in turn destabilises the economy, says general manager of Shanghai bourse.

China’s three telecom operators, panned as value destroyers in stock markets, are no longer market laggards. Stock returns this year are among the best in the world. Here’s why.

Beijing again puts He Lifeng alongside senior cadres during a high-profile stop at the People’s Bank of China, leading to increased speculation about major economic policy changes.

The Shanghai Stock Exchange Property Index jumped 3.5 per cent on Wednesday as rumours emerged that the authorities are planning a raft of supportive measures for financially stable home builders.

Shares of Chinese state-owned companies surged on Tuesday after the country’s most senior financial regulator pledged to build ‘a capital market with Chinese characteristics’.

Comments from Han Wenxiu come amid worries that focus on high-quality development and ‘common prosperity’ could sideline China’s economic growth priorities.

Reshuffle follows Central Committee retirements, banking crises and Xi Jinping’s anti-corruption campaign but scope of changes prompts uncertainty.

China and the US signed an accord granting the US accounting oversight board access to Chinese audit data, ending an impasse that has wiped billions of dollars off Chinese stocks on US exchanges.

Yi Huiman, chairman of the China Securities Regulatory Commission, promises to stabilise the capital markets and prevent ‘abnormal fluctuations’.

The move, effective Monday, holds the promise of eventually revolutionising cross-border trading in an economy that still remains significantly cut off from international markets.

Hong Kong and the US will no longer renew a mutual recognition agreement for their professional accountant to do audit works in each others market, ending more than a decade of such cross border co-operation, according to statement of Hong Kong Institute of Certified Accountants (HKICPA).

China’s securities watchdog wants listed companies to repurchase their own shares and their major shareholders to support stock prices amid efforts by Beijing to stabilise the country’s sluggish stock markets.

Yi’s remarks would bolster confidence among investors who have been beaten down by a relentless sell-off in technology stocks, combined with concerns of an economic slowdown as the Covid-19 pandemic flared up.

China’s central bank said in a draft law released on Wednesday that the existing legal framework to mitigate financial risks is disorganised and ‘lacks overall design’.

Burden of ensuring listing information complies with state security needs will fall to the companies, CSRC says.

The SEC’s list, which amounts to a clerical entry, nevertheless fans concerns in a stock market that is already jittery over deteriorating US-China relations.