Topic

Latest news and analysis about the benchmark stock indices of the Shanghai equity market, including the Shanghai Composite Index, the Shanghai A-Share Index and the Star Market for technology start-ups

Team set up by Hong Kong financial secretary will not only consider business and finance, but also geopolitics and US-China tensions.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

- Hong Kong retail funds recorded net inflows of US$3.8 billion in the first quarter, the most since attracting US$4.6 billion in the same period in 2021, industry data shows

- Fixed-income funds attracted the highest net inflows of US$4.1 billion during the period, with gross sales more than doubling from the previous quarter

Hong Kong stocks slide by most in a week and the yuan hits a six-month low amid investor caution ahead of key economic data.

Hong Kong markets close little changed, surrendering gains posted after Shanghai relaxed property sector curbs and on the back of a semiconductor investment fund.

Hong Kong stocks rally after data showed China’s industrial profits resumed growth in April.

As the first batches of a trillion-yuan offering of ultra-long-term special government bonds came roaring out of the gate this week, those bearish on China’s economic outlook triggered a feeding frenzy.

Hong Kong stocks fell for a fourth straight day and capped their biggest weekly loss since January, with a lack of positive earnings surprises and waning rate cut hopes adding to the gloom.

Hong Kong stocks fall to two-week low as correction deepened after hawkish comments from US Federal Reserve officials.

‘It’s too early to leave the party,’ says an HSBC analyst as Goldman raises its index targets by at least 5 per cent, but JPMorgan Private Bank calls an end to the rebound.

Hong Kong stocks at 10-month highs after China’s property support measures cheer investors.

Hong Kong stocks were lifted by signs corporate earnings may have bottomed out, and after Beijing delivered a batch of property support measures.

Saudi Arabia’s Public Investment Fund and Michael Burry’s Scion Asset Management increased their holdings of Chinese large caps, while Singapore’s Temasek reduced its stock holdings.

Hong Kong stocks rally continues after China unveils more property support measures with gains supported by hopes the Federal Reserve will start cutting interest rates later this year.

Bridgewater Associates, the world’s biggest hedge fund slashed its holdings drastically in the first quarter in a move may have been too hasty and caused it to miss out on the recent bull run.

Mainland China stock markets are on the back foot after US-China trade tensions rose following increased tariffs on imports of Chinese semiconductors, electric vehicles, steel and batteries.

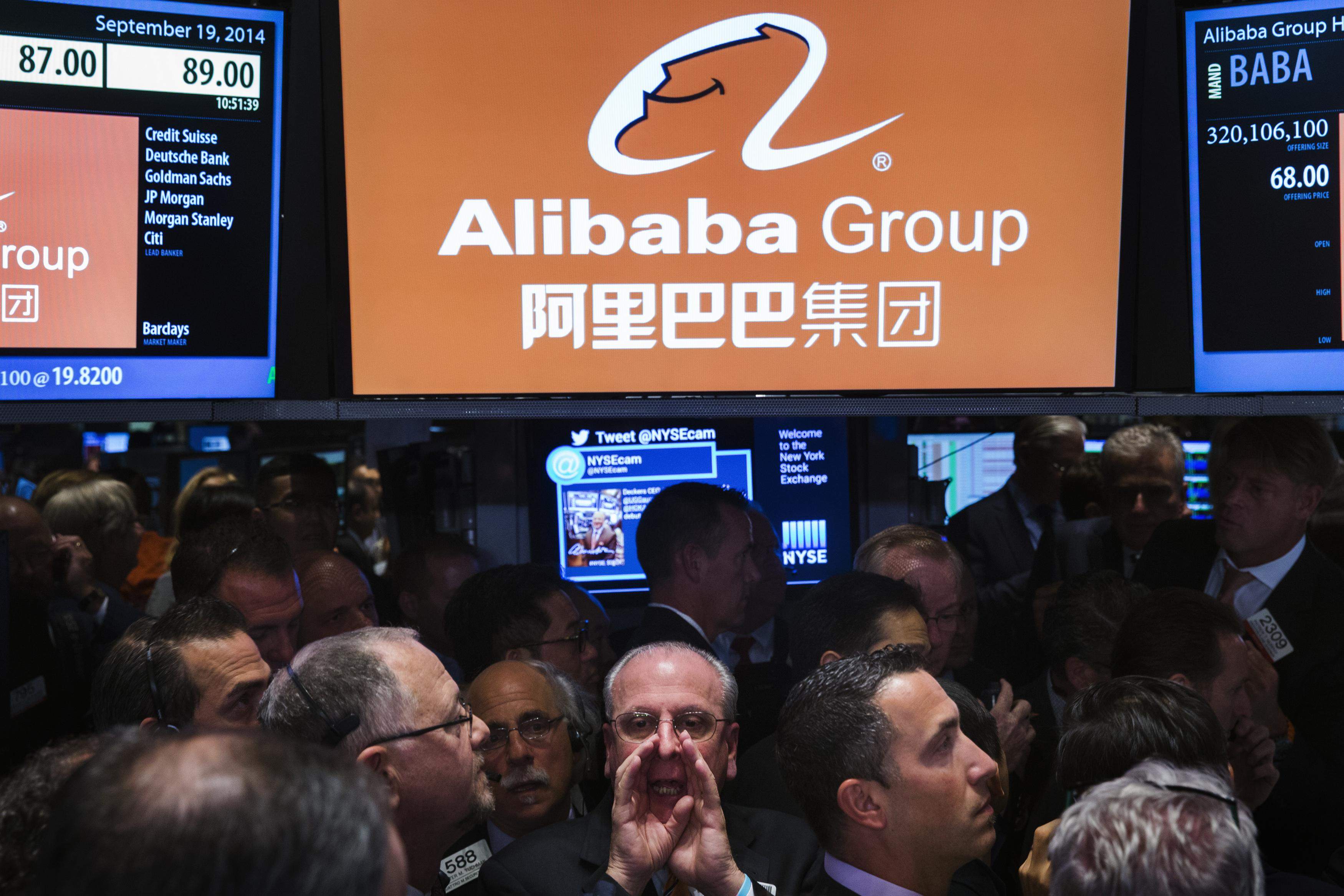

Stocks retreated from the highet level since August, taking a breather after surpassing the 19,000-point level. Gains in tech leaders such as Alibaba and Tencent tempered losses among developers and casino operators.

Hong Kong stocks advance amid growing hopes of improved corporate earnings and policy support after tepid economic data over the weekend.

In an attempt to limit the impact of data showing foreign funds selling on market sentiment, Shanghai and Shenzhen exchanges plan to cease displaying real-time figures on purchases or sales of local stocks through trading links with Hong Kong.

Economic optimism boosts Hong Kong stocks with growing hopes of US interest cuts providing an additional tailwind.

Hong Kong stocks rise driven by economic optimism after policy loosening measures announced by nearly 60 Chinese cities targeted the floundering property market with upbeat trade data providing a further boost.

‘Earnings are set to pick up as property activity stabilises and inflation recovery fuels household income and consumer spending growth,’ UBS strategist Meng Lei says.

Hong Kong stocks fell for the second straight day on Wednesday as investors awaited trade data which is expected to show both exports and imports returned to expansion territory in April, following a contraction in the previous month.

Hong Kong stocks decline from an eight-month high as traders cash in on the market bull run, while robust mainland tourism data for the holiday period fails to lift sentiment.

Investor sentiment has turned positive after a clutch of global investment banks made positive calls on Chinese stocks amid expectations of more policy support from Beijing.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

Foreign investors loaded up on Chinese stocks for a third straight month in April, adding to evidence that global fund managers have become more positive about the world’s second-largest market.

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

Investigation into Yao Qian, who serves as the director of the department of technology supervision at the China Securities Regulatory Commission, comes amid an uptick in market reforms.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

![[Shutterstock] Royalty-free stock photo ID: 1151325629 Various type of financial and investment products in Bond market. i.e. REITs, ETFs, bonds, stocks. Sustainable portfolio management, long term wealth management with risk diversification concept. - Image SHUTTERSTOCK](https://cdn.i-scmp.com/sites/default/files/d8/images/canvas/2024/05/24/81679077-e4cc-4848-b2dd-ab3393627698_9f26760e.jpg)