Topic

China Resources (Holdings) is a state-owned conglomerate registered in Hong Kong. The company is the parent of China Resources Enterprise, China Resources Power and China Resources Land, which are listed as Hang Seng Index constituent stocks and known as the Three Blue Chips of China Resources.

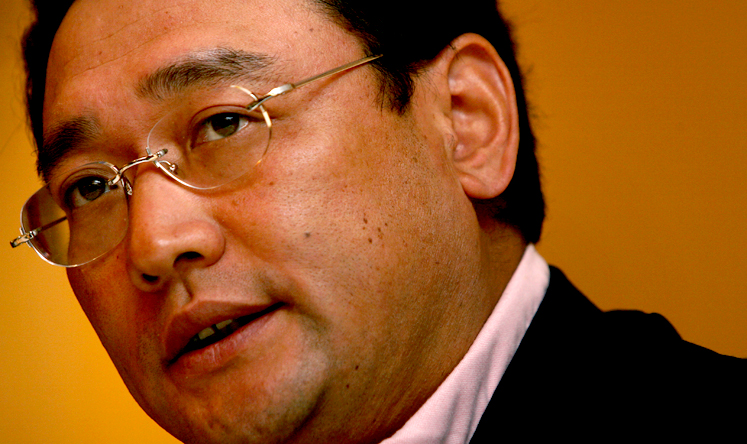

After Beijing's decision over a week ago to detain Song Lin, the chairman of China Resources, on allegations of corruption, speculation has run rife on the mainland and overseas media about its implications.

The dramatic developments that led to the sacking and detention last week of China Resources chairman Song Lin on corruption allegations have become the talk of the town in Hong Kong and Beijing.

Song, serving 14 years in jail for embezzling public assets worth more than 9.74 million yuan, has justice of the peace title revoked

A vice-president of state-owned conglomerate China Resources (Holdings) has been in detention for at least a month as part of a graft investigation, a source and mainland media reports said.

China Resources Holding's new chairman has met with at least 10 provincial governments since taking control six months ago - a charm offensive that is helping the state-owned conglomerate move past a major corruption scandal.

Wang Shuaiting, the chairman of the listed subsidiary of China Travel Service (Holdings) Hong Kong, is being investigated on suspicion of seriously violating law and party discipline "during his tenure with China Resources".

CR Land is still a top pick for investors in the mainland's property sector, analysts said, although a corruption investigation into a former chairman of its parent company has cast a shadow on its share performance for the time being.

A former mayor in Shanxi, who was sacked for failing to curtail illegal mining operations in his city, has turned out to be a key figure in helping China Resources to make inroads in the coal-rich province.

Former China Resources group chairman Song Lin was a director of two offshore companies along with another senior executive of the state-run conglomerate who is also being probed for corruption.

Two senior executives at companies in the China Resources group were detained immediately after the state-run conglomerate's former chairman, Song Lin, was placed under investigation for corruption, sources familiar with the matter have revealed.

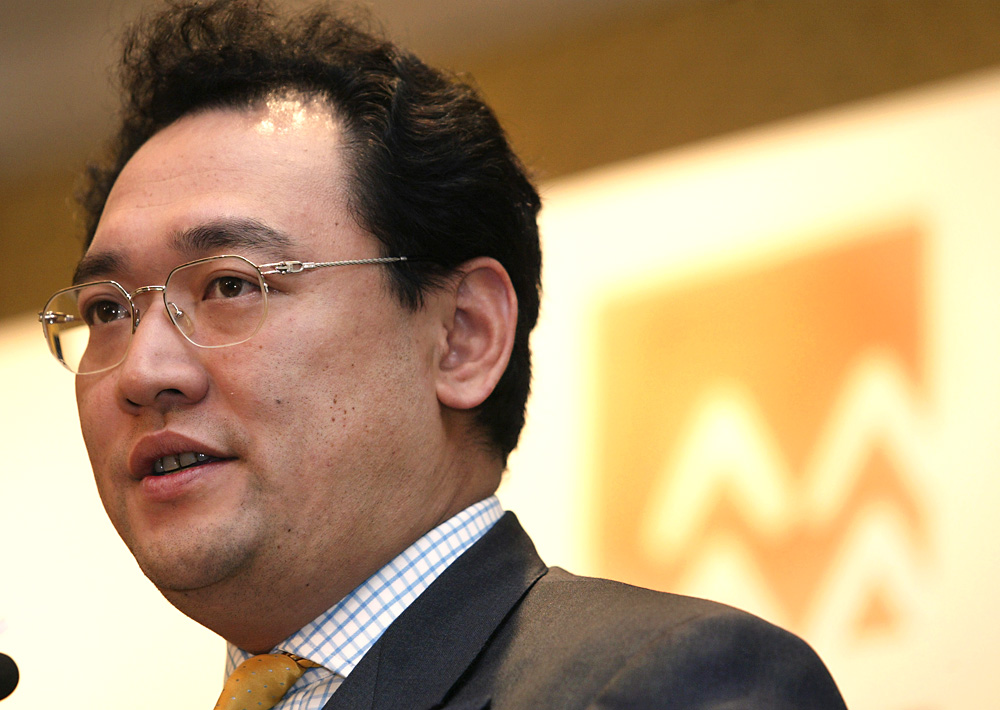

Fu Yuning, a 15-year veteran of state-owned ports-to-financial services conglomerate China Merchants Group, has been appointed chairman of China Resources Holdings (CRH), five days after former head Song Lin was put under a corruption probe.

China Resources (Holdings), which has been under the media spotlight in the past week over news that its former chairman has been probed by the Communist Party's graft watchdog for corruption, has a past that is anything but ordinary.

Shares of the five Hong Kong-listed units of China Resources Holdings tumble following the sacking and corruption probe into company chairman Song Lin.

More details have emerged from the relatives of the disgraced China Resources chairman about his humble upbringing, which are contrary to rumours that he came from a well-connected family.

China Resources said top executives had visited its key business units in a bid to shore up morale after Song Lin was removed as the conglomerate's chairman over suspicions of corruption.

Hong Kong's graft watchdog was quick to distance itself from fired China Resources boss Song Lin, erasing from its website references to his role as head of its ethics committee.

Song Lin, the scandal-hit chairman of state-owned China Resources, was yesterday sacked for "suspected serious violations of discipline and law violations".

The mainland's anti-corruption agency is investigating the chairman of China Resources Holdings after domestic media repeated accusations that a unit of the state-owned company deliberately overpaid for coal assets.

Swiss bank UBS' internal investigation of one of its senior bankers is focusing on her relationship with the chief of state-owned China Resources, sources say.

The central government's top anti-corruption agency said yesterday it was investigating Song Lin, chairman of the state-owned conglomerate China Resources Holdings.

The bank's legal and compliance department has looked into reports related to Helen Yang, also known as Yang Lijuan, an investment banker based in Hong Kong, sources familiar with the matter said.

Tesco, Britain's largest retailer, may join forces with state-backed China Resources Enterprise to bid for ParknShop. Frank Lai Ni-hium, the chief financial officer of China Resources, said the two companies were "in discussion" that might lead to a possible joint bid for the supermarket chain.

China Resources Enterprise (CRE), the mainland’s second largest operator of hypermarkets, reported an 11.1 per cent year-on-year decrease in net profit to HK$1.005 billion.

China Resources Power Holdings (CRP), which is embroiled in controversy over a 2010 coal mining investment deal, posted a forecast-beating 78 per cent jump in interim profit on the back of lower coal costs.