Topic

News about policymaking in the world’s major central banks with a focus on the People’s Bank of China, the Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan and the Reserve Bank of Australia.

March PMI reveals country’s manufacturing activity expanded at the fastest pace in over a year, as more industries show increased confidence.

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

- Consumers in China bought 308.9 tonnes (10.9 million ounces) of gold in the first quarter, representing a 5.9 per cent increase compared to the same period in 2023

- Gold represents ‘the only safe asset’ for Chinese consumers to protect their wealth against inflation, asset price declines and geopolitical risks, analysts said

The yen has been steadily sliding for more than three years and has lost more than one-third of its value since the start of 2021.

Blockchain made up about 15 per cent of the talks at Money20/20 Asia this year, just slightly below the proportion of talks on AI, as interest remains high in Asia.

China’s yuan has lost more value against the US dollar as interest rate cuts have yet to materialise, leading exporters to find whatever alternative assets they can until exchange differentials subside.

A total of 42,000 victims have seen their savings and investments in SCB evaporate after the bank was embroiled in a US$12.5 billion fraud.

The central bank said the domestic growth outlook depends on the global pivot to monetary easing and a tech upswing.

The first 18 office units have been priced from HK$7.2 million to HK$22.7 million, or around HK$12,000 to HK$14,000 per square foot, NWD said in a statement on Thursday.

The People’s Bank of China has indicated its approval for trading treasury bonds on the secondary market, signalling more robust action to boost liquidity and fuel growth is no longer out of the question.

Wars in the Middle East and Ukraine, and continuing lower US interest rates have burnished gold’s billing as an investment, but it is the unrelenting Chinese demand that is juicing the rally.

China has continued to sell its holdings in US debt as the likelihood of expected interest rate cuts grows more remote and Beijing looks to widen the diversity of its foreign asset pool.

Asia looks ready to turn a corner in quarterly earnings growth this results season. Here are five key themes to watch as the report cards roll in over the next few weeks.

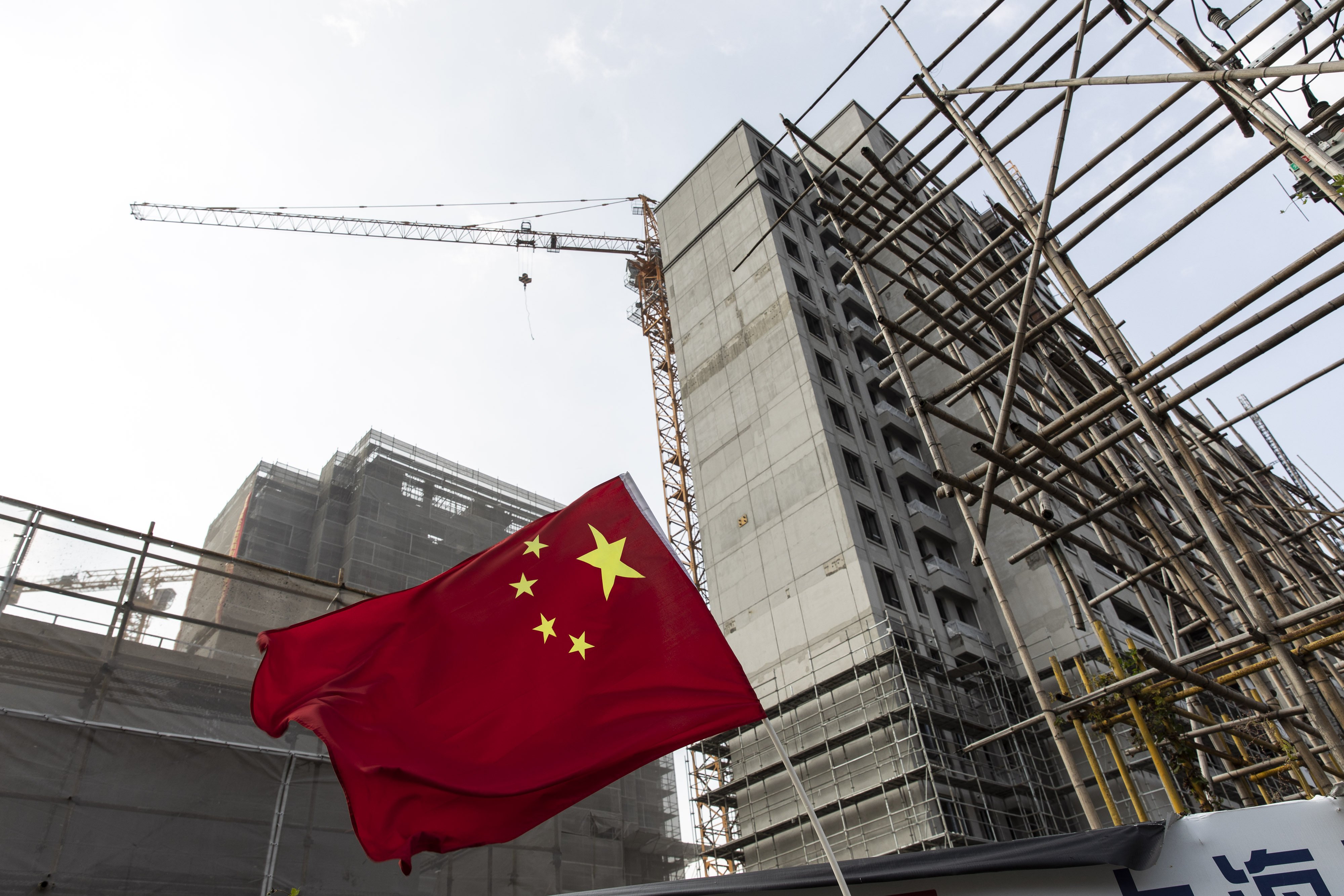

China’s banks are removing some of their long-term fixed-income products and cutting rates offered to depositors in an effort to shore up profitability, as challenges including a slumping property sector, mounting local government debt, and slow consumption recovery weigh on bank earnings.

Police say 505,000 scam alerts sent to users of Faster Payment System (FPS) between launch of warning system in November and March.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

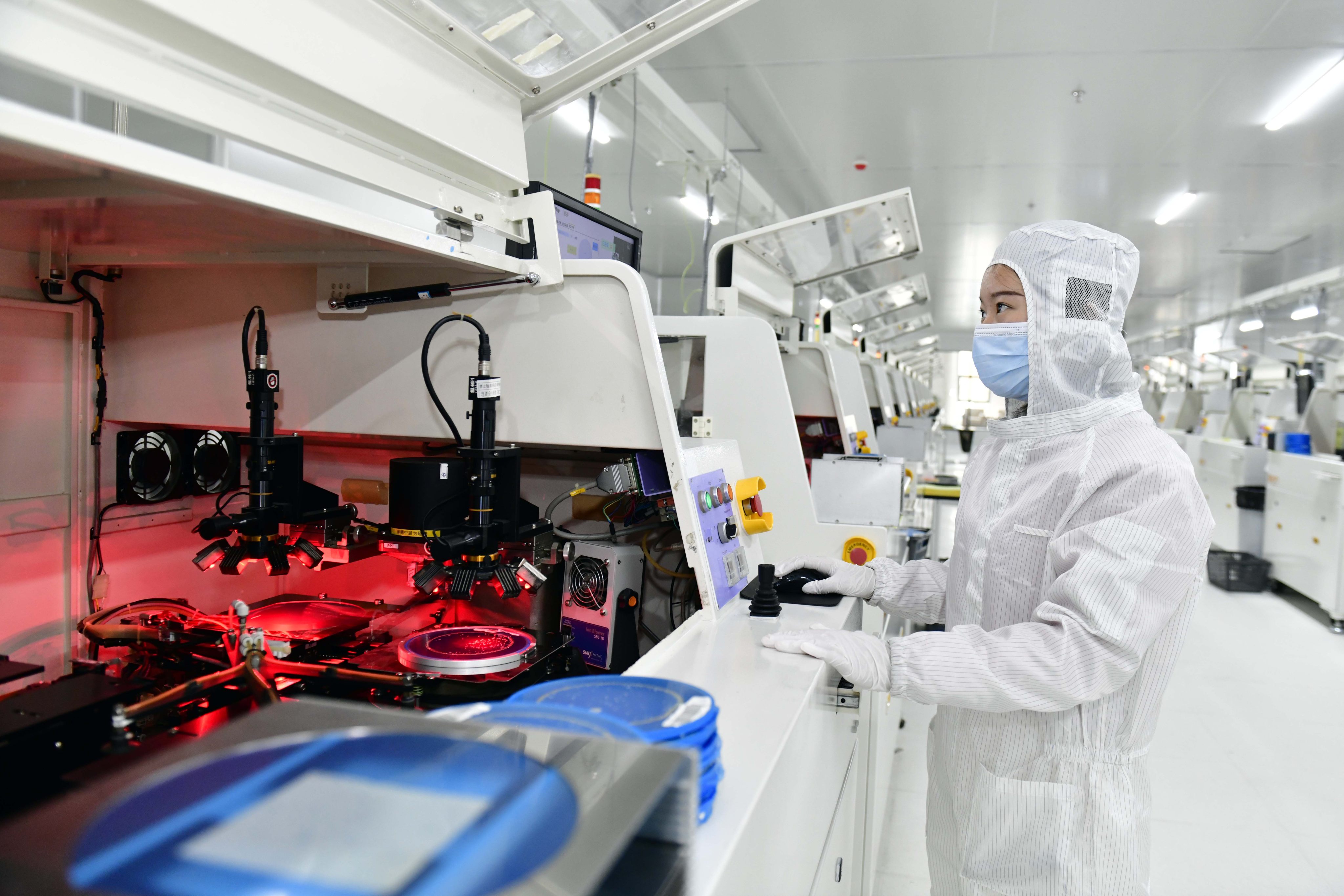

China’s central bank will incentivise the extension of credit for tech-focused companies and equipment renovations – goals named as a top priority by economic policymakers for the coming year.

The rise in gold smuggling is fuelled by a combination of a lack of official supplies and flight-to-safety demands amid a struggling economy.

Second day of talks with Vice-Premier He Lifeng precedes trip to Beijing for meetings with senior officials including premier and central bank head.

In an uncertain monetary environment where the US Federal Reserve has yet to announce interest rate cuts, China’s central bank is seeing potential moves to increase activity constrained by pressures on the yuan.

China’s finance sector was once freewheeling, but new regulations and mandates from officials suggest banks’ new role looks beyond simple profit-seeking.

Even after President Xi Jinping has asked for China’s central bank to trade government bonds, the outcome is likely to remain limited as the bank does not want to trigger negative outcomes for inflation and exchange rates.

President Xi has told financial cadres that their monetary policy toolkit must include a controversial means of injecting liquidity into China’s economy – one that has not been used in two decades.

People’s Bank of China governor Pan Gongsheng tells the Boao Forum for Asia on Wednesday that established international institutions, including the International Monetary Fund (IMF), are in need of reform.

Many Sri Lankans have yet to benefit from a new social welfare programme and are still struggling with the IMF’s harsh austerity measures.

Beijing’s new off-budget treasury bonds will span decades, and they have been sold only 3 times before – in some of the most challenging economic times.

People’s Bank of China (PBOC) has named two new academic advisers for its monetary policy committee, which submits advice to the State Council on key moves including interest rate changes and the value of the yuan.