Alibaba reduces stake in GoGoX amid Hong Kong logistics services firm’s mounting losses, as it faces cutthroat competition on the mainland

- Alibaba has cut its GoGoX stake four times over the past two months, leaving it with an 8.89 per cent equity holding as of December

- GoGoX has recorded losses since 2018 owing to stiff competition on the mainland and its continued international expansion

Following those moves, the biggest shareholder of GoGoX remains billionaire Yao Jinbo – the founder, chairman and chief executive of mainland Chinese online classifieds giant 58.com – with a 38.69 per cent share. GoGoX co-founder Chen Xiaohua, with a 5.95 per cent stake, retains his position as the company’s third-biggest shareholder.

The company – which expects to remain in the red this year, according to its 2022 prospectus – narrowed its losses to 642.9 million yuan (US$90.37 million) in the first half of 2023, from 1.05 billion yuan in the same period in 2022.

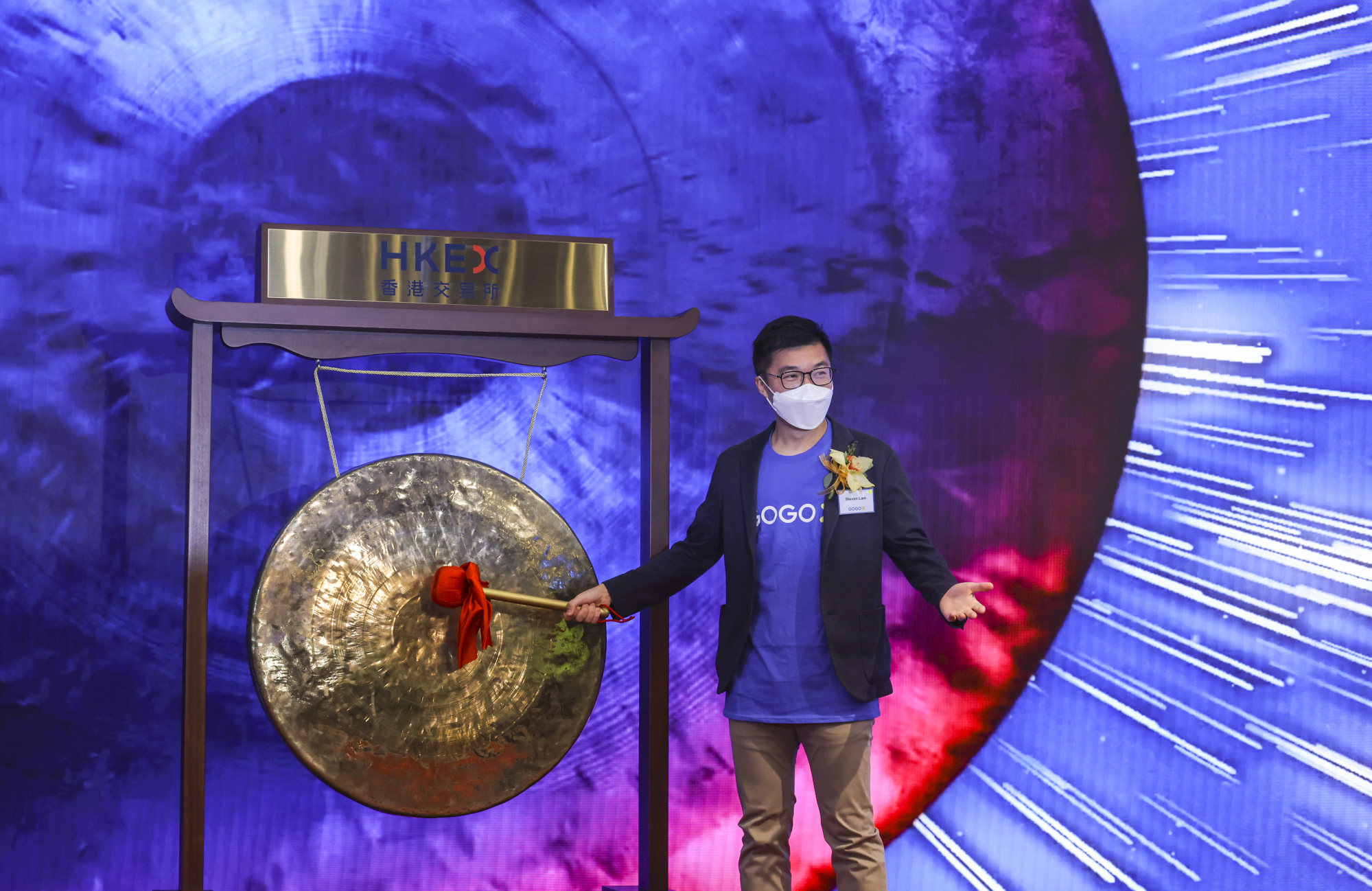

GoGoX also went through a major management reshuffle in December, as founder Chen resigned from his chairman role. The company tapped Steven Lam Hoi-yuen, another co-founder and the co-chief executive of GoGoX, as its new chairman.

Cainiao aims to raise at least US$1 billion, subject to market conditions, according to sources cited in a Post report that month.

Alibaba is trying to stop the bleeding with its stake cut, as its initial goal with the GoGoX investment was to gain financial returns through the listing and create synergy with its own services, according to Zhang Yi, founder and chief analyst at Guangdong-based consultancy iiMedia.

“This is still a market with huge demand and many opportunities even with the price wars, similar to those in the bike-sharing and ride-hailing sectors,” Zhang said. “So the bigger problem is more likely to lie within the operation of GoGoX, which will need revolutionary measures to reverse its losses.”

Alibaba logistics spin-off Cainiao to boost overseas position with Best buyout

Huolala currently leads the mainland’s intracity courier delivery services market with a 61 per cent share, according to Frost & Sullivan data cited in the prospectus of Lalatech, which is eyeing a Hong Kong IPO.

Similar to on-demand services like ride hailing, the early stage of competition in intracity freight services has relied heavily on subsidies for users.

That “cash-burning” business model, however, has faced increased scrutiny from regulators, who recently summoned Lalatech for talks regarding drivers’ rights and unfair price cuts.

GoGoX and other courier delivery services providers have also received “reminders” from regulators about their operations in the past year.