AWS made cloud computing services mainstream, but it still hasn’t cracked China

- Existing government policies prevent Amazon Web Services from building and operating its own data centres in China

- AWS provides its services in the country through two local tech partners

Led by Jassy, who joined Amazon in 1997, AWS was launched in 2006 as a simple computing and storage service delivered remotely over the internet. It has since become a global cloud platform used by millions of start-ups, enterprises and government customers around the world.

AWS’ presence in China has remained so small that it is barely mentioned in market reports from the major tech research firms.

AWS did not immediately respond to an inquiry for comment on Wednesday.

The stakes are high for AWS, as demand for cloud computing services in China has continued to accelerate on the back of domestic providers’ expansion initiatives.

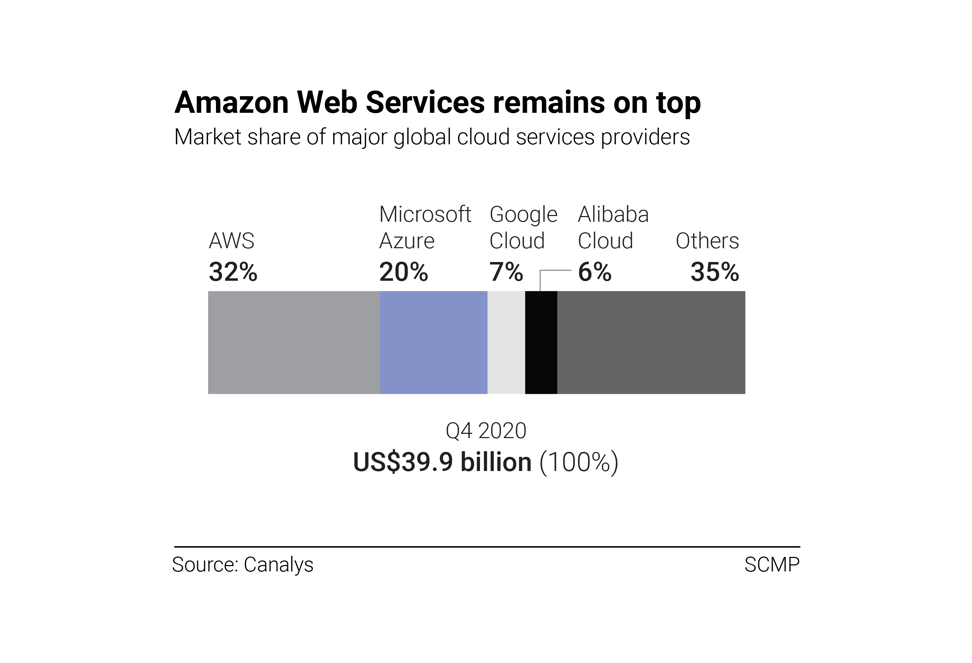

China, the world’s second-largest cloud services market, saw total spending reach more than US$5 billion for the first time in the September quarter last year, according to a report by research firm Canalys.

That also enabled domestic market leader Alibaba Cloud to strengthen its position with a 40.9 per cent share, followed by Huawei Cloud, Tencent Cloud and Baidu Cloud, according to Canalys. It had the “others” category for smaller players with a combined 19.9 per cent share.

The situation for AWS, however, offers potential for growth. “AWS is not performing badly in China,” said Liu Lihui, senior research manager at IDC China. “Enterprises with cross-border business always choose AWS, including Chinese companies that are expanding overseas operations.”

Prominent domestic customers of AWS include Swire Coca-Cola, the Shaanxi University of Science and Technology, artificial intelligence firm Shanghai CraiditX Technology and bitcoin mining equipment maker Canaan Creative, according to its website.

What has held back AWS expansion in China are existing government policies. “Unlike domestic players, AWS cannot build cloud infrastructure in China because of policy limitations and uncertainties,” Liu said. “Foreign operators, for example, must rely on licensed local companies to deliver their cloud services.”

Alibaba sees growth in cloud as China doubles down on digitalisation

Cloud computing services enable companies to buy, sell, lease or distribute a range of software and other digital resources as an on-demand service over the internet, just like electricity from a power grid. These resources are managed inside data centres.

Apart from policy constraints, foreign cloud services providers will find it difficult to enter major business areas including public service, smart city projects and local finance, according to Liu, who described those areas as among the largest users of cloud services in China.

“AWS saw its underlying growth accelerate as more companies shifted parts of their business to the cloud,” said Martin Garner, chief operating officer at CCS Insight.

Amazon’s Jeff Bezos to step down as CEO

The gains of AWS last quarter were made on the back of business expansion in the financial services, media and entertainment, retail and e-commerce, power and utilities, technology, travel and automotive sectors, according to Amazon’s results announcement.

“How AWS will perform in the future [in China] will depend on who will next lead the business, [the state of the] US-China relationship and [any change in] policies in the local cloud services industry,” IDC’s Liu said.