Climate change: sustainable investments on the rise as investors tie environmental concerns with financial returns

- BlackRock says sustainable investing combines traditional approaches with ESG insights to reduce risks and boost long-term returns

- Investors are increasingly looking to ensure their investments make an impact on society and sustainability, BNP Paribas says

This article was part of a special supplement on private banking which was published in the South China Morning Post print edition on October 20, 2021.

Sustainable investing has been gaining popularity over the past decade as investors become are increasingly concerned about environmental and social impacts of their investments as well as the financial returns.

While the Covid-19 pandemic over the past one and half years has caused an unprecedented disruption to the global economy, it has also highlighted the importance and opportunities of sustainable investing, especially in the emerging markets.

According to BlackRock, a global investment manager, sustainable investing is the combination of traditional investment approaches with environmental, social and governance (ESG) insights to reduce risk and enhance long-term returns.

The firm said the growth of the sustainable investing market in recent years has been driven by several factors: financial decision-makers are asking more of companies and are seeking more sustainable investment solutions; regulators and governments are expanding their focus on incorporating sustainability into investment information and decision making; and the growing recognition that ESG research and analysis can potentially identify investment risks and generate excess returns.

In Asia, there is a growing appetite for sustainable investing, said BNP Paribas Wealth Management Asia. The company said traditionally, investors look to engage in responsible investing through screening investment options with a set of ESG factors.

However, today’s investors also want to see evidence that their investments make generate an impact on society or the environment, not just financial returns. It believes that sustainable and responsible investments will become mainstream in the next few years, and that ESG criteria will be fully integrated into the risk, return and liquidity criteria traditionally considered by investors.

Despite the popularity of sustainable investing, there is confusion over the different terminologies and concepts − such as socially responsible investing (SRI), ESG investing, and impact investing − which has hindered the uptake of the strategy, suggested PitchBook, a financial data company. According to the firm, SRI, ESG investing and impact investing are major categories under the umbrella of sustainable investing, and each has its own specific characteristics and applications.

In SRI, investors use screening and exclusion, divestment, positive reinvestment and shareholder activism to achieve positive social or environmental outcomes; ESG refers to a framework used to evaluate a company’s risks and practices; and for impact investing, investors look for both financial returns and measurable social and/or environmental results.

Impact investing takes place mainly in the private markets, while SRI is typically practised in publicly traded vehicles, and ESG is part of an investment assessment process rather than an investment strategy.

Among these, impact investing is more popular among private investors with a variety of private equity products on the market for them to choose from. The Global Impact Investing Network (GIIN) defines impact investments as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

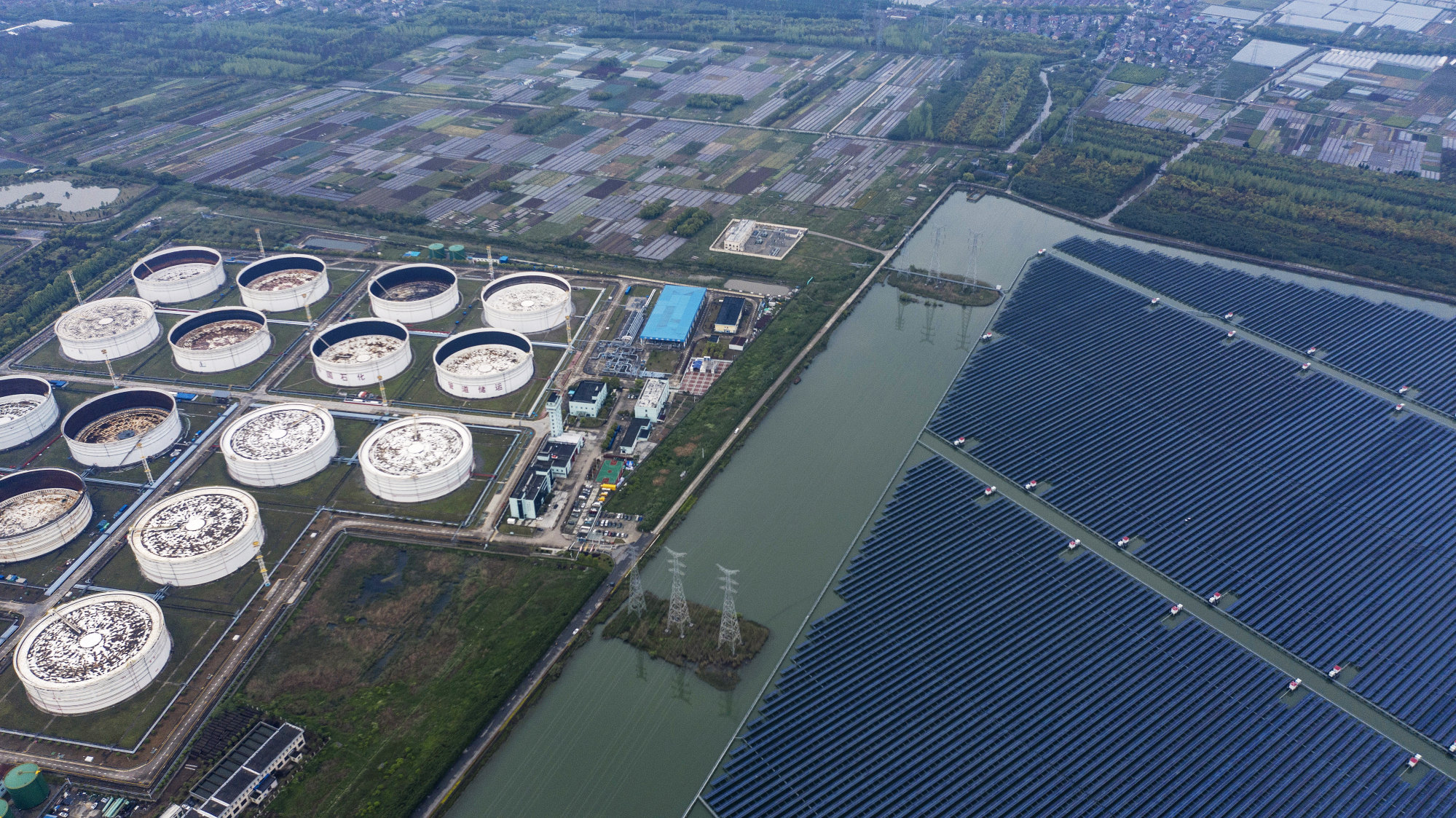

The organisation said the growing impact investment market provides capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, health care and education.

According to GINN’s Impact Investor Survey 2020, the US$715 billion global impact investing market has grown in depth and sophistication over the past decade. The survey finds that 88 per cent of the respondent’s report meeting or exceeding their financial expectations. In terms of impact performance, nearly all (99 per cent) of respondents said they had met or exceeded their expectations since inception.

Energy (16 per cent) and financial services (12 per cent, excluding microfinance) were the key sectors to which respondents allocated capital, with most capital allocated to developed markets (55 per cent). The findings are based on replies from 294 of the world’s leading impact investors, who collectively manage US$404 billion of impact investing assets. The survey also finds that despite the risks and uncertainty caused by Covid-19, 57 per cent of the respondents said they are “unlikely” to change the volume of capital they had planned to commit to impact investments.

GINN said that the widespread social and economic consequences of the Covid-19 pandemic have further amplified the critical need for impact investing to play a critical role in addressing the crisis. The view is shared by Union Bancaire Privée (UBP), which said for impact investors, 2020 has been a real stress test in terms of balancing impact and financial returns.

UBP said that while Covid-19 has exposed how wide the gap is between the various emerging markets, and has worsened an already bad income distribution problem in many emerging market economies, many opportunities will arise in sectors that can benefit from the multi-year investment cycles as a result of the United Nation’s sustainable development goals (SDGs).

“There is a broad universe which includes a variety of company profiles, from the ones which should continue to benefit from elevated growth rates [such as renewable energy] to sectors such as education and financial inclusion businesses [such as mobile payments, microcredit and SME financing] where many companies that suffered substantially during the pandemic could do very well in the next few years,” it added.

Jonathan Fletcher, emerging market fund manager and head of Emerging Market Sustainability Research of Schroders, said Covid-19 has magnified the importance of impact investing in emerging markets, which are the perfect place for impact investing because investors’ interest in understanding the impact of their investment decisions has never been greater.

Fletcher said the health crisis triggered by Covid-19 has been a reminder of the harsh realities that many people across the world face every day (many of those affected live in emerging market) and the pandemic has exacerbated existing challenges. “We see the potential for investors to have an impact and help solve some of the many global challenges as enormous. In emerging markets, the impact of Covid-19 has only magnified this need. As the world exits the pandemic, environmental and social issues are likely to gain even greater focus. Better tools to analyse and monitor companies and their operations mean that the power to drive change is in the hands of investors.

The nature of emerging markets means that there is also a broad range of investment opportunities. Providing capital to companies which meet defined investment criteria enables them to grow sustainably, and to have a greater impact in the future,” he added.