Thai developer expects brisk home sales to mainland buyers

Sansiri forecasts China to becomes its biggest foreign market in 2018

Sansiri, one of Thailand’s top property developers, said it expected to be kept busy by Chinese investors looking to diversify their assets by buying Thai properties for both personal use and investment.

The company forecasts that home purchases by the mainland citizens would account for 40 per cent of their international sales next year, with China to surpass Hong Kong to become its largest foreign market.

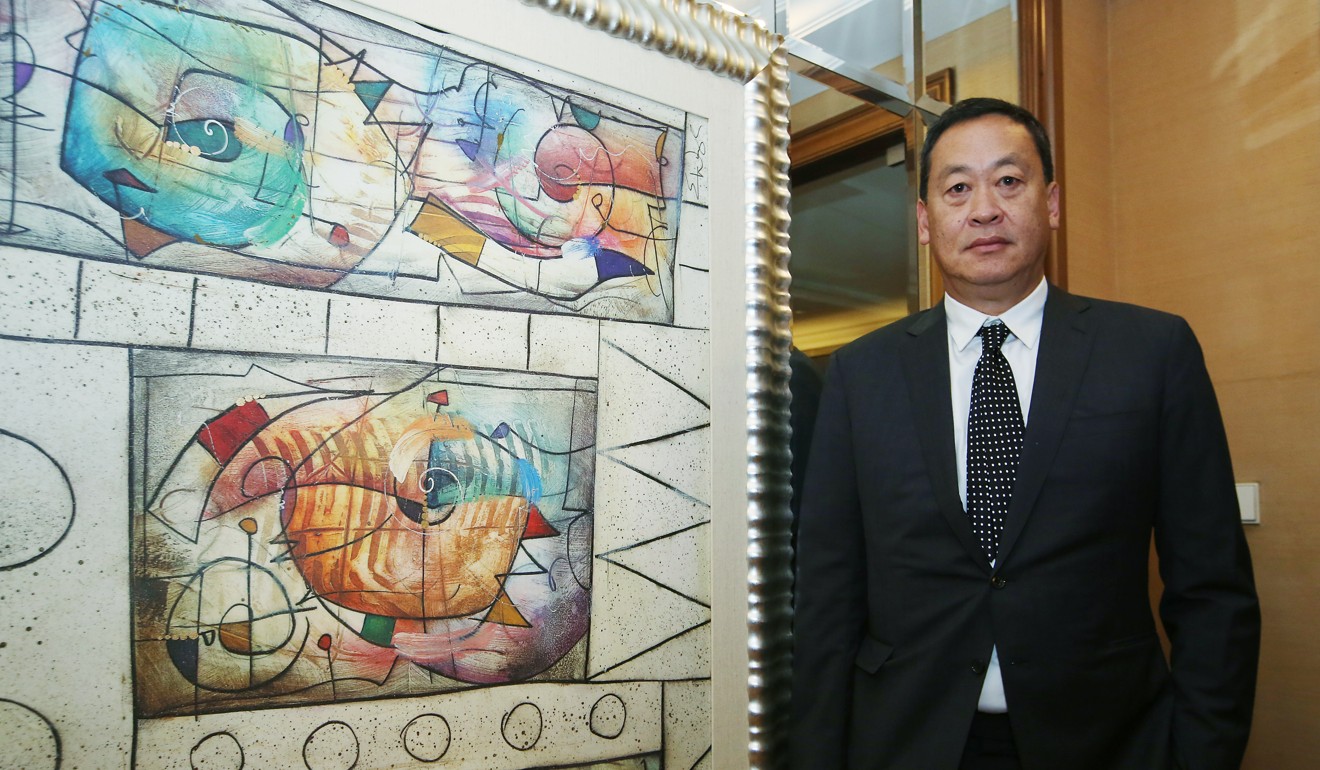

“It could happen this year, that China becomes our largest foreign market,” Srettha Thavisin, president of Sansiri, told the South China Morning Post. “But it will definitely happen next year.”

Wealthy mainland Chinese are increasingly looking to buy flats and houses in Southeast Asian countries, with a proportion of them expecting to use the properties for personal residence, rather than just for investment.

Sansiri said a rising number of Chinese citizens, lured by the inexpensive properties and low living costs in Thailand, were making plans to live in the country when they retire.

Properties offered by Sansiri to mainland buyers range from 500,000 yuan (US$75,900) to more than 4 million yuan a unit.

In Shanghai, a three-bedroom flat in the city’s downtown areas could sport a price tag of 10 million yuan.

Southeast Asia is emerging as a new investment magnet for middle-class Chinese seeking to own a home abroad due to the affordability of the properties in the region.

Cobby Leathers, head of Sansiri’s international businesses, said new Chinese clients would initially buy low-priced homes in Thailand as a way of testing the market.

“Some of them want to live cheaply in Thailand when they retire,” he said.

Leathers added that those mainland buyers who have business ties with Thailand would opt for luxury properties.

Some of them want to live cheaply in Thailand when they retire

Sansiri has earmarked US$370 million worth of pre-sale properties for foreign markets in 2018.

At present, Hong Kong buyers represent 39 per cent of the company’s international sales, followed by mainland Chinese clients who account for 32 per cent. The mainland buyers are usually aged between 35 and 55.

Beijing tightened its foreign-exchange control late last year to contain capital outflows.

The policy was believed largely, to curb mainlanders’ overseas homebuying spree.

Morgan Stanley predicted that outbound property investment by mainland would drop 84 per cent to US$1.7 billion in 2017 and another 15 per cent to US$1.4 billion next year.

Leathers said the foreign-exchange control had minimal impact on Sansiri’s business since there was no cancellation of transactions arising from payment issues.

Sansiri has four offices in the mainland cities of Beijing, Shanghai, Guangzhou and Shenzhen.

Thavisin said the increase of low-cost flights connecting China and Thailand would also drive the company’s sales as more people buy properties for leisure purposes.